Treasury Offset Program - Dept of Treasury Bureau of Fiscal Service: What You Should Know

If you just opened a letter from the Bureau of Fiscal Service and thought, “What is this, and why are they taking my tax refund?” you’re not alone. Many people are caught off guard, and its heart breaking to get notice your Tax Refund has been applied somewhere else. Here’s what you need to know before panic sets in.

TLDR;

The Bureau of Fiscal Service is the U.S. Treasury’s debt collection arm.

You may get a notice if you owe IRS taxes, student loans, SBA debt, or overpaid benefits.

They collect through the Treasury Offset Program, which can take your tax refund or federal payments.

Notices include who you owe, how much, and how they’ll collect.

If your refund was taken, it's likely already applied to the debt.

You can respond by:

Paying in full via Pay.gov

Calling 888-826-3127 to set up a payment plan

Disputing the debt in writing with proof

The Bureau is legit, but scammers do impersonate them — always verify contact info at fiscal.treasury.gov.

Once your IRS debt goes to them, collection efforts escalate.

Don’t ignore the notice — act quickly and get help if needed.

What Is the Bureau of Fiscal Service?

The Department of the Treasury Bureau of Fiscal Service manages the government’s money. Think of them as the bill collectors that cross collect for other government agencies, including Federal, State & local agencies.

They handle overdue student loans, delinquent SBA loans, State Tax Debt, Delinquent State Court orders such as child support and even benefit overpayments.

If you got a letter, it’s because some government agency flagged your account as delinquent, and it was placed in the Bureau of Fiscal Services for collections under the Treasury Offset Program or “TOP”.

