IRS CDP Hearing: How to Request a Collection Due Process Appeal and Challenge IRS Collections

Direct Answer Upfront: What an IRS CDP Hearing Actually Does

If you receive an IRS collection notice that includes Collection Due Process (CDP) rights, you have a short window to ask the IRS Independent Office of Appeals to review your case before (or shortly after) a levy or lien moves forward.

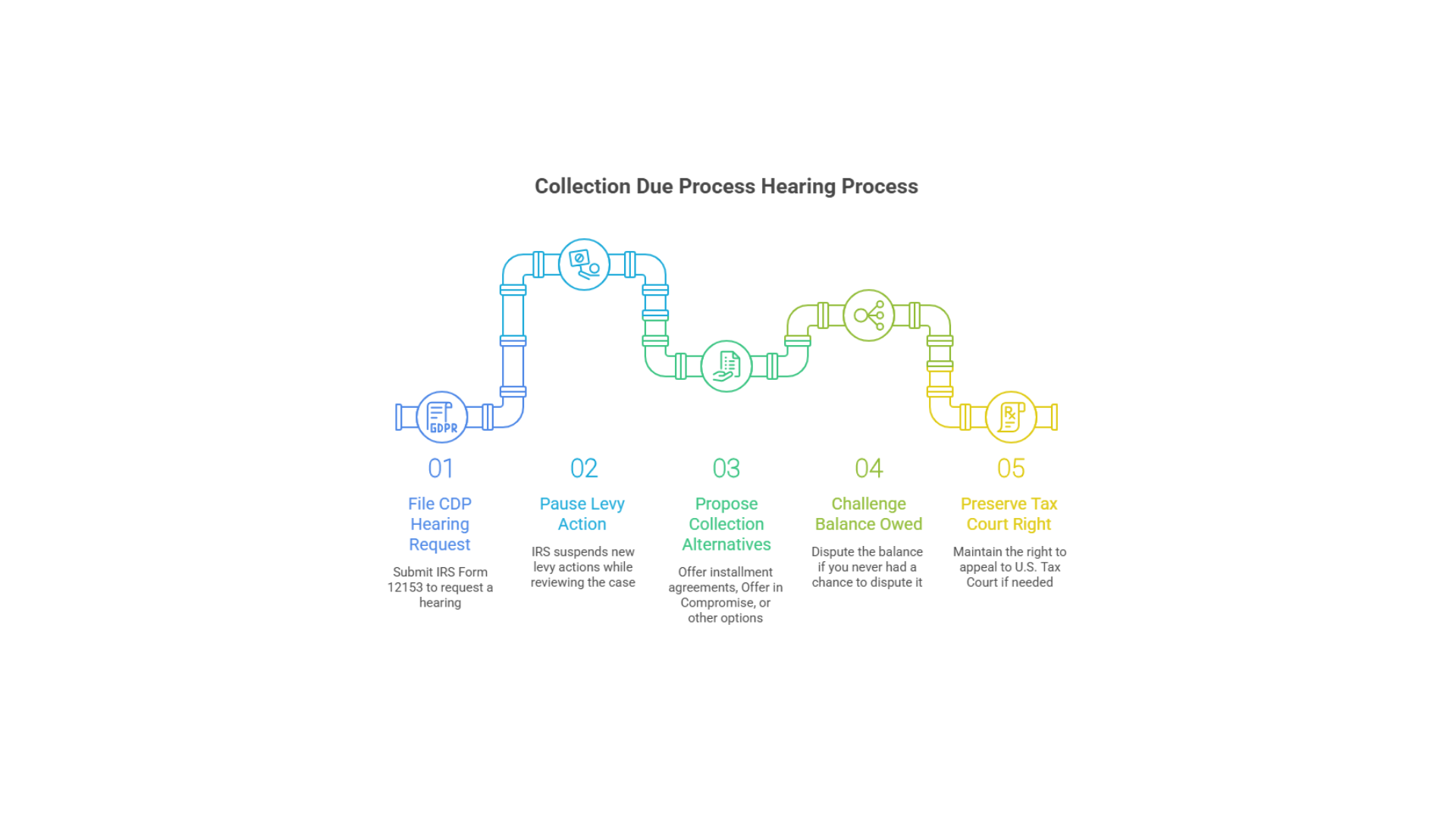

A timely CDP hearing request filed using IRS Form 12153 can:

Pause most new levy action while Appeals reviews your case

Allow you to propose collection alternatives, such as:

Installment agreements

Offer in Compromise

Currently Not Collectible status

Lien withdrawal or modification

Let you challenge the balance owed in limited situations where you never had a prior chance to dispute it

Preserve your right to go to U.S. Tax Court if you disagree with Appeals’ final decision (timely CDP only)

TLDR;

An IRS CDP hearing (Collection Due Process hearing) lets you challenge certain IRS liens/levies and send your case to the IRS Appeals Office.

