Is Your Spouse’s Tax Debt Now Your Problem?

You got married. Maybe there was cake, music, even matching tattoos. But now comes something less fun: your spouse owes the IRS. You didn’t create that debt, yet it feels like you’re suddenly on the hook too.

This is one of the most common and overlooked tax problems married couples face. If you’re newly married and your spouse has IRS issues, here’s what you need to know before the IRS takes your refund.

TLDR;

Filing a joint tax return means the IRS can collect your spouse’s debt from you.

Injured Spouse Relief (Form 8379) can protect your refund if your spouse owes back taxes.

Innocent Spouse Relief (Form 8857) may remove your liability if your spouse underreported income and you didn’t know.

The IRS reviews lifestyle and behavior—not just paperwork—when you request relief.

Filing “Married Filing Separately” may protect you if your spouse has existing tax debt.

Always ask about IRS debt before filing jointly, and keep your financial records clean.

You’re not automatically stuck—but ignoring the issue can make it worse.

Talk to a tax pro early—don’t let the IRS surprise you after it’s too late.

The IRS and Joint Tax Returns: When Two Become One (Big Bill)

When you file jointly, you and your spouse are both responsible under what’s called joint and several liability. That means:

The IRS doesn’t care who earned the income.

They can collect up to 100% of the balance from either spouse.

Even after a divorce, the IRS may still come after you.

So yes, your refund can be taken because of your spouse’s past tax debt.

You’ve Got Options: Two IRS Relief Paths

Before you panic, know this: The IRS isn’t completely heartless. If you get caught in your spouse’s tax mess, you may qualify for relief.

