Form 2848 vs Form 8821: IRS Power of Attorney vs Tax Information Authorization

IRS Power of Attorney vs IRS Tax Information Authorization

If you have ever wondered, “Form 2848 vs Form 8821, which one do I actually need?” you are not alone. Many taxpayers, and even some professionals, mix up the IRS power of attorney form and the IRS tax information authorization form.

This guide gives you the real world difference between Form 2848 and Form 8821. You will see when each form is appropriate and how I decide which one to use in active IRS cases.

TLDR;

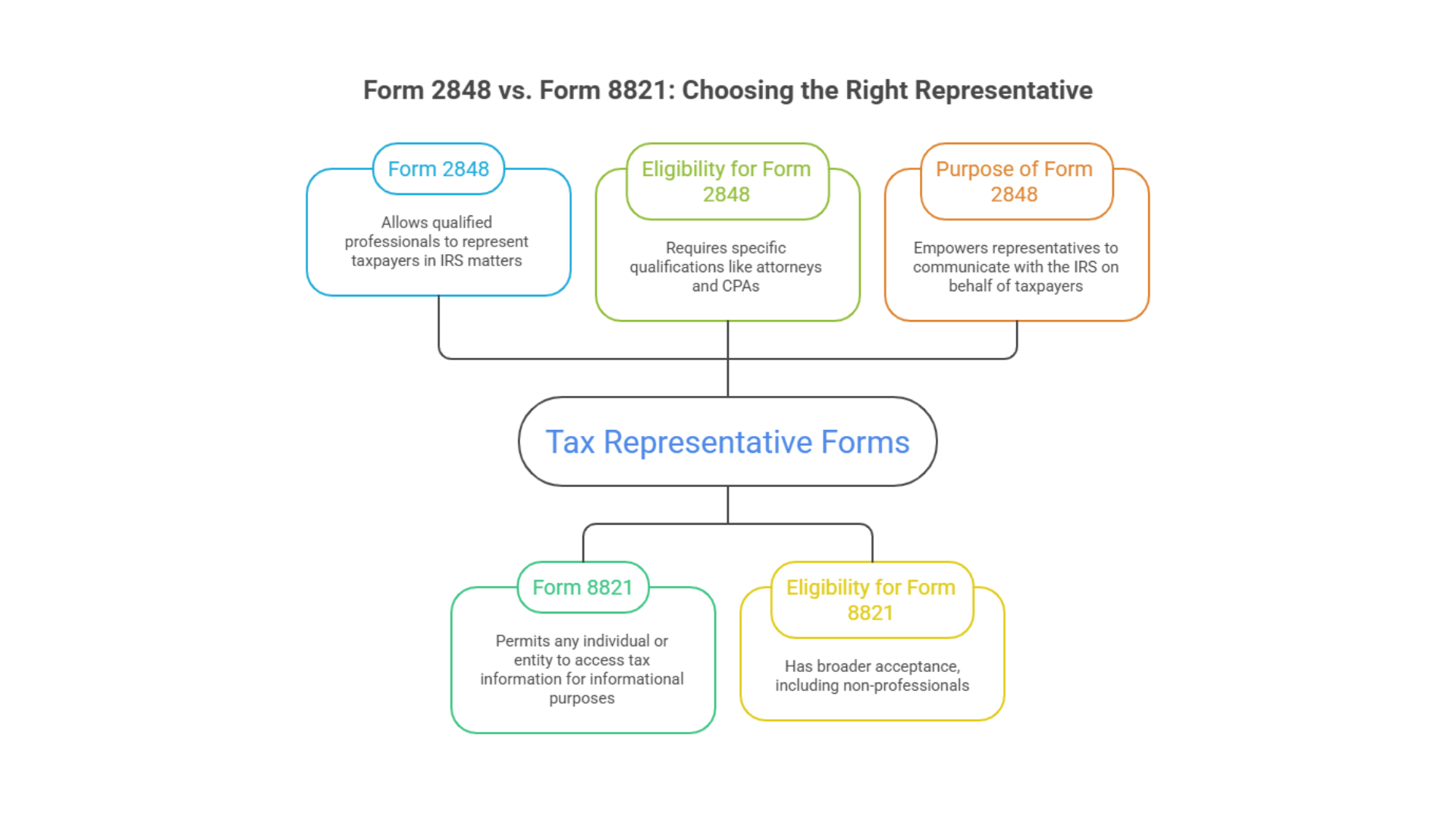

Form 2848 is for representation plus information access, it lets a qualified pro speak to the IRS and handle your case.

