IRS CAP Request: When You Disagree With Collections

If the IRS files a lien, hits your bank account with a levy, or shuts down your installment agreement, it can feel like the ground just shifted under you.

The Collection Appeals Program (CAP) is the IRS’ fast-track review process for certain collection actions. An IRS CAP Request is how you ask the IRS Independent Office of Appeals to step in and review what Collections is doing.

In this guide, I’ll walk you through how CAP works, when it’s the right move, how to file Form 9423, and what to expect after you file. I’ll draw on official IRS guidance as well as what I see every day in tax relief cases.

TLDR;

An IRS CAP Request uses Form 9423 to appeal specific collection actions (liens, levies, seizures, and installment agreement decisions), not the underlying tax bill.

CAP is part of the IRS Collection Appeals Program, meant to quickly review whether a collection action is reasonable and followed IRS rules.

It’s best used when you disagree with how the IRS is collecting (bank levy, wage garnishment, lien filing, IA rejection/termination), not when you’re arguing “I don’t owe this.”

Deadlines are tight – some are only a few business days after a manager conference or notice, so waiting can kill your CAP rights.

Before Appeals reviews your case, you usually need a Collection manager conference to try to resolve the issue.

Block 15 on Form 9423 is critical: you must clearly explain why you disagree with the action and what specific resolution you’re proposing, backed by documents.

While a timely IRS CAP appeal is pending, the IRS often pauses that specific levy/lien/seizure action, giving breathing room in many cases.

CAP decisions are binding on both you and the IRS and generally do not lead to Tax Court, unlike a timely CDP hearing.

CAP is a short-term shield, not a full tax debt solution—you still need a long-term plan (IA, OIC, CNC, penalty relief, etc.).

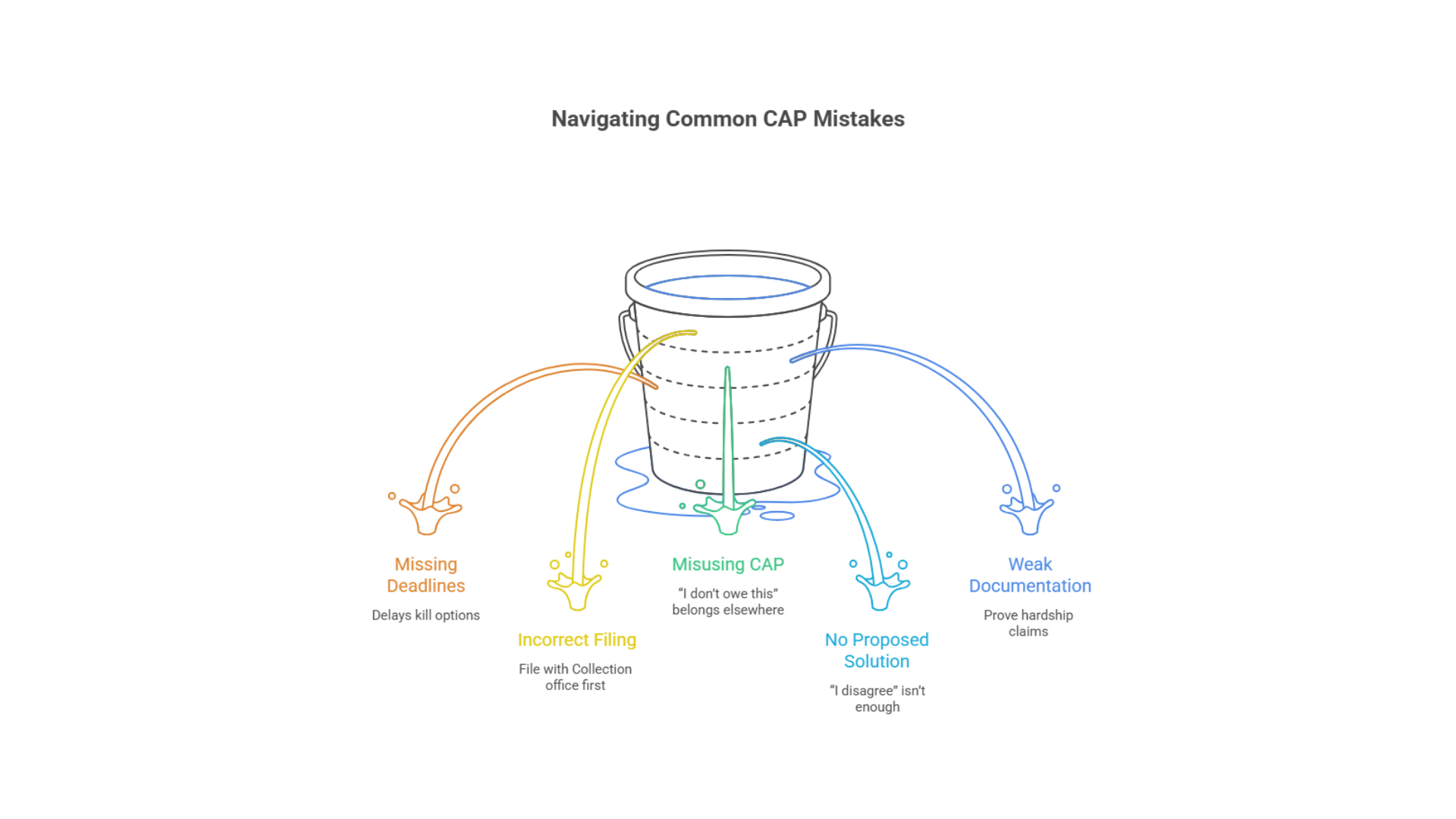

Common mistakes: filing late, using CAP to fight the amount of tax, sending Form 9423 to the wrong place, giving weak or vague explanations, and not attaching financial proof.