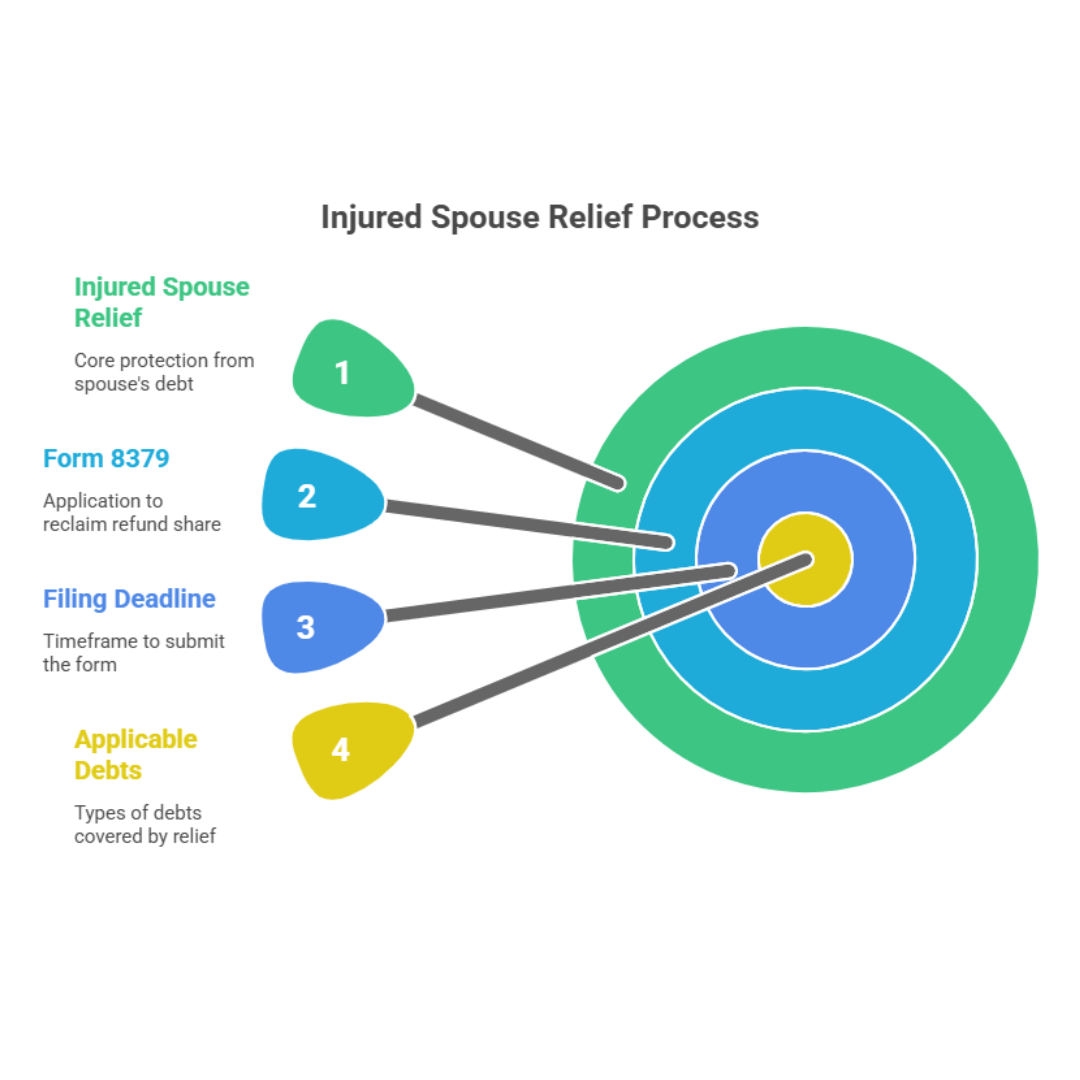

1. Injured Spouse Relief

For joint filers whose refund was taken to pay a spouse’s debt.

File Form 8379 to reclaim your share.

Must file within 3 years of the due date or 2 years after the payment.

Applies to IRS debt, child support, and other federal offsets.

This tells the IRS: “Don’t punish me for something I didn’t cause.”

