How to Handle a CA Notice of Proposed Assessment (FTB NPA Letter)

If the Franchise Tax Board (FTB) sent you a Notice of Proposed Assessment (NPA), don’t ignore it. This isn’t just a random bill. It’s California saying, “We think you owe more.” From the day you get it, the clock is ticking.

You might just have a chance to challenge the State’s Proposed Tax Bill.

TLDR;

The FTB Notice of Proposed Assessment means the state believes you owe more taxes.

Common reasons: unfiled returns, mismatched income (e.g. 1099s), IRS adjustments, or disallowed deductions.

You have 60 days to respond—after that, it becomes a final tax bill.

Ignoring the notice can lead to penalties, interest, liens, or levies.

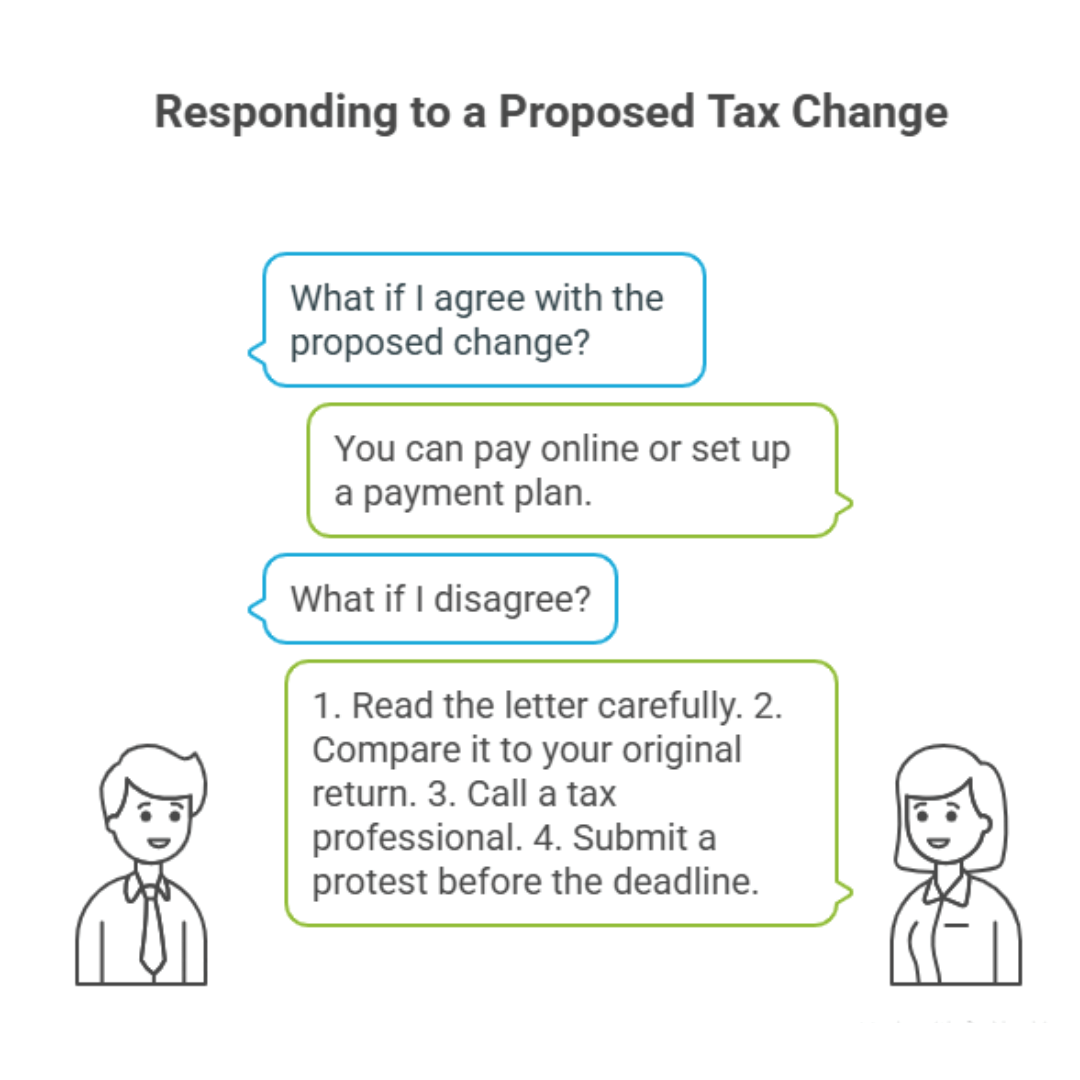

If you agree, you can pay online or request a payment plan.

If you disagree, file a protest with supporting documents before the deadline.

A protest letter should be clear, factual, and include proof.

Get professional help if the balance is high, the notice is unclear, or you're behind on other filings.

Action beats silence—respond before it turns into a bigger problem.

What Is a CA Notice of Proposed Assessment (NPA)?

An NPA is California’s way of telling you that a specific tax year has a problem or that you didn’t file at all. They’ve proposed changes that usually mean you owe more. It’s essentially California's version of a tax correction letter.

You might also hear it called:

CA tax notice

FTB notice

Tax assessment letter

California proposed tax assessment

The notice shows how much the state believes you owe and why. Common reasons include: math errors, unreported income, disallowed deductions, or IRS Examination Changes, IRS CP2000 Change in which the changes carry over to California.

What Does the CA NPA Letter Look Like?