You request it using IRS Form 12153—that’s the core tool to get your case in front of Appeals.

You usually have 30 days from the CDP notice date for a timely CDP hearing (strongest rights, including potential levy pause and Tax Court access).

After 30 days (up to about a year), you may still get an Equivalent Hearing, but with weaker protections (no Tax Court, no statute suspension).

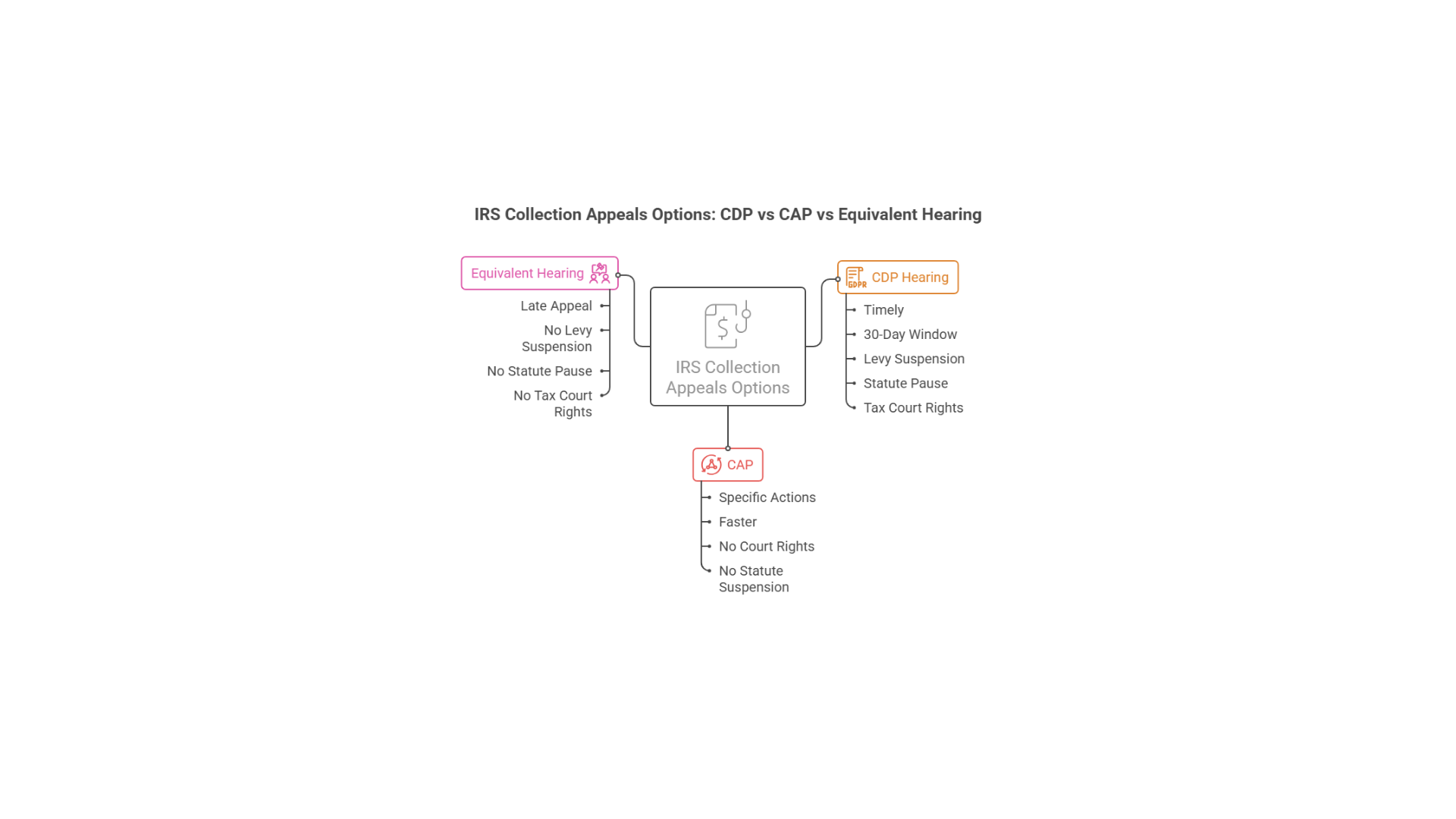

CDP vs CAP:

CDP = broader review, more rights, slower.