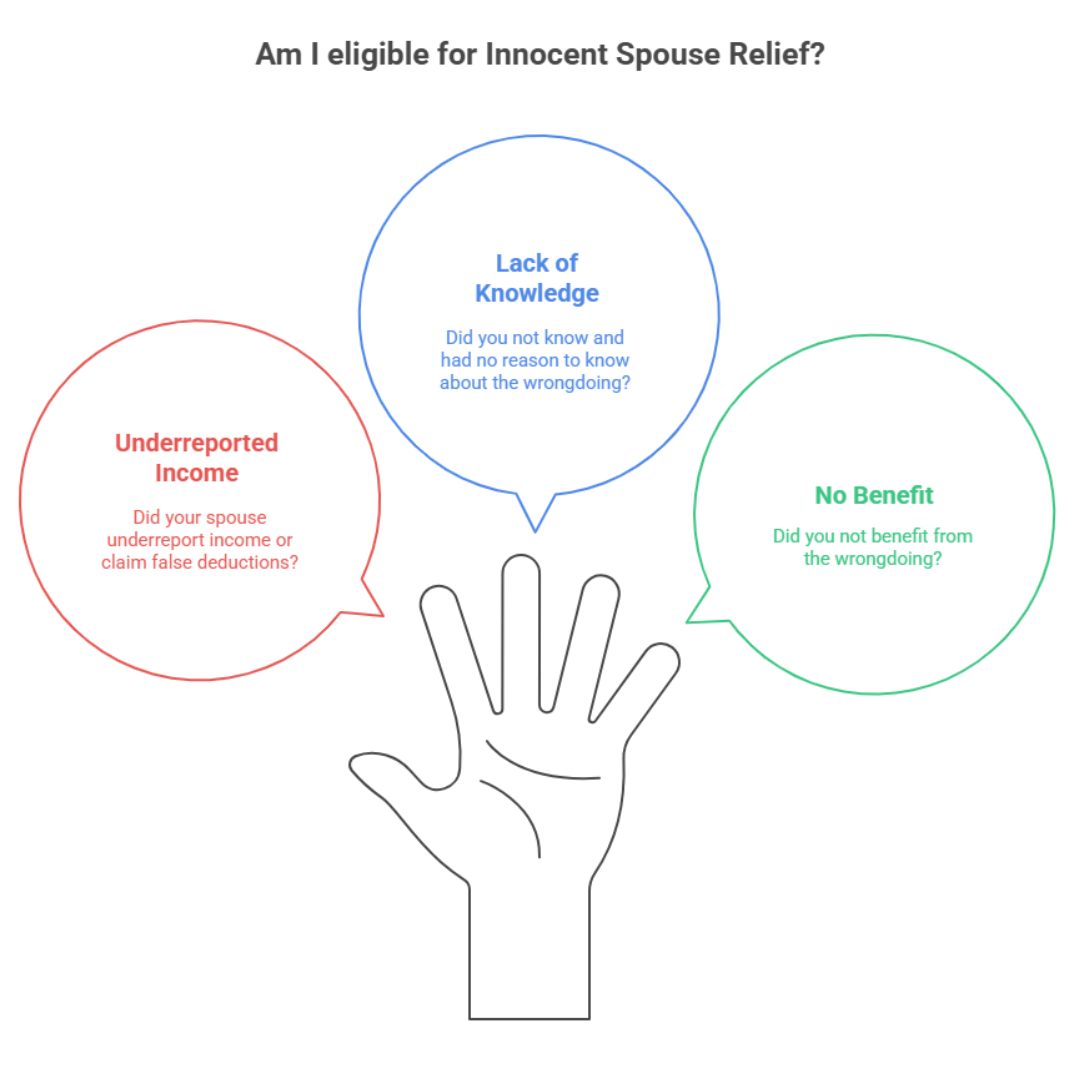

2. Innocent Spouse Relief

This applies when:

Your spouse underreported income or claimed false deductions.

You didn’t know, and had no reason to know.

You didn’t benefit from the wrongdoing.

Relief is requested with Form 8857 and comes in three forms:

Innocent Spouse Relief

Separation of Liability

Equitable Relief

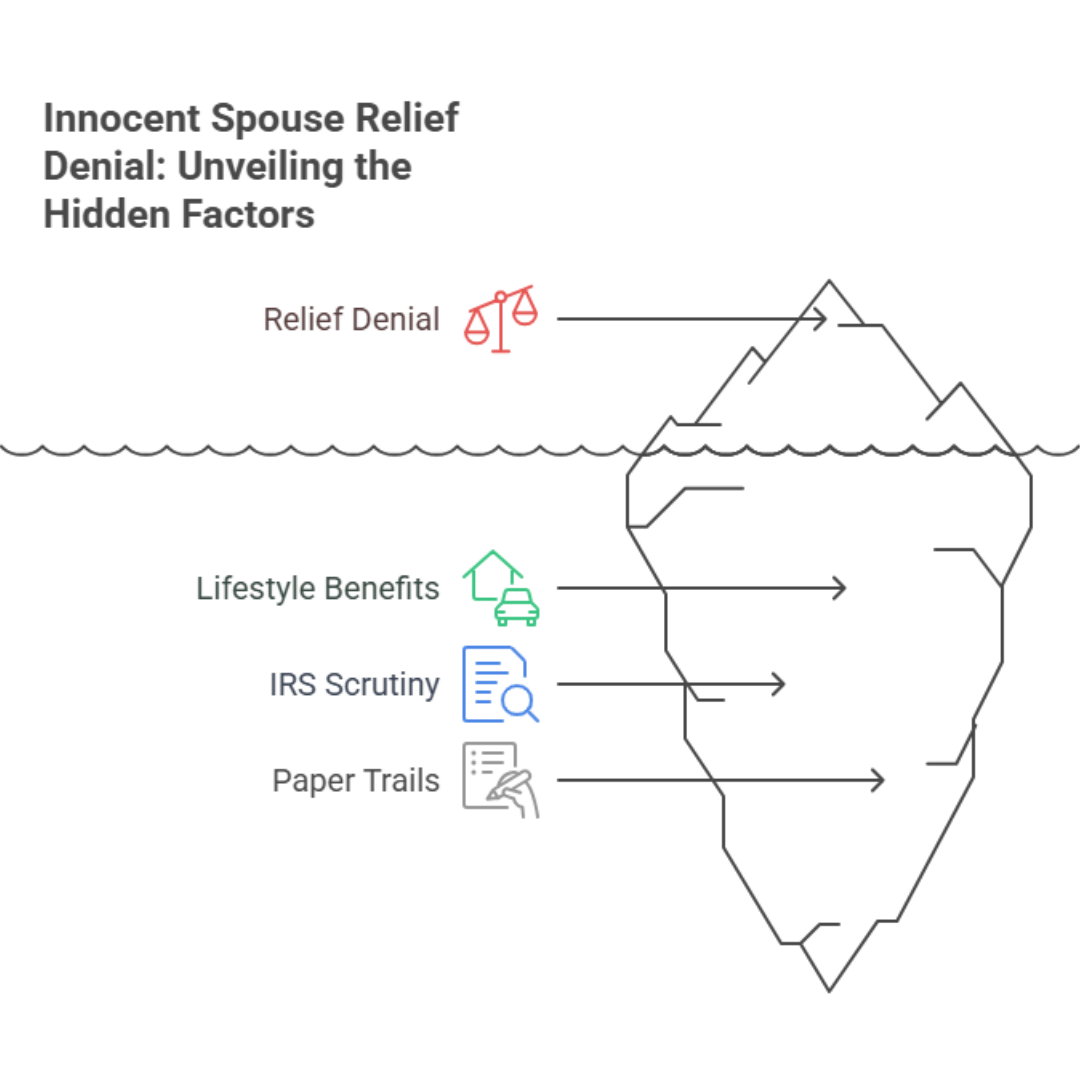

A Real Case That Went Wrong

A widow applied for innocent spouse relief after her late husband underreported his income. The court denied her because she had benefited from the inflated lifestyle.