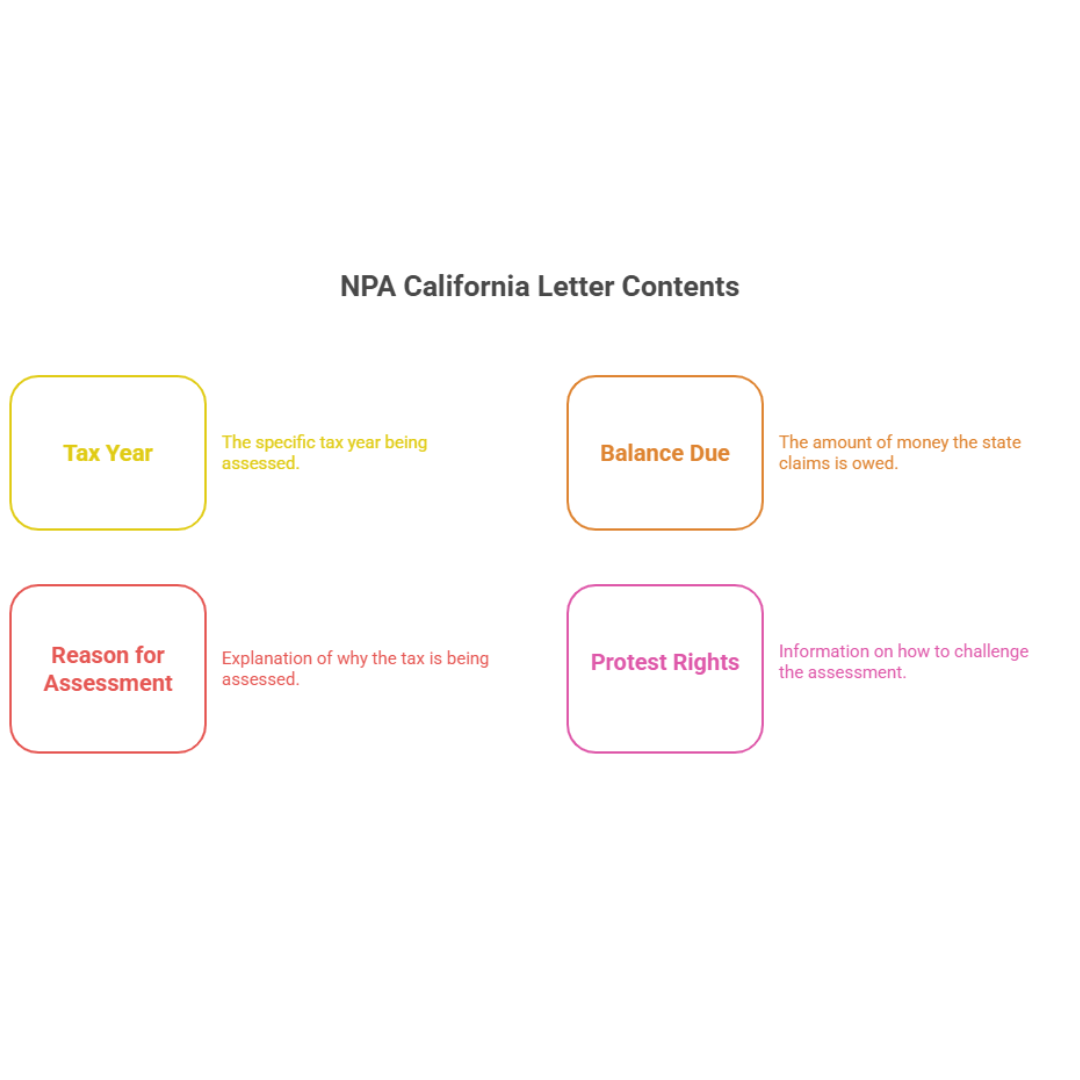

Your NPA California letter will list:

The tax year in question

The proposed balance due

The reason for the assessment

Your protest rights

Why Did You Get a Notice of Proposed Assessment in California?

