Tax Debt| IRS Audit | Unfiled Tax Returns

Facing Serious IRS Tax Problems?

Highly Rated IRS Tax Relief Expert

We Agressively Help with IRS Taxes so that you can live your best life!

Do I Qualify for the Best Tax Relief? Find out with a Free Case Review

Call Today (24 Hours /7 Days a week) Or Book Online!

✔Confidential ✔No Pressure ✔Personalized

Get the right Tax Help from a Trusted Tax Relief Professional

Schedule a free case review. There is no commitment or obligation to move forward.

✓ Get Fresh Start Program qualifications

✓ Tax Filing Compliance Review

✓ No Cost Strategy Session ( A $495 Value)

Are you overwhelmed with IRS tax debt, facing an IRS audit, or dealing with years of unfiled taxes? Semper Tax Relief understands how stressful and confusing these issues can be.

We offer confidential, free case reviews to help you find the best solution. Our licensed tax professionals provide honest, straightforward advice tailored to your unique situation, ensuring you get the relief you need. Whether you're a small business owner, working family, young professional, or homeowner, we're here to help you resolve your tax issues efficiently and effectively. Submit your inquiry today and take the first step toward financial peace of mind.

Free IRS Tax Relief Guides:

-

Ultimate Tax Debt Resolution Guide

The Complete Strategy to settle your tax debt.

-

IRS OIC Calculator

Calculate your back tax savings

-

IRS Offer In Compromise Guide

Know everything about the IRS OIC tax settlement program.

TOP RATED & HIGHLY TRUSTED TAX RELIEF PROFESSIONAL

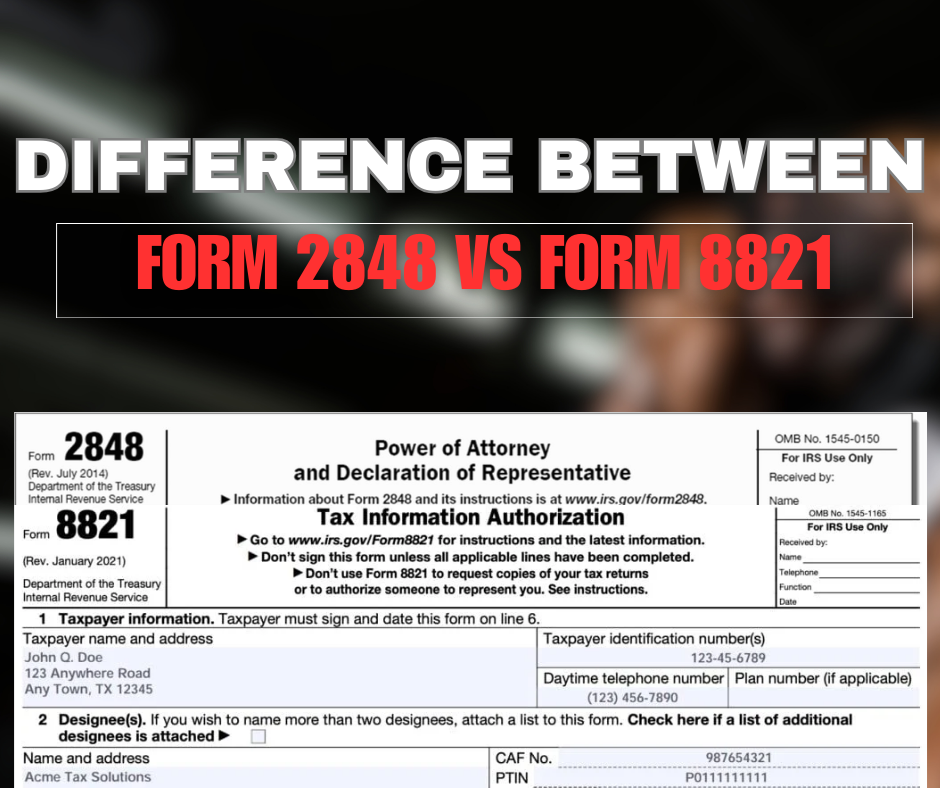

What is an IRS Tax Power of Attorney Representative?