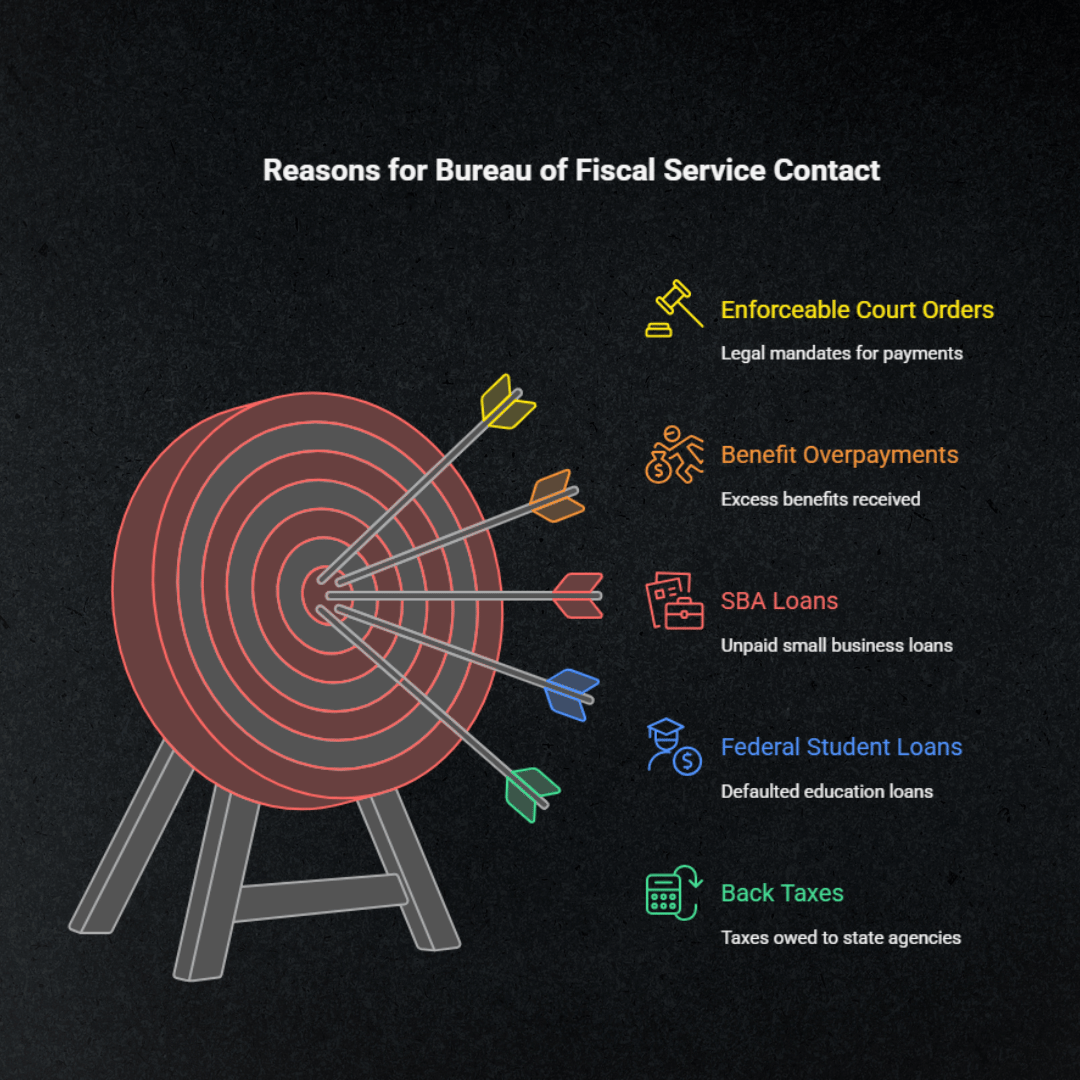

Why They Contacted You

They don’t send letters randomly. Common reasons include:

Back taxes referred by State government Agencies

Federal student loans in default

SBA loans that went unpaid

Benefit overpayments (Social Security, unemployment, etc.)

Enforceable Court Orders ( Delinquent Child Support Payments)

When the original agency can’t collect, the Bureau of Fiscal Service steps in.

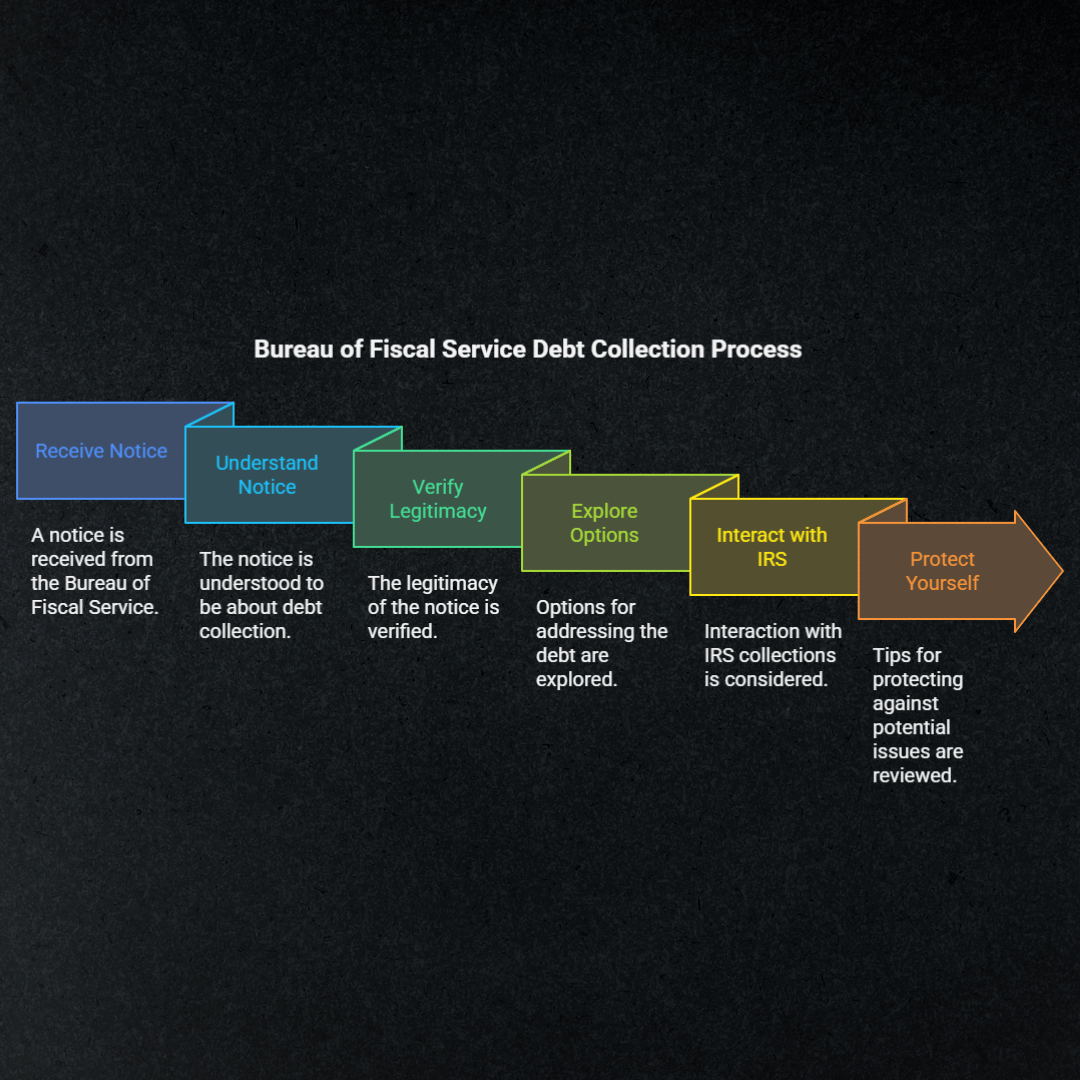

What the Notice Means

Getting a letter or call from the Treasury isn't fake. It's real, and usually bad news if ignored. That notice includes:

The name of the creditor agency, including contact information of that agency

Type of Debt owed

Your total debt owed

Amount of your IRS Tax refund applied to the debt

Treasury Offset Trace Number

Account #

The Treasury Offset Program can take your tax refund automatically if your account is flagged.