CAP = faster, narrower, no Tax Court.

In Form 12153, you must:

Check the right boxes (lien, levy).

List correct tax types/periods.

Give a clear reason for the hearing (not just “I can’t pay”).

Indicate what you want (IA, OIC, CNC, lien relief, etc.).

At the CDP hearing, an Appeals officer:

Reviews whether IRS followed proper procedures.

Looks at your finances and compliance.

Considers collection alternatives (installment agreement, OIC, hardship).

CDP is a powerful way to stop or prevent levies, challenge overly harsh collection, and structure realistic tax debt relief.

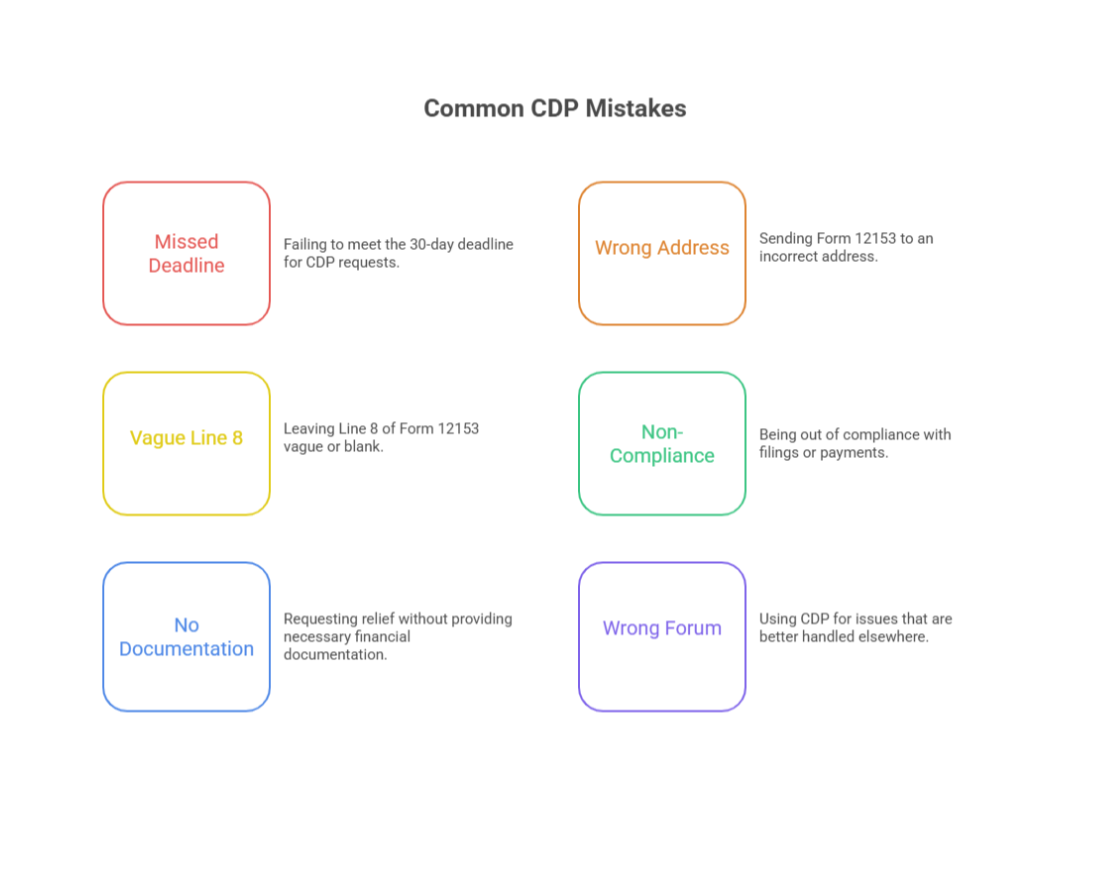

Common mistakes: missing the 30-day window, mailing Form 12153 to the wrong address, vague explanations, no financials, and using CDP for the wrong issue.

You can handle a CDP hearing yourself, but complex cases (wage garnishment, bank levy, payroll tax, big balances) are often safer with a tax pro who does CDP/Appeals work regularly.

In plain language:

A Collection Due Process hearing is your formal path to appeal an IRS levy or lien, request tax debt relief options, and challenge how the IRS is trying to collect, before enforcement goes too far.