Quick Answer: What Is an IRS CAP Request?

An IRS CAP Request is a formal appeal you file when you disagree with certain IRS collection actions, such as:

Filing or keeping a Notice of Federal Tax Lien

Issuing or keeping a levy or seizure

Rejecting, terminating, or changing an installment agreement

Denying certain requests about liens or levies (like lien withdrawal, subordination, or return of levied funds)

You request CAP by filing Form 9423, Collection Appeal Request, after you’ve had (or attempted to have) a conference with the IRS Collection manager.

CAP is about how the IRS is collecting, not whether you owe the tax.

And unlike a Collection Due Process (CDP) hearing, a CAP decision is final you generally can’t go to Tax Court if you disagree.

Key Takeaways (Read This If You’re In a Hurry)

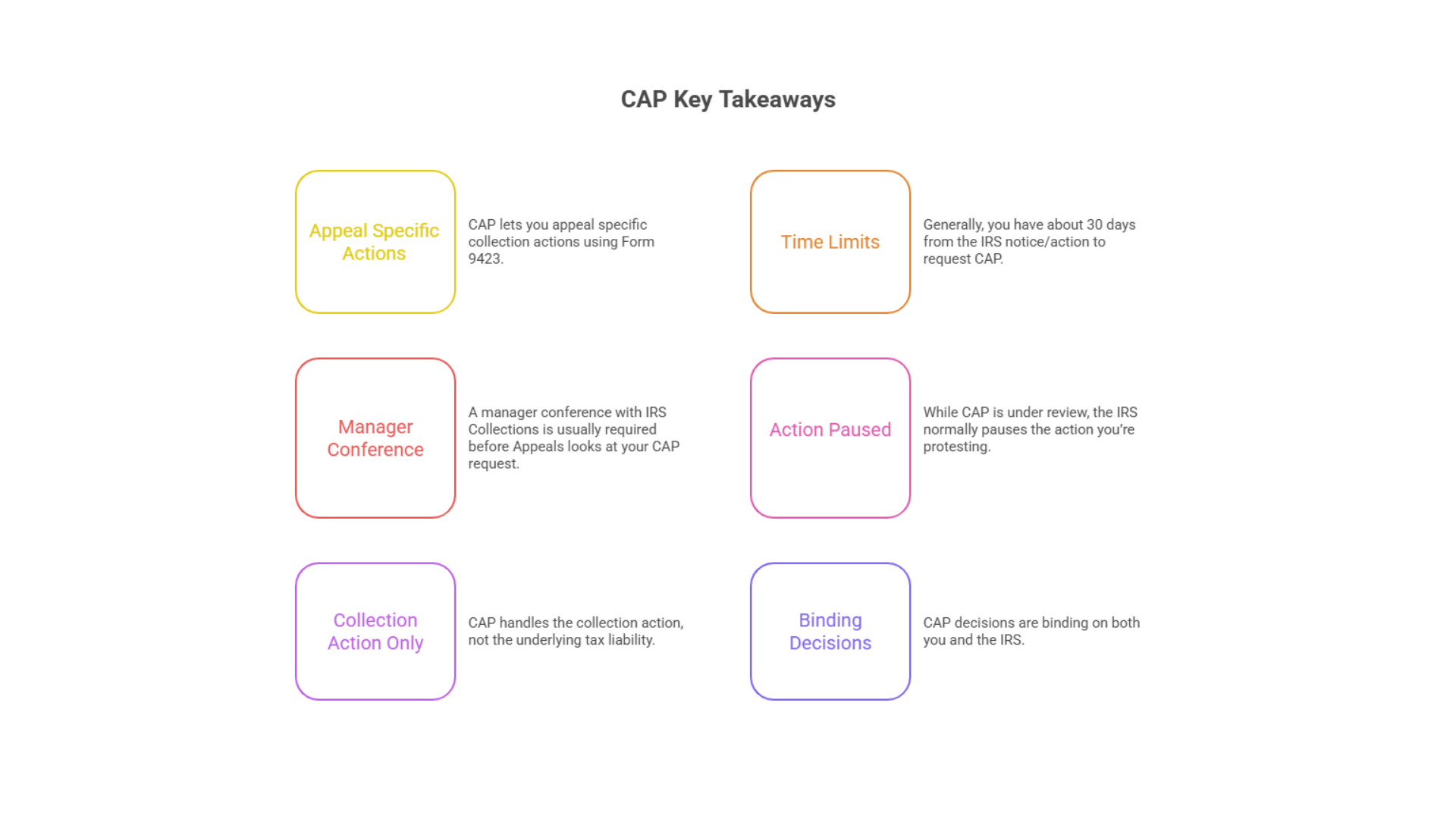

CAP lets you appeal specific collection actions (liens, levies, seizures, installment agreement decisions) using Form 9423.