That case tells us two things:

The IRS looks at lifestyle, spending habits, and what you "should have known."

Paper trails matter. What you sign (and how much you question it) matters even more.

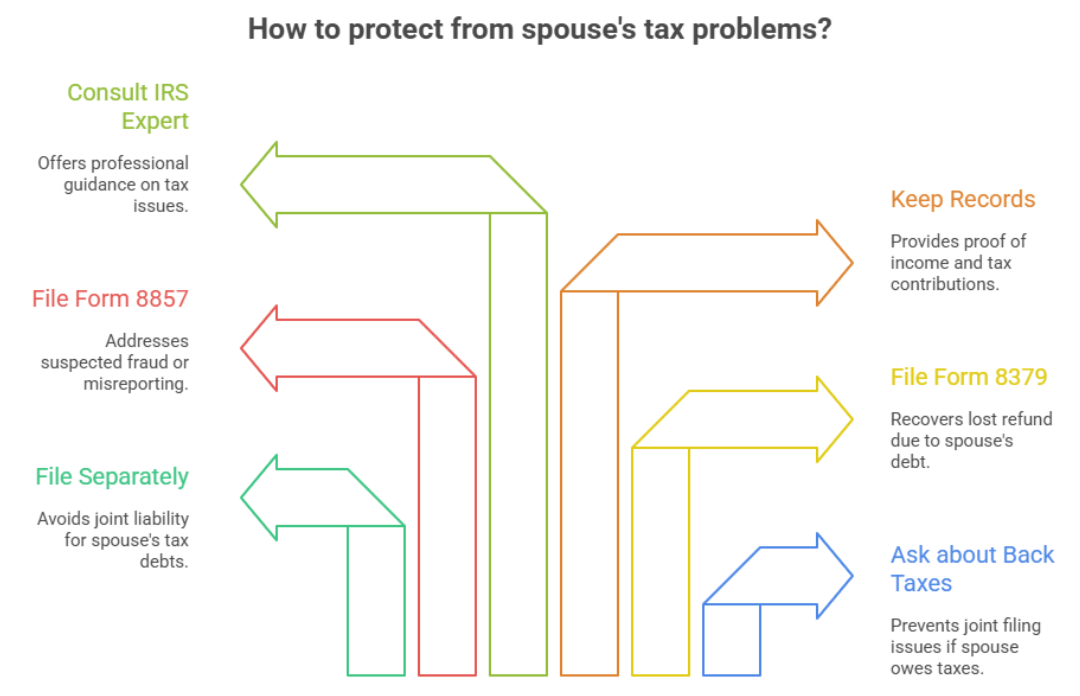

How to Protect Yourself from a Spouse’s Tax Problems

Here’s your checklist:

Before you file jointly, ask if they owe back taxes. Seriously.

If they do, consider filing as "married filing separately"

If you’ve already filed and lost a refund, file Form 8379

Suspect fraud or misreporting? Look into Form 8857

Keep your own records, pay stubs, bank statements, and anything that shows your share

Consult someone who handles IRS collections and can guide you through it

Spouse’s IRS Tax Debt FAQs

-

The IRS can take your entire refund.

-

Only if you file jointly. Debts before marriage don’t attach to you personally.

-

Yes, unless you file an injured spouse claim.

-

Consider filing separately, or file jointly and include Form 8379.

-

Yes, unless you claim injured spouse relief.

-

No—only if you file jointly. Debts from before marriage don’t attach to you personally.

-

Consider filing separately, or file jointly with Form 8379.

Final Word: Don’t Let IRS Debt Wreck Your Honeymoon

Marriage is full of surprises, but IRS letters shouldn’t be one of them. If you marry someone with tax problems, you don’t have to go down with the ship. The IRS has built-in protections you just need to know how to use them.

If you want help protecting your income and navigating these rules, that’s what we do every day.