In this guide, I’ll walk through:

How to request an IRS CDP hearing step by step

The difference between CDP vs CAP vs Equivalent Hearings

What actually happens during a CDP hearing

Common Form 12153 mistakes that weaken cases

How tax professionals handle real CDP cases involving wage garnishments, bank levies, and tax liens

This guide is based on nearly two decades of IRS tax problem work and over $250 million in back taxes resolved for individuals and businesses through Semper Tax Relief.

Understanding the IRS CDP Hearing

What Is an IRS Collection Due Process Hearing?

The IRS defines a Collection Due Process (CDP) hearing as your opportunity to speak with an independent Appeals officer about serious collection actions. These actions usually involve a lien or levy. During the hearing, you can discuss alternatives or raise limited challenges to the balance.

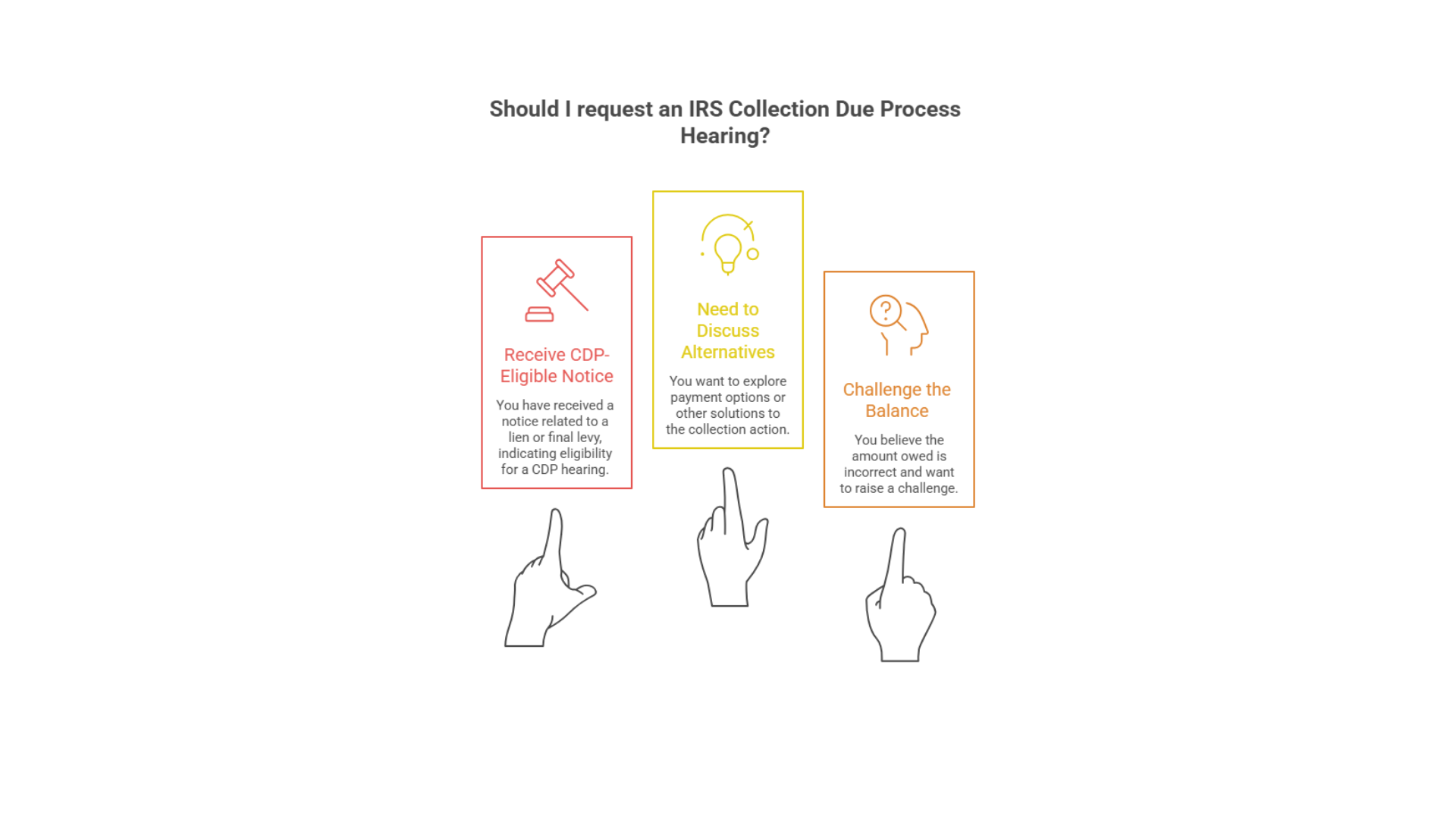

Key points:

You must receive a CDP-eligible notice, which is typically tied to a lien or final levy notice.