To verify the information in the treasury offset program, you can contact the Fiscal Service 800-304-3107.

What Does It Mean When Treasury Takes Your Refund?

It means your debt has officially crossed into collections territory. The Dept of Treasury offset payment explanation boils down to this: they apply your tax refund or federal payment to your unpaid debt. You may not get a heads-up beforehand. The IRS, for example, may send your refund straight to them without passing Go.

If this has happened to you, your options are to:

Dispute the debt if it’s incorrect

Pay the balance in full

Ask about a payment plan

What Are Your Options Now?

You’ve got a few ways to address this. None of them involve ignoring it and hoping it vanishes.

1. Pay in Full

The fastest way to shut it down. Payments are typically made through Pay.gov.

2. Set Up a Payment Plan

Call their Cross-Servicing Center at 888-826-3127 to request a payment agreement. Heads-up: They may still offset refunds until you’re fully paid up.

3. Dispute the Debt

If you believe the debt isn’t legit, here’s how to dispute a debt with the Bureau of Fiscal Service:

Submit a written dispute to the address on your letter.

Request debt validation in writing.

Include documentation if the amount or reason seems off.

Is the Bureau of Fiscal Service Legit or a Scam?

They’re 100% real, but you’re right to be skeptical. Scammers often pose as federal agencies. If you want to confirm, look up the Department of the Treasury Bureau of the Fiscal Service contact number at fiscal.treasury.gov. Don’t call back numbers from voicemails without double-checking.

How IRS Collections Tie In

If you have IRS Tax Debt, and are receiving a refund for the current year, the refund is automatically applied to the balance owed first. Once your debt is paid off, you can expect your tax refund.

If you do not have a clean

Treasury Offset ProgramDept of Treasury Bureau of Fiscal Service BLOG FAQs

-

Yes. The BFS is a Treasury bureau that manages federal disbursements and collects delinquent non-tax debts through programs like TOP and Cross-Servicing. Check contact details on the official site if in doubt.

-

TOP matches your federal payments (like tax refunds) against debts you owe to federal or state agencies. If there’s a match and the law allows, part or all of your payment is offset to pay that debt.

-

Call the TOP IVR at 800-304-3107 (TTY/TDD 800-877-8339). The system tells you which agency received your money and provides their contact info.

-

Dispute with the creditor agency listed on your notice, not TOP or the IRS. TOP can’t set up payment plans or adjust balances. The IVR can help you identify the right agency to call.

-

TOP can redirect your refund to another agency. That doesn’t change your IRS balance unless the refund was going to pay your IRS debt. Reduced refunds from offsets to other agencies won’t lower IRS balances. See IRS Topic 203.

-

Call the Cross-Servicing Call Center at 888-826-3127 (hearing impaired: 711). They handle arrangements and questions on debts referred to Cross-Servicing.

-

Use Pay.gov for “Bureau of the Fiscal Service: Debt Management Services – Online Payment for Delinquent Nontax Debt.”

-

There are different gorunds to appealing the IRS actions. When the IRS issues a CP504 notice, the appeal available is the Collectiona Appeals Program or CAP Request.

A CAP request is a fast track appeals program that is different from a CDP or Collections Due Process Hearing. .A CAP request is designed to have an IRS Collections Manager review for the legality of the notice & to resolve the account with you. If the account is not resolved with IRS Management, the IRS office of appeals will review the account.

-

There are different gorunds to appealing the IRS actions. When the IRS issues a CP504 notice, the appeal available is the Collectiona Appeals Program or CAP Request.

A CAP request is a fast track appeals program that is different from a CDP or Collections Due Process Hearing. .A CAP request is designed to have an IRS Collections Manager review for the legality of the notice & to resolve the account with you. If the account is not resolved with IRS Management, the IRS office of appeals will review the account.

Final Thoughts

The Dept of Treasury Bureau of Fiscal Service isn't out to ruin your life, but they will collect what’s owed and they’ve got the tools to do it. If you've received a notice, had your refund taken, or feel stuck in collections, you're not powerless. There's a path forward.