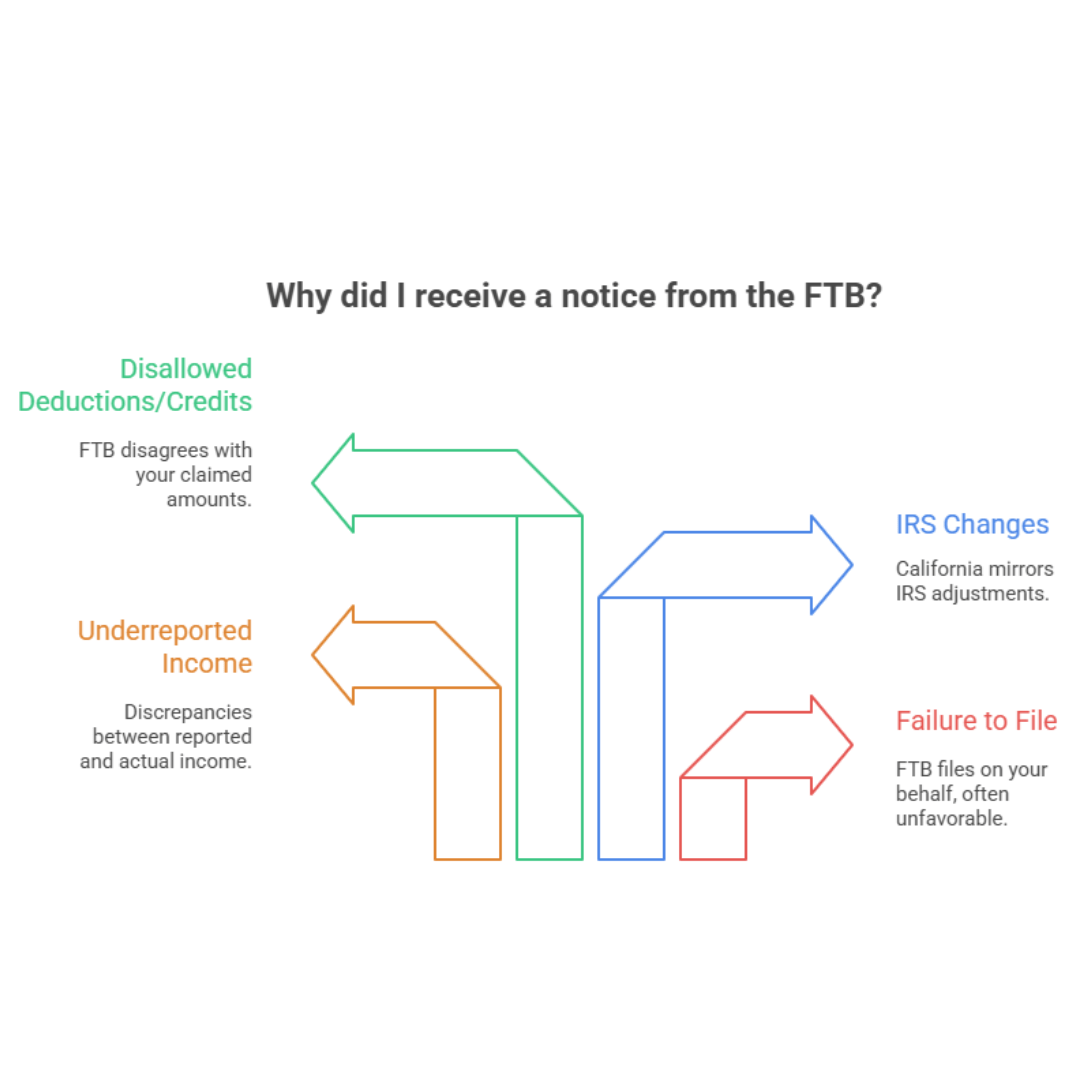

Here are the most common reasons:

You didn’t file a return - FTB files one for you, but it's never in your favor.

FTB says you underreported your income - This happens when 1099s, W-2s, or bank activity don’t match your filed return.

The IRS made changes - California picks up adjustments and mirrors them.

Your deductions or credits got disallowed - FTB disagrees with your numbers.

If you’re staring at the letter thinking, “This isn’t right,” you’re not alone.