Form 8821 is for information access only, it allows transcripts and notices, but no representation and no IRS calls on your behalf.

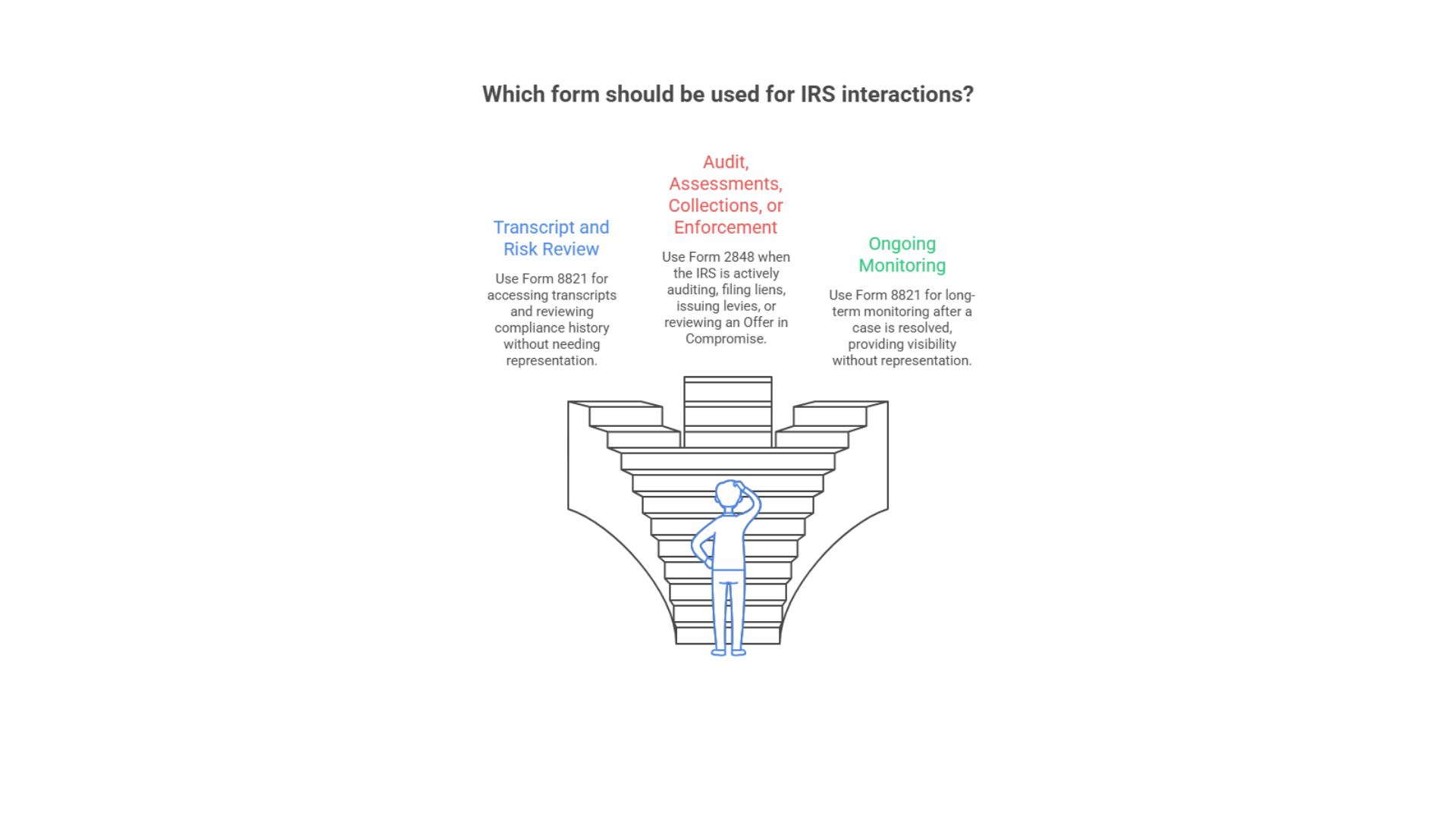

Use 8821 for early diagnosis, transcript pulls, compliance review, and ongoing monitoring after resolution.

Use 2848 for active IRS matters, audits, collections, payment plans, OIC, appeals, lien and levy issues.

Who you name matters, 2848 is limited to IRS eligible reps like EA, CPA, attorney, while 8821 can be almost anyone or any organization.

2848 carries more responsibility and authority, 8821 is lighter scope and lower risk.

Both can be revoked or replaced, and reps can withdraw, cleaning up old authorizations prevents future problems.