You request the hearing using IRS Form 12153.

The case is handled by Appeals, not the same collection unit that issued the notice.

This is the core appeals process for certain IRS collection actions.

CDP vs CAP vs Equivalent Hearing (Quick Comparison)

There are three main ways to challenge IRS collections:

CDP Hearing (Collection Due Process)

CAP (Collection Appeals Program)

Equivalent Hearing

High-Level Differences

CDP Hearing (Timely)

Triggered by a CDP notice (final levy or lien filing)

Must be filed within 30 days

Levy action is suspended by law

Collection statute pauses

Tax Court rights preserved

Best for broad review and long-term protection

Equivalent Hearing

Same notices, but filed after the 30-day window

No automatic levy suspension

No statute pause

No Tax Court rights

Useful if you missed the deadline but still want Appeals review

CAP (Collection Appeals Program)

Used for specific actions (levy, lien filing, IA denial)

Faster, but no court rights

No statute suspension

Best for narrow disputes where speed matters

How I Evaluate CDP vs Other Appeals Options

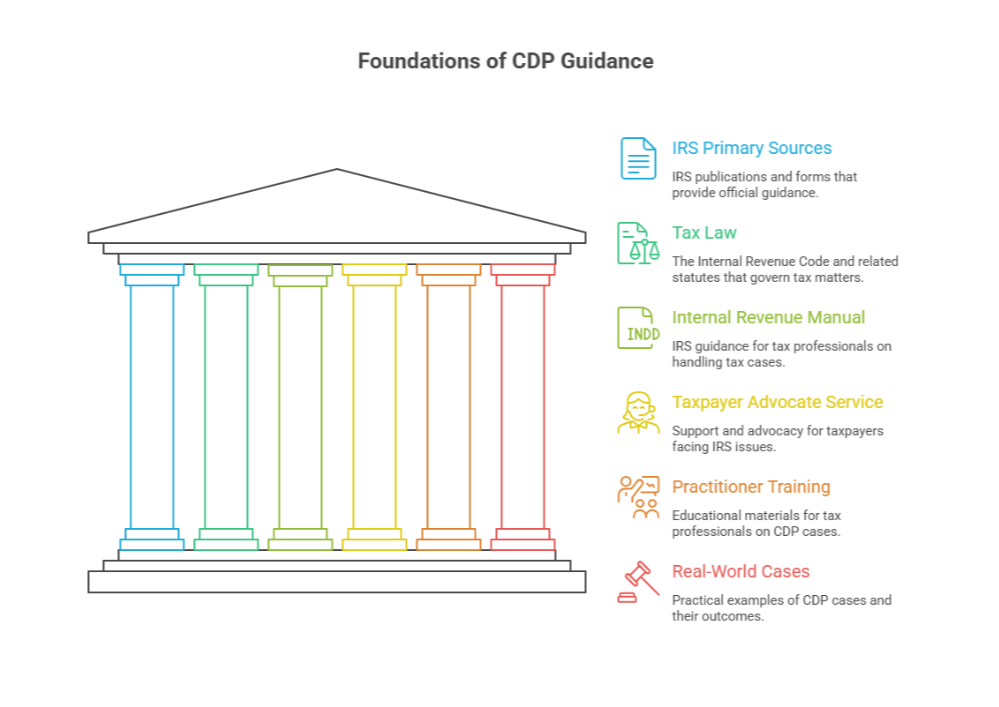

This guide is based on:

IRS primary sources and Form 12153 instructions

Tax Law: Title 26 USC ( I.R.C the Internal Revenue Code)

Internal Revenue Manual guidance

Taxpayer Advocate Service explanations

Practitioner training materials

Nearly 20 years of real-world CDP cases involving:

Wage garnishments

Bank levies

Payroll tax liens

I focus on what the IRS publishes, what the law allows, and what actually works for small business owners and working families.