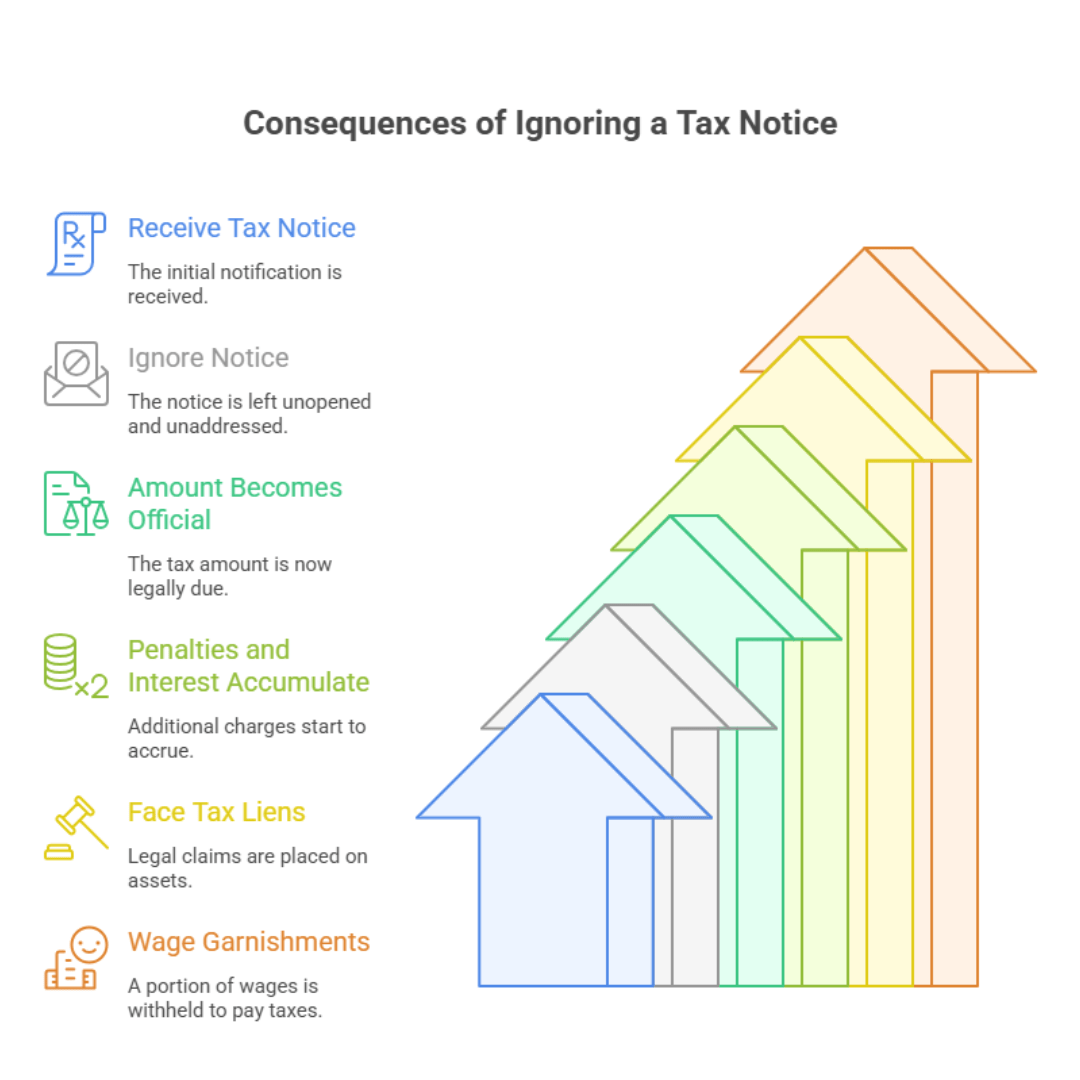

What Happens If You Ignore the Notice?

Here’s what’s waiting if the letter sits unopened:

The amount becomes official and collectible.

Penalties and interest begin stacking.

You could face tax liens or wage garnishments.

Ignoring this is like ignoring smoke from your engine. Eventually, something breaks.

How to Respond to a Notice of Proposed Assessment (FTB Response Guide)

If you agree with the proposed change:

You can pay online at the FTB website.

Set up a payment plan if you need time.

If you disagree:

Here's how to fight it:

Read the letter carefully. Make sure you understand what triggered it.

Compare it to your original return. Where are they saying the numbers went wrong?

Call a tax professional if you’re not sure how to verify or explain your position.

Submit a protest before the 60-day deadline.

You can use FTB’s protest form or mail a written letter. Include documentation and a clear explanation.