IRS Form 2848: Power of Attorney & Declaration of Representative

Form 2848 is the IRS’s official Power of Attorney for tax matters. When you sign it and list the tax forms and years, you are authorizing your Representative to stand in your place with the IRS for those items. We can talk to IRS agents, review your confidential records, receive copies of notices, negotiate on your behalf to move your case forward.

Who can be your IRS Tax Power of Attorney Representative

On IRS Form 2848 you may authorize one of the following types of Representative:

Attorney or:

Certified Public Accountant ( CPA) or:

Any of the 3 types of Representatives you authorize can represent you before the IRS. This authorization is valid for IRS matters only. It does not apply to state agencies, banks, courts, or any non-IRS purpose.

Get A Free Tax Relief Strategy Session Today!

Call (949) 506-3457 (24 Hours / 7 Days)

Tax Debt Relief Process

Free Case Review

Free case review evaluating the current Tax problems, and evaluating the right Solutions

Compliance

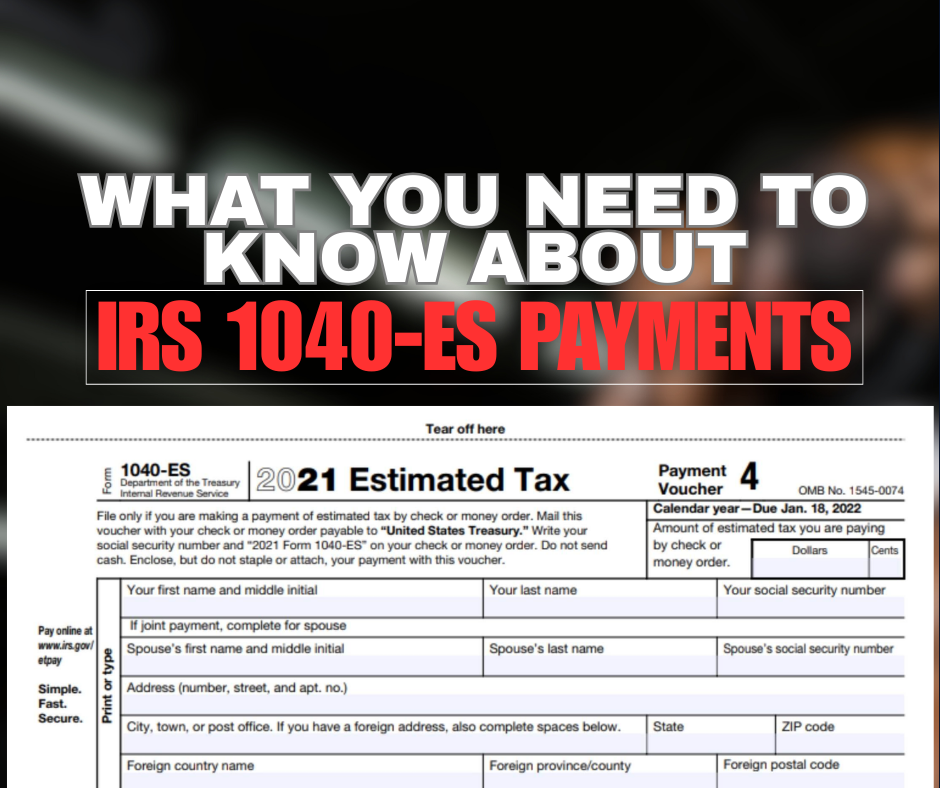

Get In Tax Filing Compliance & Correcting Withholding Issues Or Establishing Quarterly Es Payments