For many actions, you generally have about 30 days from the IRS notice/action to request CAP. Some levy/seizure situations have shorter business-day deadlines.

A manager conference with IRS Collections is usually required before Appeals looks at your CAP request (installment agreement cases have special rules).

While CAP is under review, the IRS normally pauses the action you’re protesting (unless they think assets are at risk).

CAP handles the collection action, not the underlying tax liability. If you want to fight the amount you owe, you may need CDP or a different appeal route.

CAP decisions are binding on both you and the IRS. No Tax Court review in most cases.

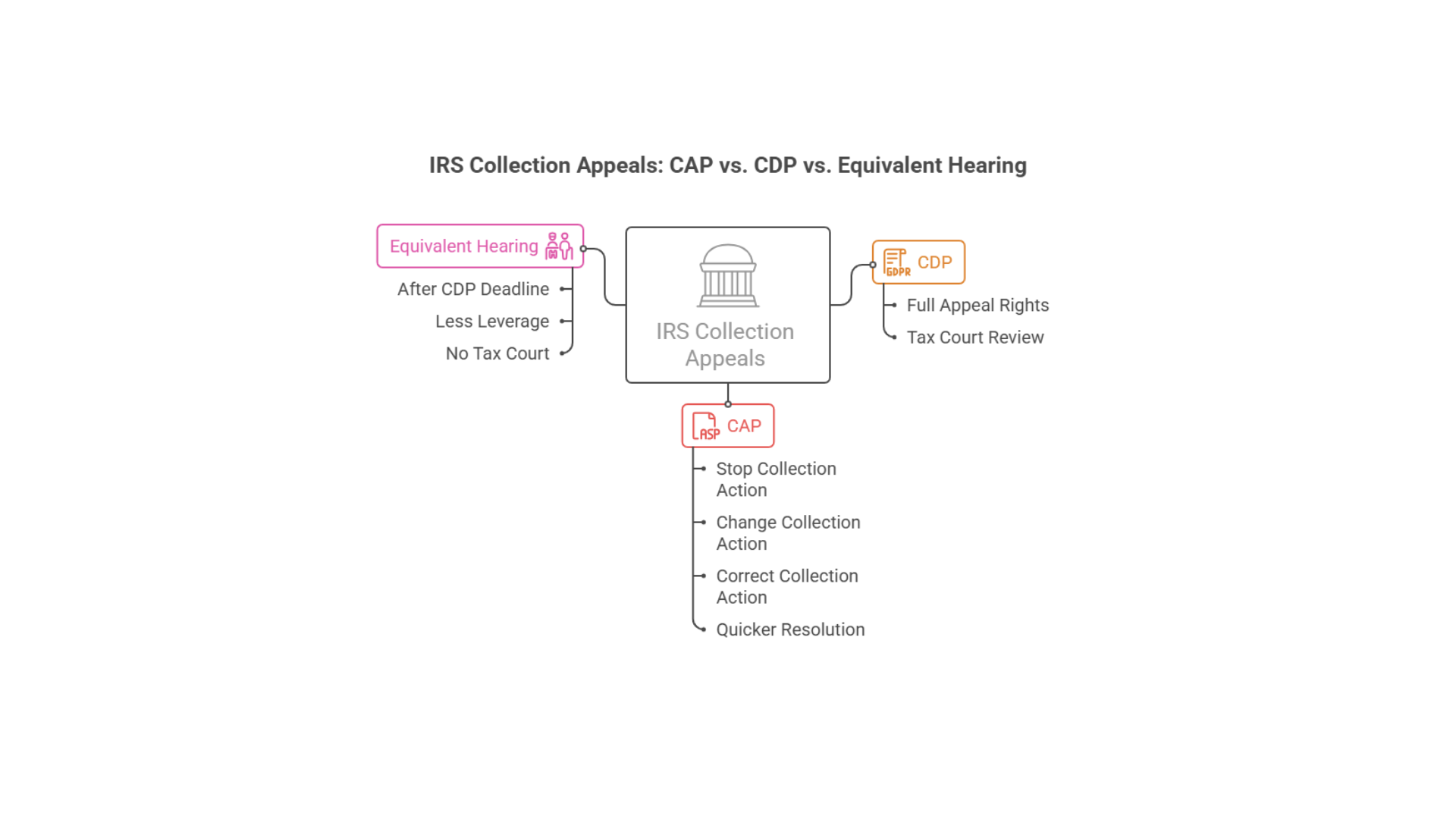

CAP vs CDP vs Equivalent Hearing (Plain English)

Here’s the quick framework I use when someone asks:

“Should I file a CAP request or a CDP hearing?”

Use CDP if you still have full appeal rights and you might want Tax Court review.

Use CAP if you’re focused on stopping, changing, or correcting a specific collection action and you need a quicker resolution.

Equivalent Hearing is like CDP, but filed after the CDP deadline, usually less leverage and no Tax Court.