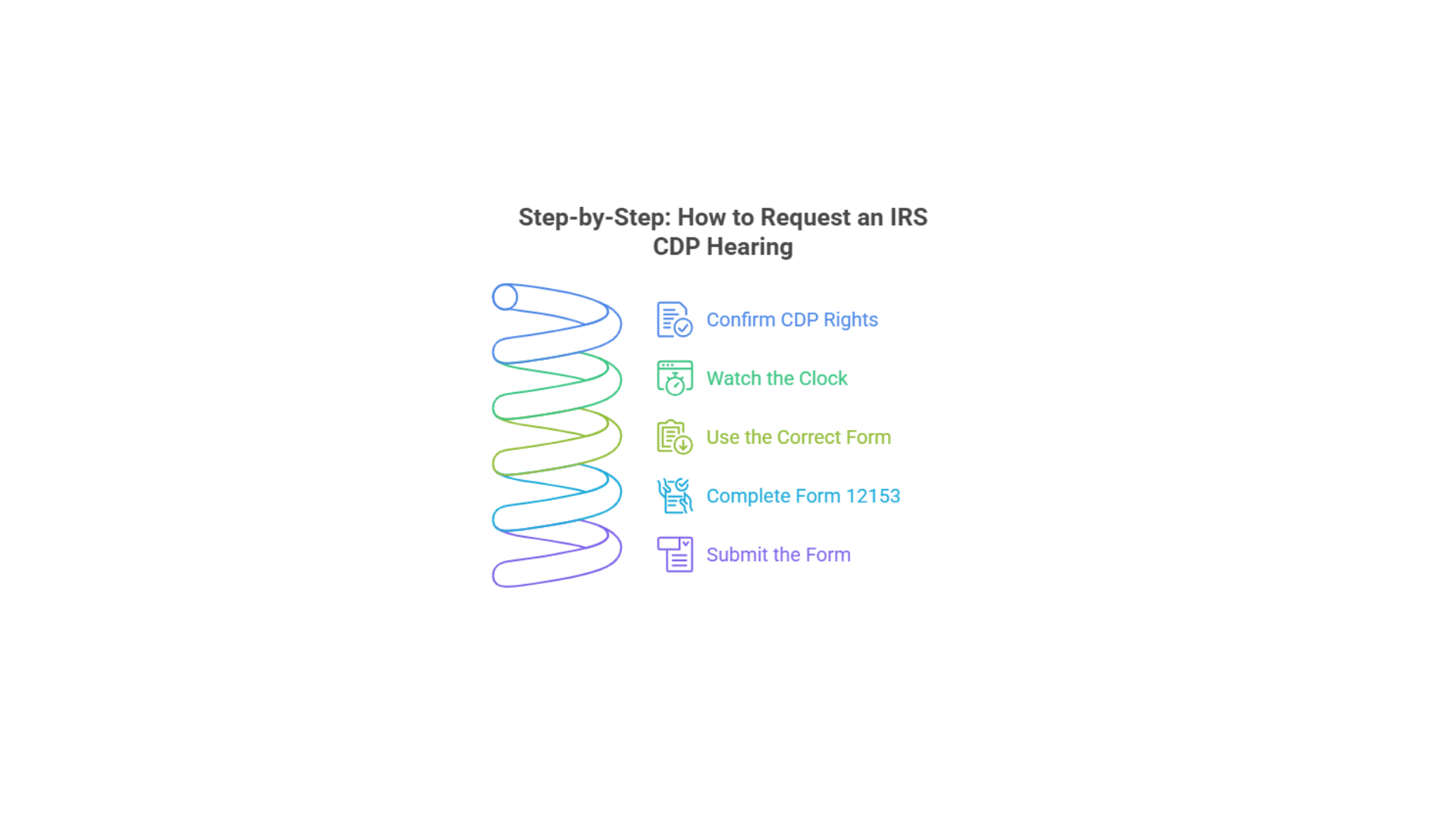

Step-by-Step: How to Request an IRS CDP Hearing

Step 1: Confirm You Have CDP Rights

Not every IRS notice gives CDP rights.

You usually qualify if you received:

A Notice of Federal Tax Lien Filing and Right to a Hearing, or

A Final Notice of Intent to Levy and Right to a Hearing, IRS LT11 Notice or Letter 1058 , or

Another levy notice that specifically mentions CDP

If the notice says “Collection Due Process” and gives a deadline (usually 30 days), CDP rights apply.

A CP504 is often an early warning. True CDP rights usually come later if no action is taken.

Step 2: Watch the Clock

Timely CDP: Form 12153 filed within 30 days

Equivalent Hearing: Usually available up to 1 year, depending on the notice

This timing matters:

Timely CDP = levy protection, statute pause, Tax Court rights

Equivalent Hearing = fewer protections

This is the first thing I check when someone asks about CDP hearing help.

Step 3: Use the Correct Form

Download IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing directly from the IRS website.