Negotiate

Submission & Negotiation Of The Tax Relief Program With The Irs

Tax Relief

Enjoy the peace of mind of knowing your tax problems have been put to rest

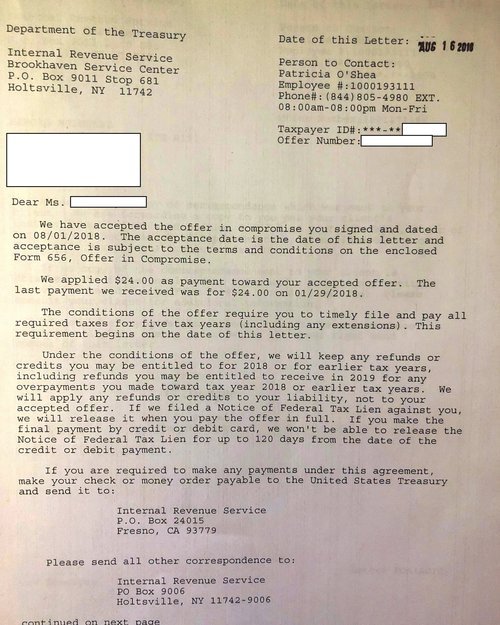

Verified IRS Offer In Compromise Acceptance Results YOUR RESULT IS OUR FOCUS

If you have IRS Tax Debt, Do you qualify for the IRS Offer In Compromise Program?

CALL TODAY (949) 506-3457

Rather Have us Call you? Click Below to Schedule Online!