When to Use the IRS Collection Appeals Program (CAP)

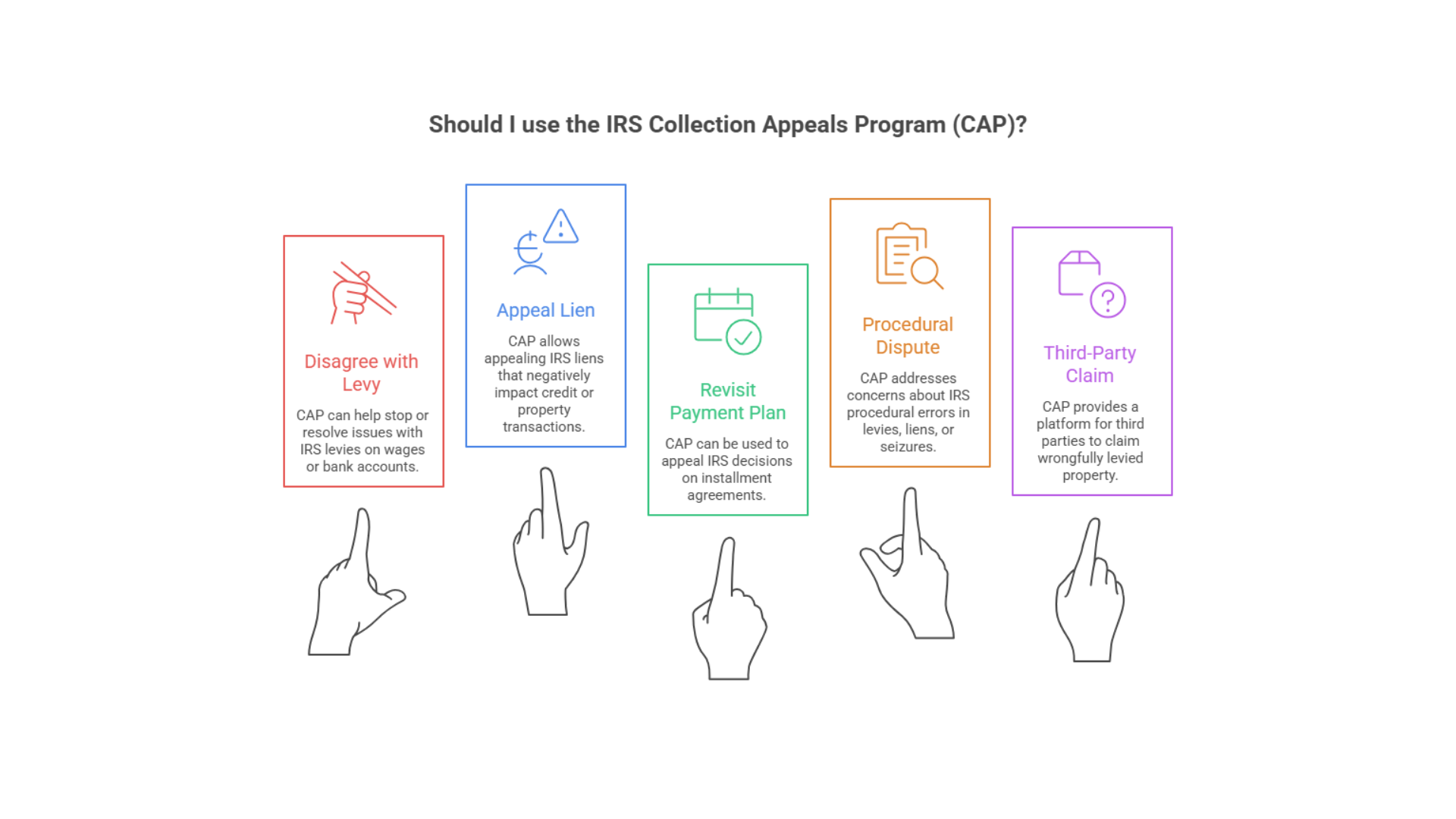

Your situation is a good match for CAP when:

You disagree with an IRS levy already hitting wages or a bank account and want to stop it

You want an IRS lien appeal because an NFTL is hurting credit, a sale, or refinance

The IRS rejected, terminated, or changed your installment agreement and you need an IRS payment plan appeal

You believe the IRS didn’t follow procedures on a levy, lien filing, or seizure

You’re a third party claiming your property was wrongfully levied

If you still dispute the amount of tax, or you want to present an Offer in Compromise, or argue broader alternatives like Currently Not Collectible, CAP may not be your main tool.