It’s used for:

Timely CDP requests

Equivalent Hearing requests if the deadline was missed

Step 4: Completing Form 12153 (High-Level)

Line 1 – Basis for Hearing

Check lien, levy, or both

Line 2 – Timely vs Equivalent

Timely requests are automatic if filed within 30 days

Some taxpayers also check Equivalent Hearing as a backup

Lines 3–7 – Contact Info

Names, SSN/EIN, address, phone

Business owners must match IRS records exactly

Tax Period Table

List tax type, form number, and periods

Attach copies of the IRS notices when possible

Line 8 – Reason for the Hearing (Critical)

Common valid reasons:

Disputing the balance (no prior appeal opportunity)

Misapplied payments

Innocent Spouse Relief

Lien modification or withdrawal

Requesting:

Installment agreement

Offer in Compromise

Currently Not Collectible status

Short, clear language works best.

Line 9 – Proposed Collection Alternatives

Check what you are realistically seeking. Expect to submit financial forms (433-A or 433-B).

Signature

Signed by you or your authorized representative

Power of Attorney (Form 2848) must match the periods listed

Where to Send It

Use the address or fax on the CDP notice, not the payment address

Keep proof of mailing or fax confirmation

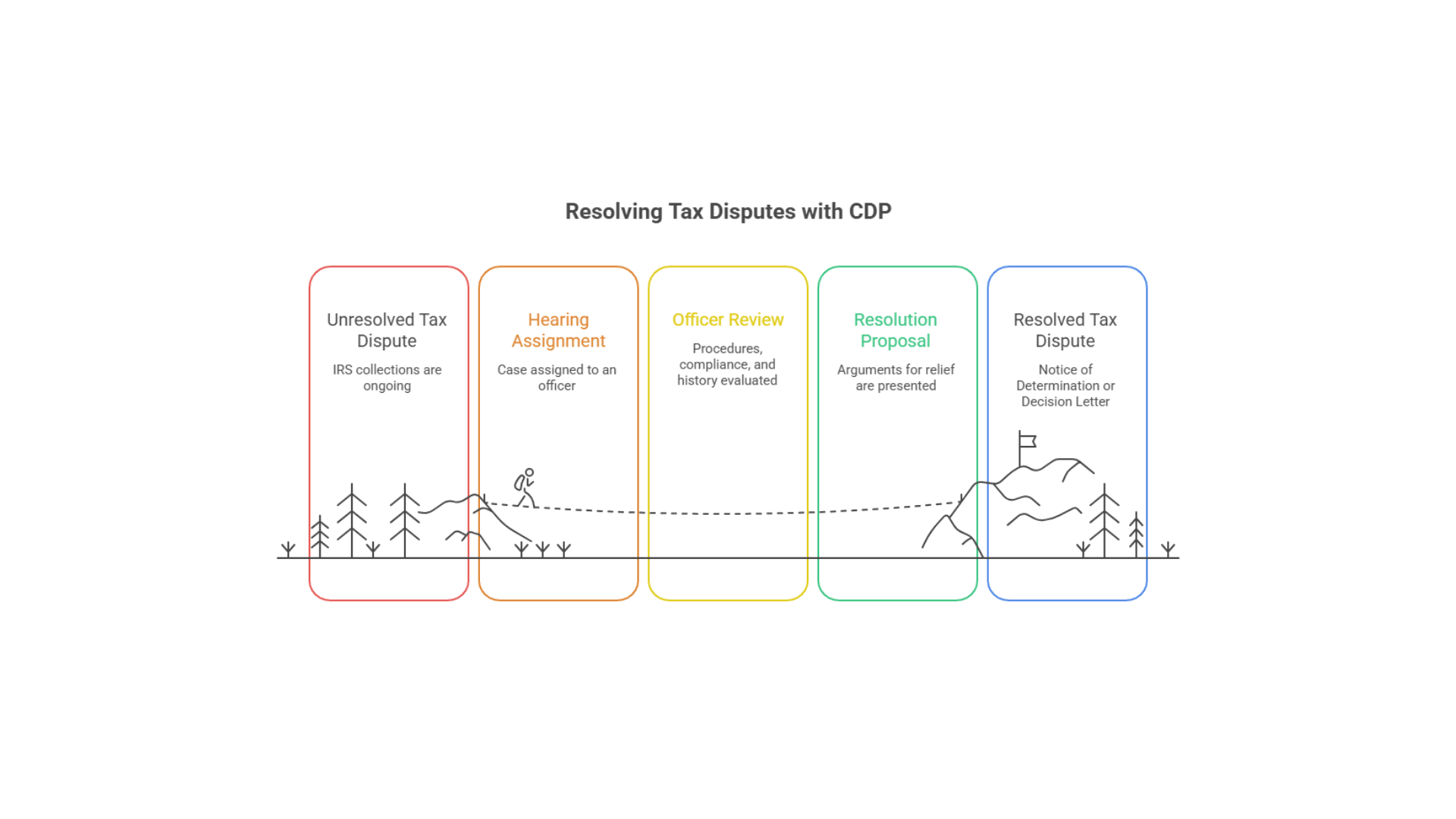

What Happens at a CDP Hearing?