Quick Answer, Difference Between Form 2848 and Form 8821

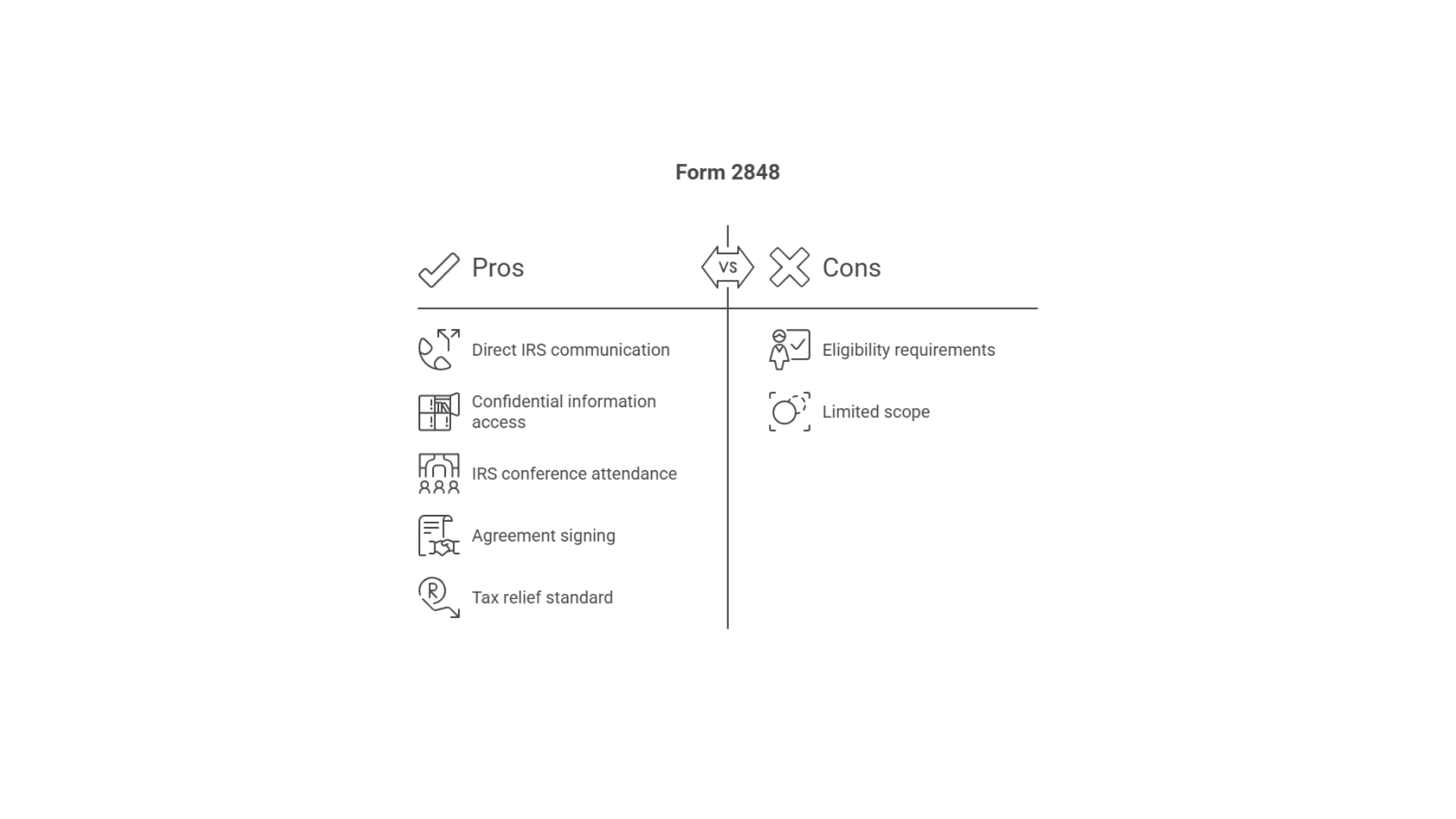

Form 2848, Power of Attorney and Declaration of Representative

This is the IRS power of attorney form. You use it when you want a qualified individual, such as an EA, CPA, or attorney, to represent you before the IRS. They can speak for you, attend conferences, and handle many tax matters for you.