Sample Response to CA Notice of Proposed Assessment

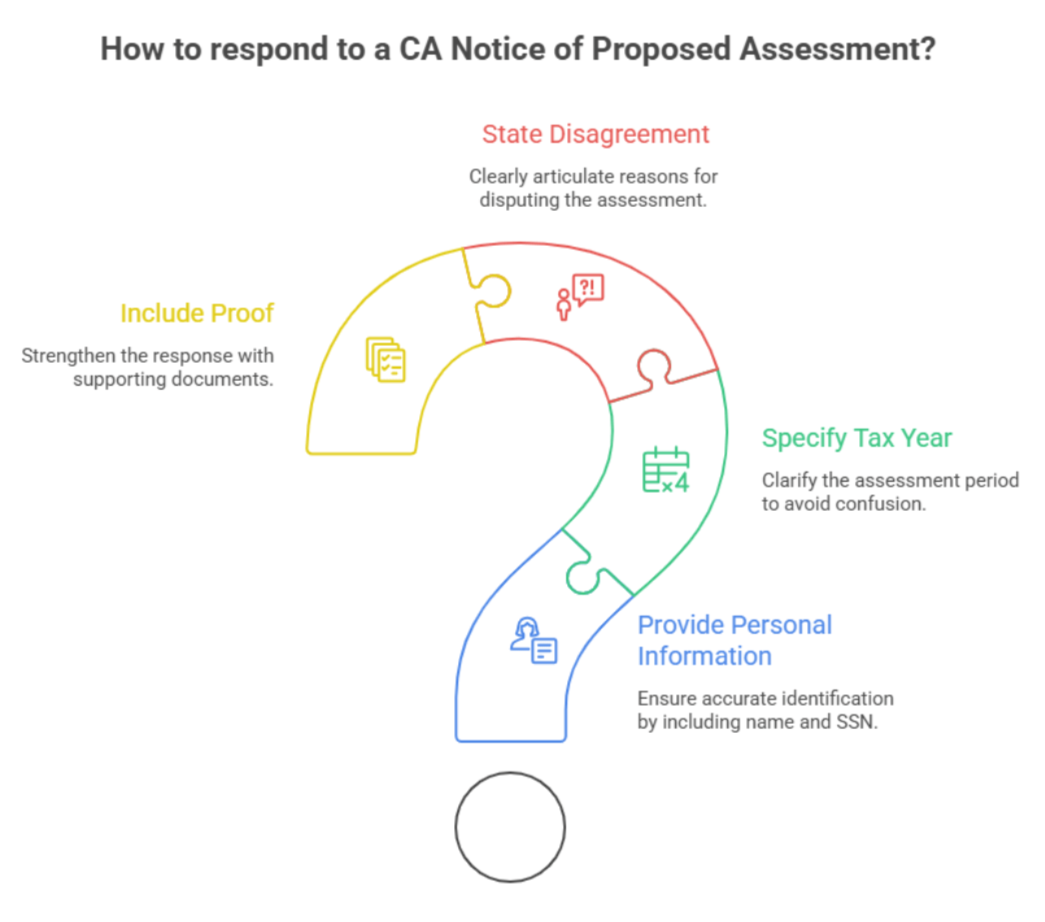

Your response should include:

Name and SSN

Tax year in question

Why you disagree

Copies of proof (W-2s, 1099s, receipts, etc.)

Keep it clear and to the point. This is not the time for a novel; just present the facts that support your case.

What If You Agree with the FTB Assessment?

Some people decide it’s easier to just pay it and move on. If that’s you:

Use the FTB payment options (online, mail, or installment plan)