Who You Speak With

Your case is assigned to an Appeals or Settlement Officer, independent from collections.

They will:

Verify IRS procedures were followed

Review compliance and account history

Evaluate your proposed resolution

Format

Usually by phone or video

Informal conference, not a courtroom

You can raise:

Ability-to-pay arguments

Penalty relief

Why a levy or lien causes financial harm

The Outcome

Timely CDP: Notice of Determination (appealable to Tax Court)

Equivalent Hearing: Decision Letter (final administratively)

Real-World Snapshots: How Tax Pros Handle CDP Hearings

I can’t share client names, but here’s how IRS appeals representation for a CDP hearing in [city/state] commonly plays out in my practice.

Case 1: Wage Earner, Final Notice of Intent to Levy

Balance: mid five-figures on 1040.

Situation: IRS final notice of intent to levy. The client typed “stop IRS levy” and “IRS CDP hearing help near me” into Google and then called me.

Strategy:

Filed Form 12153 within 30 days (timely IRS levy appeal).

Filed missing returns and fixed withholding.

Proposed an installment agreement the budget could actually handle, and requested first-time penalty abatement.

Common CDP Mistakes That Hurt Cases

Missing the 30-day deadline

Sending Form 12153 to the wrong address

Leaving Line 8 vague or blank

Being out of compliance with filings or payments

Requesting relief without financial documentation

Using CDP for issues better handled elsewhere

Result: The levy was held off, the installment agreement accepted, and penalties partially reduced.

Case 2: Small Business Owner, Payroll Tax Lien

Balance: six-figure 941 payroll tax debt.

The IRS had filed a Notice of Federal Tax Lien, creating IRS lien appeal issues that blocked financing.

Strategy:

Requested a CDP hearing on the lien notice.

Prepared Form 433-B and cash-flow projections.

Negotiated a structured installment agreement, then requested lien withdrawal after making payments and meeting criteria.

Result: A workable payment plan was established. The lien was later withdrawn so the client could refinance.

Case 3: High-Balance Individual, Equity and Limited Cash

The client asked, “IRS CDP hearing vs CAP appeal, which is better for me?”

Because we wanted Tax Court rights and a broad review of several years and liens, we chose CDP over CAP.

We used the hearing to align a multi-year payment plan and lay the groundwork for penalty abatement, rather than chasing numerous small CAP actions.

These are examples of how tax professionals handle IRS CDP hearings in practice. Not every case is a home run, but the structure helps avoid chaos.

IRS CDP Hearing FAQs

-

Yes. A CDP hearing is often the best structured place to request or refine an installment agreement, especially to stop or prevent IRS levy action.

-

If you have a qualifying notice and are within the 30-day window, a timely CDP hearing is one of the strongest tools to stop IRS levy and get Appeals involved. There could be other ways to stop an IRS levy, a review of you total circumstances would be best.

-

Timelines vary, but it’s common for cases to take several months from Form 12153 filing through decision, especially if financials or returns are missing at the start. The IRS isn’t fast. Still, the pause on levy and the access to Appeals and Tax Court can be worth the patience.

-

If you don't pay the full amount owed by the due date, the IRS may take further action to collect the debt, including Levying or garnishing your income sources & placing a lien on your property or seizing your assets. In addition, the IRS may issue a passport revocation.

-

For many taxpayers, the choice between CDP and CAP depends on the situation, and if you are allowed to file the appeal based on IRS action and the deadline to file the appeal.

-

CDP often wins.

-

CAP may be better.

-

While you can represent yourself, hiring an experienced & knowledgeable tax professional may help with the technical maneuvering to handle the appeals procedure. Many people search “hire tax professional for IRS CDP hearing” or “IRS collection appeal help for small business owners” because the stakes (liens, levies, wage garnishments) are high, and the rules are technical. Having a pro who works with IRS appeals daily can help you avoid burning key rights by mistake.

Final Thoughts

A CDP hearing is not a last-minute Hail Mary.

It’s a structured opportunity to:

Slow down enforcement

Bring Appeals into the case

Push toward a stable resolution

Use it correctly by:

Reading notices carefully

Filing Form 12153 on time

Making realistic, documented requests

Treating Appeals as a negotiation, not a fight