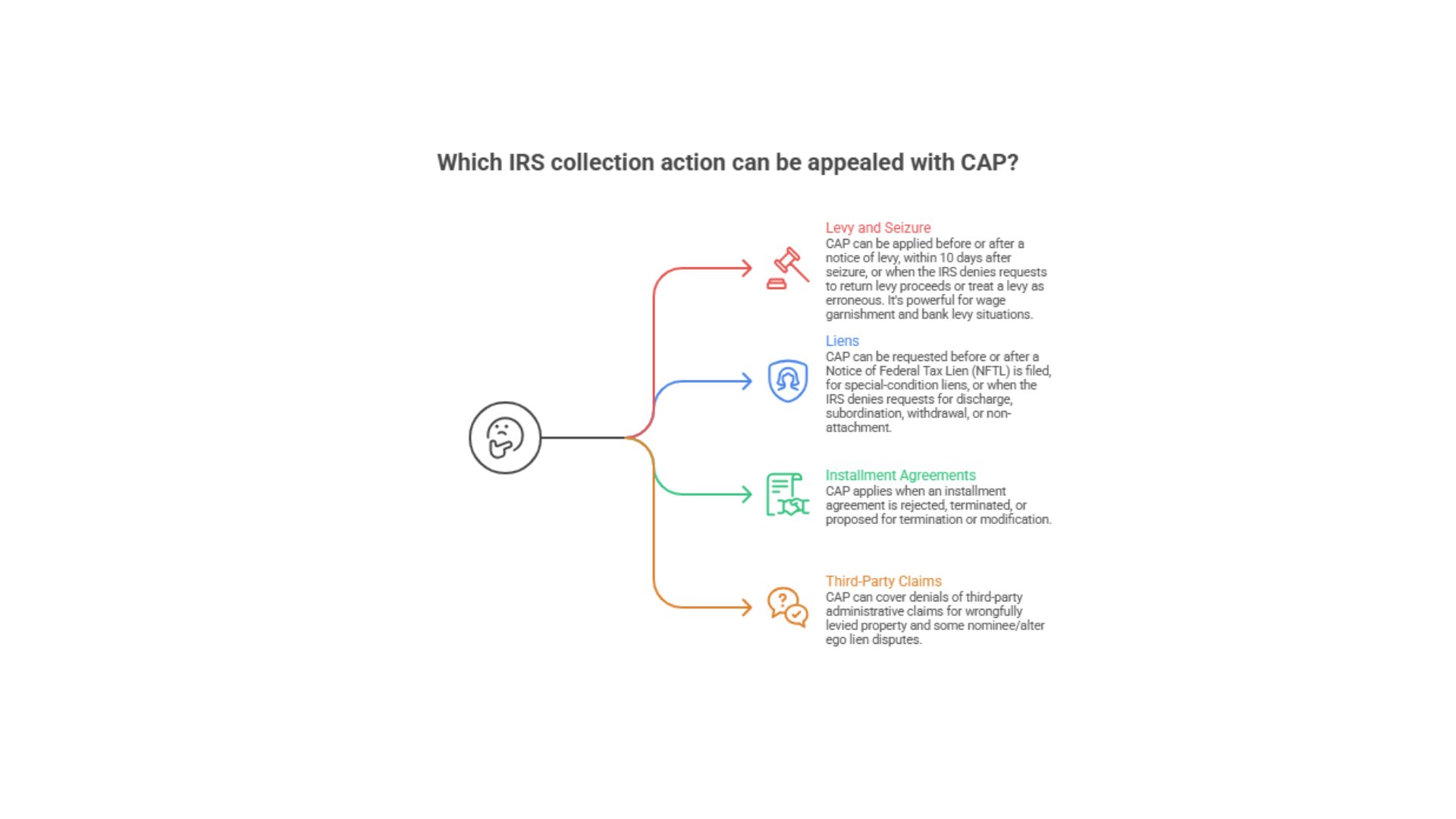

What Collection Actions You Can Appeal with CAP (Practical Breakdown)

1) Levy and Seizure (IRS Levy Appeal)

CAP can apply:

Before or after a notice of levy

Before or within 10 days after a seizure of property (deadlines can be short)

When the IRS denies your request to return levy proceeds or treat a levy as erroneous (in certain situations)

For third parties claiming wrongful levy before funds are sent to the IRS

This is where CAP becomes a powerful move for wage garnishment or bank levy situations.

2) Liens (IRS Lien Appeal)

You can request a CAP lien appeal:

Before or after the IRS files a Notice of Federal Tax Lien (NFTL)

After special-condition liens (nominee/alter ego/transferee)

When the IRS denies requests for discharge, subordination, withdrawal, or non-attachment

3) Installment Agreements (IRS Payment Plan Appeal)

CAP applies when an installment agreement is:

Rejected

Terminated (or proposed for termination)

Modified (or proposed for modification)

4) Third-Party Claims & Wrongful Levy Issues

CAP can cover:

Denials of a third-party administrative claim for wrongfully levied property

Some nominee/alter ego lien disputes

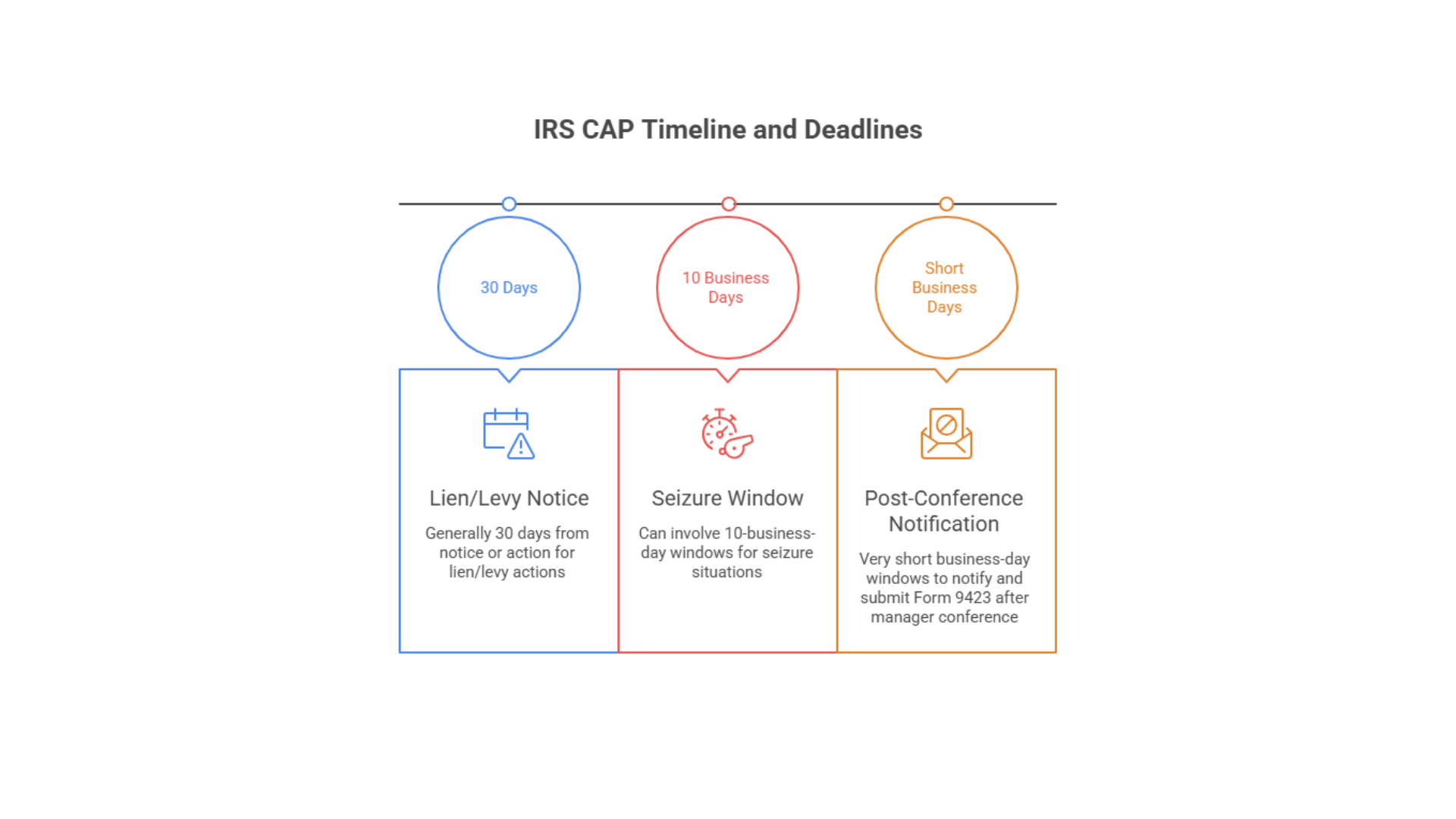

IRS CAP Timeline and Deadlines (Where People Get Burned)

This is where CAP trips people up: deadlines can be short, and some are measured in business days.

A simplified view:

Many lien/levy actions: generally about 30 days from the notice or action

Seizure situations: can involve 10-business-day windows

After a manager conference: there can be very short business-day windows to notify and submit Form 9423

Bottom line: CAP is not something to sit on. If you delay, your best tool to dispute IRS collection actions may expire.