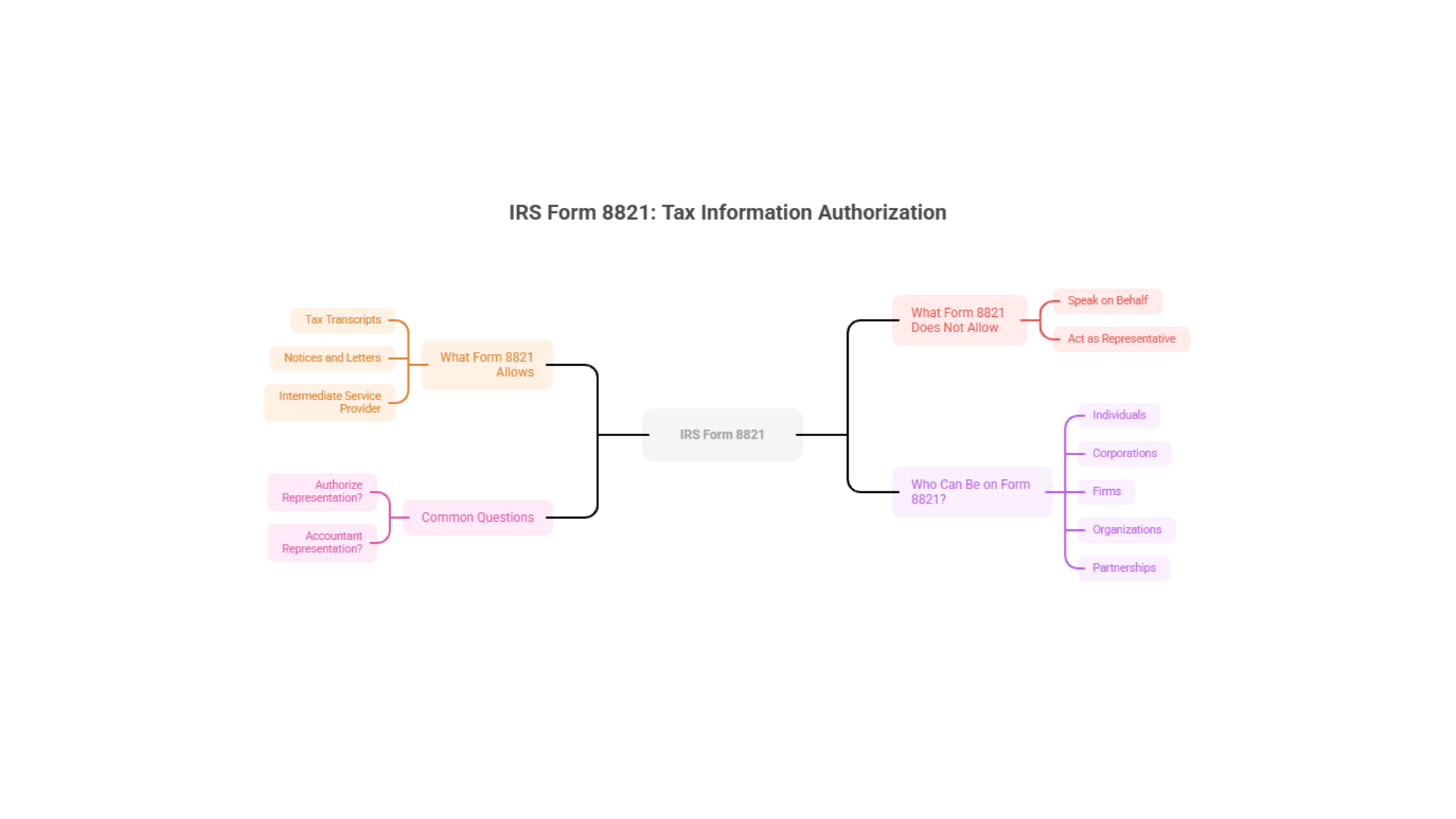

Form 8821, Tax Information Authorization

This is the tax information authorization form. You use it when you want someone to inspect or receive your confidential IRS information, but not represent you.

Core Difference

Form 2848 gives representation and information access.

Form 8821 gives information access only.

If you want a professional to speak to the IRS, negotiate, stop collections, or appear on your behalf, you need Form 2848. If you only want someone to pull your IRS transcripts or review your records, Form 8821 is usually enough.

Side by Side Comparison: IRS POA vs Tax Information Authorization

| Criteria | Form 2848, IRS Power of Attorney | Form 8821, Tax Information Authorization |

|---|---|---|

| Official IRS Name | Form 2848, Power of Attorney and Declaration of Representative | Form 8821, Tax Information Authorization |

| What It Does | Authorizes an individual to represent you and receive tax info | Authorizes an individual or entity to receive your IRS information only |