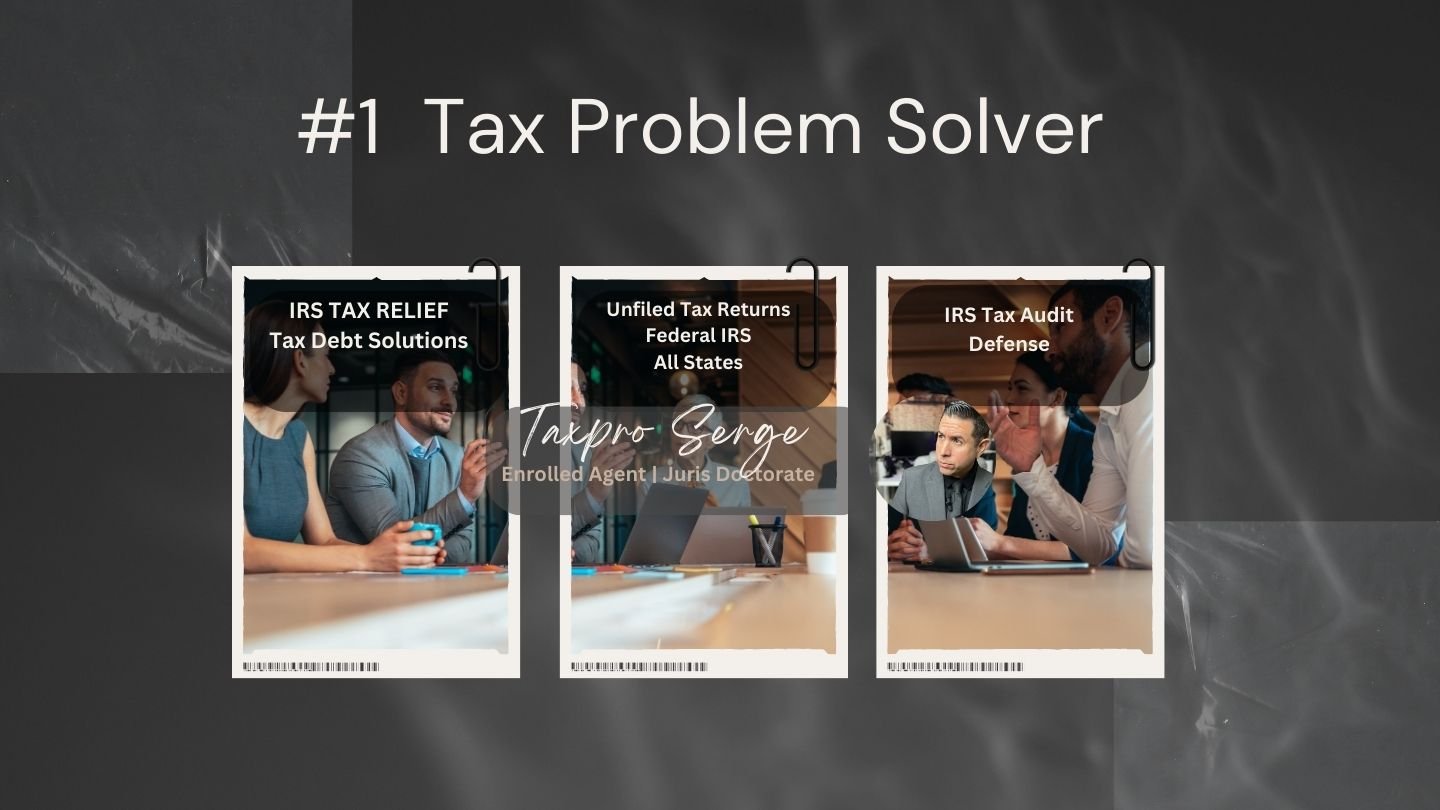

Your Tax Relief Team

-

Sergio Melendez, JD EA

Juris Doctorate | Enrolled Agent

-

Andrea Duque, JD

Juris Doctorate

-

Jeff Pachuilo, EA

Enrolled Agent

-

Cindy Sosa

Case Manager

-

Jennifer Kimberly, CTEC

Tax Preparer

Why Choose Semper Tax Relief?

When you have attempted to fix your tax problems with the IRS or your State Taxing Agency and have encountered nothing dead ends, you do not want to make the mistake of hiring an incompetent tax attorney or worse, an over-priced Tax Relief Firm.

Most Tax Relief Companies offering these types of services remain anonymous from you, which is scarier than the IRS. Dealing directly with the IRS would be 1000% better than getting scammed by an unknown tax relief company. Learn more about why we are different: About Semper Tax Relief

-

It is wise for someone to take the initiative to fix their own tax problems. It is highly recommended that you first make contact with the IRS, and fix your tax problems. However, the IRS is in a current state of crisis, facing historic backlogs which are affecting the overall response rate. In addition, they have new hires that are inexperienced and poorly trained, which affects the information being relayed to taxpayers.

Semper Tax Relief’s tax professionals have the technical know-how knowledge & experience with procedures to navigate complicated legal matters with the IRS.

Another step someone has taken is contacting their own tax professional who has been handling all prior tax filings. This step has also been taken by most of Semper Tax Relief’s clients. However, it is common that their tax professional lacks knowledge of tax relief laws and is not familiar with the legal procedures of the IRS, that is when hiring Semper Tax Relief would make sense.

Featured In Several Media Outlets:

https://finance.yahoo.com/news/semper-tax-relief-announces-continuous-171100136.html?guccounter=1

https://ca.finance.yahoo.com/news/semper-tax-relief-announces-continuous-171100136.html?guccounter=1

https://www.insidertracking.com/semper-tax-relief-announces-continuous-commitment-as-a-trusted-partner-for-irs-tax-challenges

IRS Tax Tips and News You Can Use

Stay up to date with the latest IRS updates, tax-saving strategies, and real-world advice to help you keep more of what you earn & to stay out of the Radar of the IRS

READY TO MOVE FORWARD?

![Highly Trusted Tax Relief Firm: Semper Tax Relief is led by Sergio Melendez [Enrolled Agent | Juris Doctorate]]](https://images.squarespace-cdn.com/content/v1/630e5bcd055b7e23102f03a4/dbdc79dd-153c-4855-b41a-2cb6335f1857/Top+Rated+IRS+Resolution+Expert.jpg)