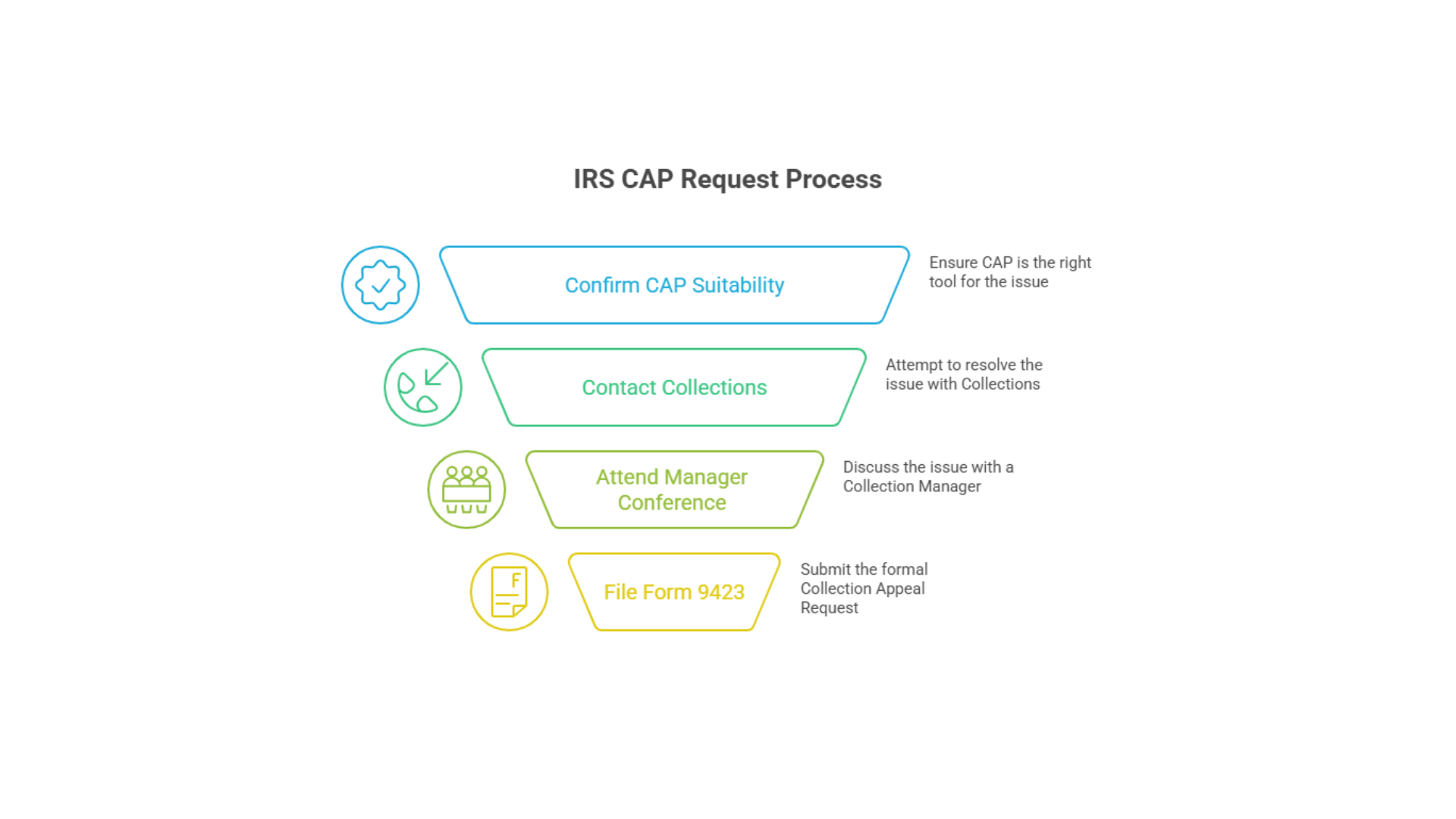

How to File an IRS CAP Request (Step-by-Step)

Step 1 – Confirm CAP Is the Right Tool

Before you file Form 9423, confirm:

Your issue is a collection action (lien, levy, seizure, IA decision)

You’re inside the CAP window

You’re not trying to re-litigate the underlying tax

Ask yourself:

“If the IRS stopped or adjusted this collection action, would that solve the immediate crisis?”

If yes, CAP is probably part of the plan.

Step 2 – Call Collections and Ask for a Manager

The IRS expects you to try to resolve it with Collections first.

Call the number on the notice, or your Revenue Officer (RO)

Request a manager conference

Explain why the action is unreasonable and what you propose instead

Document:

Date/time of calls

Names and ID numbers

What was discussed and any promises made

Step 3 – The Collection Manager Conference

At the conference:

Explain why you disagree with the lien/levy/seizure/IA decision

Provide supporting docs (bank statements, hardship proof, financials)

Propose a realistic alternative (different IA terms, levy release, lien change)

If the manager fixes it, you may not need CAP.

Step 4 – File Form 9423 (Collection Appeal Request)

Key points:

File Form 9423 with the Collection office or RO, not directly with Appeals

Make sure it’s received/postmarked within the required deadline

Attach copies of:

IRS notices

IA letters

Financials/hardship documents

Prior correspondence that supports your position

Use a delivery method with proof of mailing and delivery

Form 9423 “Block 15” (The Part That Wins or Loses)

This is the heart of your CAP request.

Don’t write: “This is unfair.”

Instead:

State the issue clearly

Explain the impact (hardship, payroll disruption, etc.)

Give a specific alternative that still allows reasonable collection

Example style:

“The levy hit our operating account right before payroll and creates economic hardship. We proposed a payment plan supported by updated financials.”

“We can pay $X per month based on current cash flow. We’re requesting release of this levy and acceptance of the proposed installment agreement.”

Attach proof:

Bank statements

Pay stubs / P&L / cash-flow summary

Proof of hardship (shutoff, eviction, medical, etc.)