Keep records of the payment

Adjust next year’s taxes to prevent the same issue

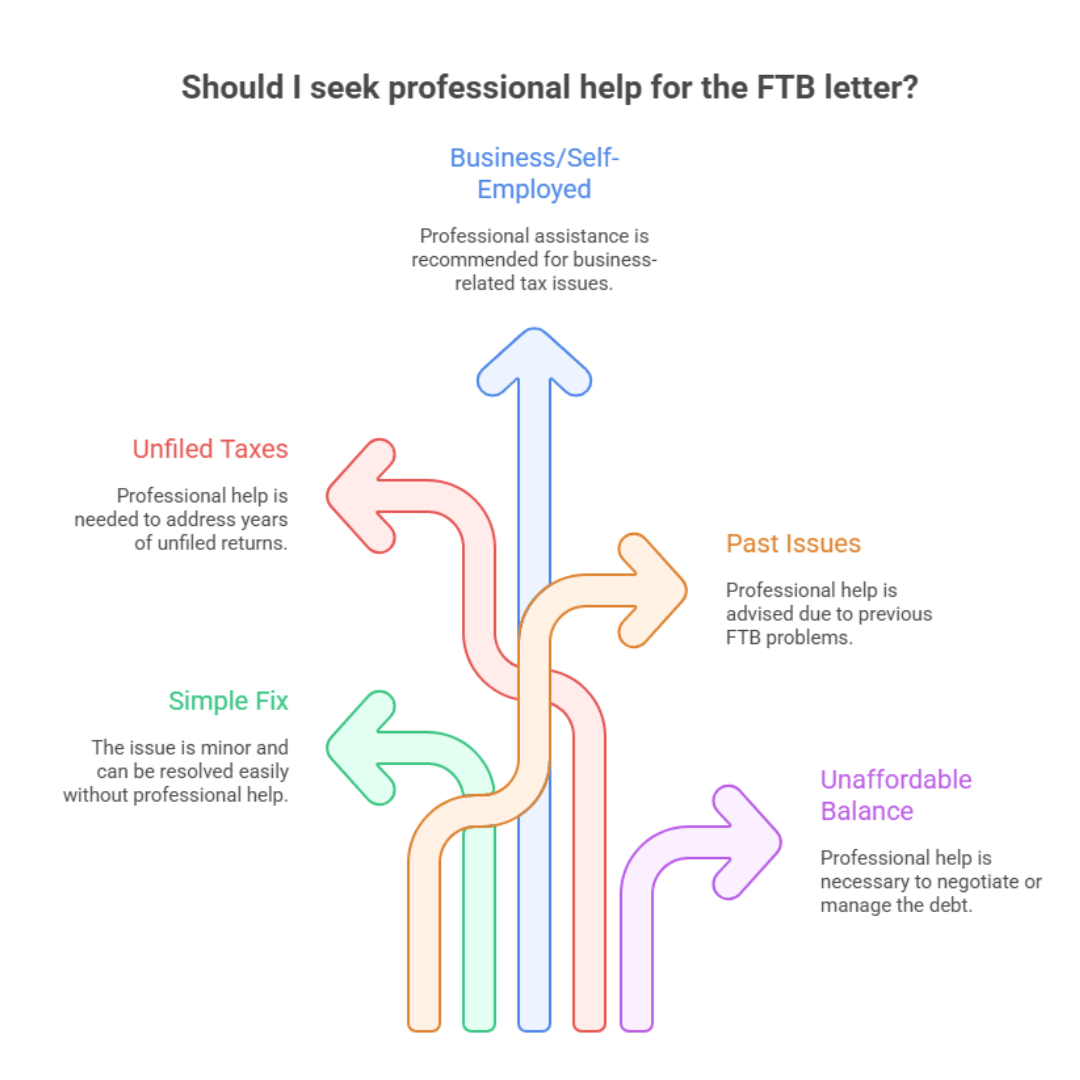

When to Get Professional Help

Sometimes, a Franchise Tax Board NPA letter is a simple fix. Other times, it’s a symptom of deeper problems, such as years of unfiled taxes or misreported income.

Call in backup if:

You didn’t file a return and don’t know how to fix it

You run a business or are self-employed

You’ve already had past issues with the FTB

The proposed balance is more than you can afford

FTB says I owe more taxes in California is a sentence we hear often. There’s always a way to respond strategically.

CA Notice of Proposed Assesment FAQs

-

From July 1 to Dec 31, 2025, the rate is 7% on personal and corporate underpayments.

-

You must pay estimates if you expect to owe at least $500 for 2025 ($250 if married filing separately) and your withholding/credits will be less than the smaller of:

90% of your 2025 tax, or

100% of your 2024 tax.

-

If your 2024 CA AGI was more than $150,000 ($75,000 MFS), you must base estimates on the smaller of:

90% of your 2025 tax, or

110% of your 2024 tax.

If your 2025 CA AGI is $1,000,000+ ($500,000 MFS), you must use 2025 tax only—no prior-year safe harbor allowed.

-

California splits payments unevenly, unlike the IRS:

Q1: Apr 15, 2025 → 30%

Q2: Jun 16, 2025 → 40%

Q3: Sep 15, 2025 → 0%

Q4: Jan 15, 2026 → 30%

-

Yes, if either applies:

Any single estimate or extension is over $20,000, or

Your original return tax is over $80,000.

Once triggered, all future payments must be e-paid. If you don’t, there’s a 1% penalty.

-

The penalty is 5% of the unpaid tax plus 0.5% per month (or part), up to 40 months. The maximum combined penalty can reach 25%.

-

What happens if I don’t act within 60 days of a Notice of Proposed Assessment (NPA)?

Don’t Freeze, Fight or Fix

Letting that FTB assessment letter collect dust is the worst option. Whether you pay, protest, or need more time, action is better than silence.

Need help figuring out your next move? Let us review your notice before the clock runs out. We'll help you get clear on what you're dealing with and what to do next.

Let’s handle this before it snowballs.

Contact us today to get started.