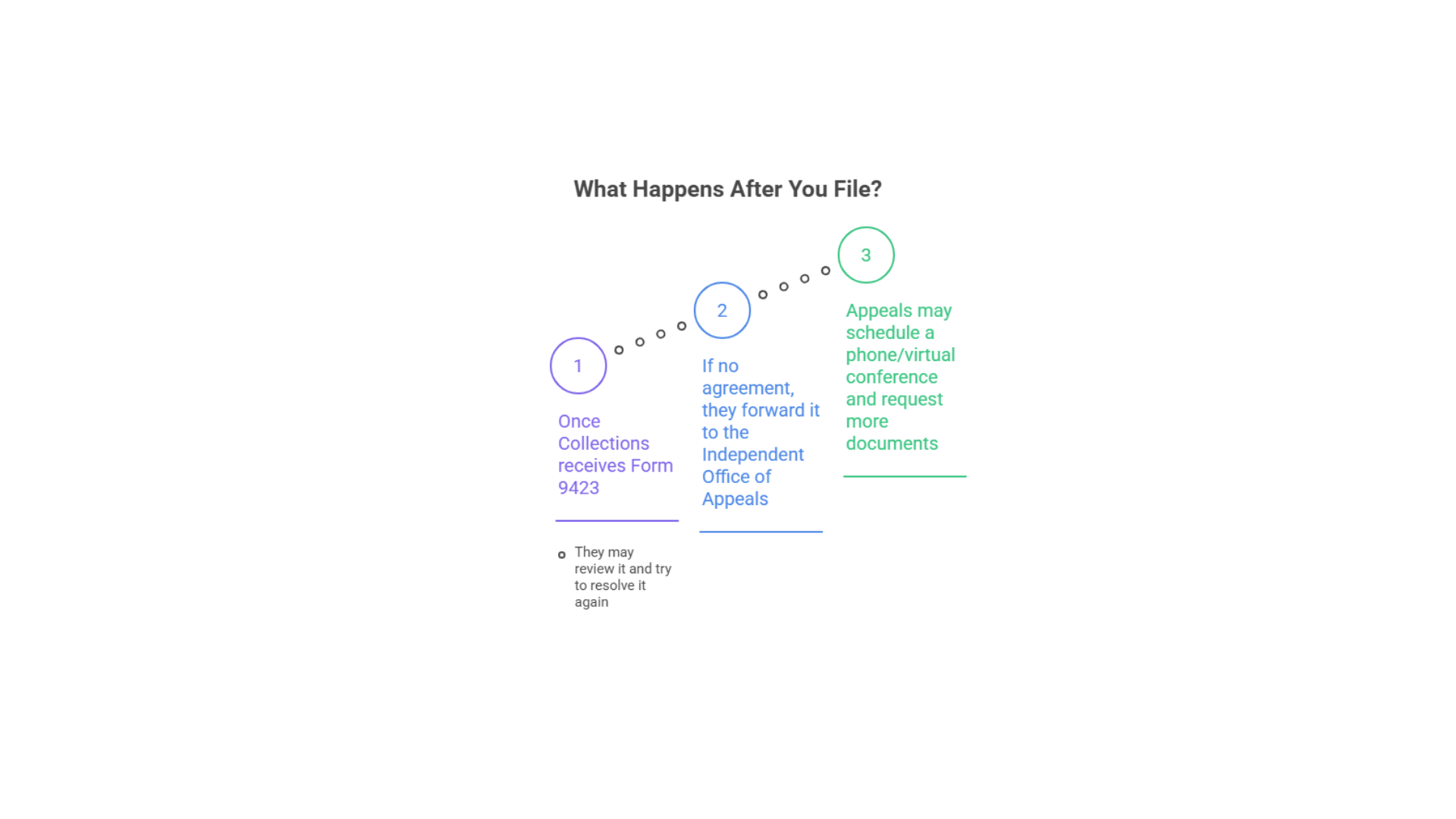

What Happens After You File?

Once Collections receives Form 9423:

They may review it and try to resolve it again

If no agreement, they forward it to the Independent Office of Appeals

Appeals may schedule a phone/virtual conference and request more documents

Does CAP Stop IRS Collections?

Often, yes the IRS normally pauses the collection action you’re protesting while CAP is pending (with exceptions if they believe collection is at risk).

Is the CAP Decision Final?

Yes. The decision is binding on you and the IRS, and you generally can’t challenge it in Tax Court.

Common CAP Mistakes (and How to Avoid Them)

Missing deadlines → Treat CAP like a fire drill. Delay kills options.

Sending Form 9423 to Appeals → File with the Collection office/RO first.

Using CAP to fight the tax amount → “I don’t owe this” usually belongs elsewhere.

No proposed solution in Block 15 → “I disagree” isn’t enough.

Weak documentation → If you claim hardship, prove it.

IRS CAP Request: When You Disagree With Collections FAQs

-

A taxpayer may file, and a third party may file if their property is subject to the collection action. Form 9423 is designed for both situations.

-

Yes. A taxpayer representative can pursue CAP, but in practice you typically want the proper authorization on file so IRS personnel will speak with the representative.

-

Yes. You can submit a CAP request in writing, and the Taxpayer Advocate Service notes CAP requests can be made using Form 9423, or verbally or in writing in notice only situations.

-

The IRM indicates you can contact Collection again or submit Form 9423, and you should document the original request for the conference and the fact you were not contacted in Block 15.

-

IRS Appeals guidance states you should submit Form 9423 within 3 business days of the manager conference.

-

Appeals policy generally suspends collection while lien, levy, and seizure CAP cases are in Appeals, but the IRM notes the stay is not required if the CAP request is received more than 2 business days after the conference date, with an additional note that the CAP request can still be accepted up to 10 business days after the conference in many situations.

-

Often yes, if the issues are tied to the same collection function and you can present them clearly. Practically, you will want to keep it readable, and list each period and each protested action so there is no ambiguity.

-

You can usually supplement. Appeals may request additional documents during the conference process, so you should be ready to deliver updated financials, bank statements, payroll proof, or other records on short notice.

What to Do If You Disagree With IRS Collections Right Now

Gather everything

Notices, letters, bank statements, pay stubs, IA letters

Identify the lane

Is it CDP (fresh final notice) or CAP (specific collection action)?

Mark deadlines

30-day windows

business-day windows on seizures/manager conference situations

Decide your ask

What do you want Appeals to do?

What payment/arrangement can you realistically maintain?

If the stakes are high (job, business payroll, home sale, bank levy), this is where getting help can prevent expensive mistakes.