What Are IRS 1040-ES Payments and Why They Matter for Self-Employed Taxpayers

If you’re like many self-employed folks, you might feel that IRS payments can feel like a black hole. But the IRS doesn’t wait until the April Deadline. The IRS expects you to pay as you go. That’s where the quarterly payments or Form 1040-ES comes in.

TLDR;

IRS Form 1040-ES is used to pay estimated taxes if your income isn’t subject to withholding (freelance, gig work, rentals, etc.). Also Known as Quarterly Estimated Tax Payments

If you are self employed & expect to owe $1,000 or more, you're likely required to pay quarterly taxes.

The IRS follows a pay-as-you-go system—waiting until April can trigger penalties.

Use the safe harbor rule to avoid fees (90% of this year’s tax or 100–110% of last year’s).

Calculate payments by estimating your income, subtracting deductions, and adding self-employment tax.

2026 due dates: April 15, June 16, September 15, and January 15 (2027).

Payments can be made online (IRS Direct Pay, EFTPS), by mail (vouchers), or via IRS2Go app.

Missing a payment may result in penalties and interest—but partial payments help reduce damage.

If you can’t pay in full, adjust next quarter’s amount or look into IRS payment plans.

Don’t ignore it—staying ahead with 1040-ES keeps the IRS off your back.

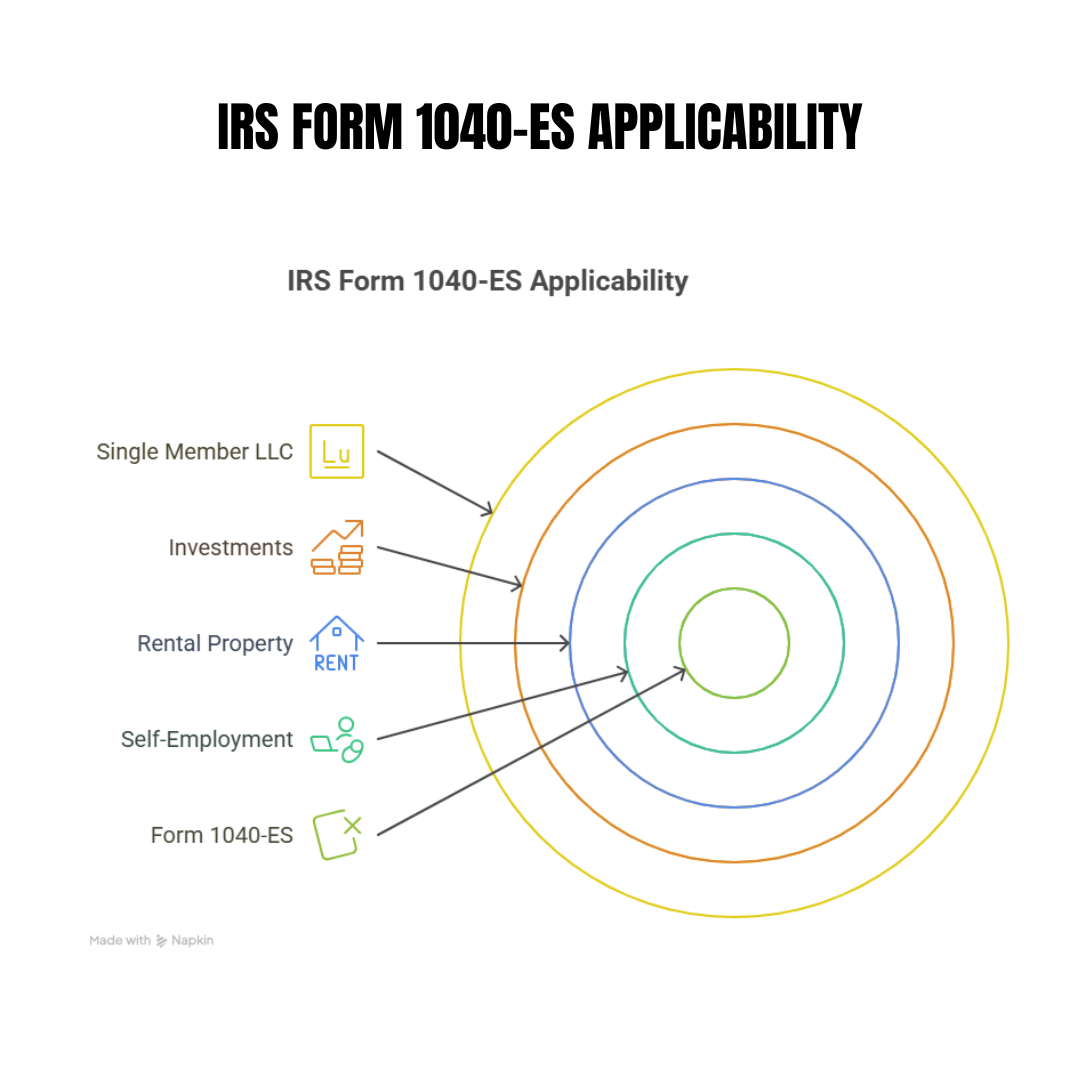

What is the IRS 1040-ES or Quarterly Estimated Tax Payments?

Form 1040-ES is what you use to make your Quarterly estimated tax payments to the IRS. If you’re self-employed, own rental property, trade crypto, or earn 1099 income this form likely applies to you. It also applies if you have a single-member LLC.

Self-employment (contractors, consultants, gig workers)

Rental property

Investments (stocks, crypto, etc.)

Side hustles and business ventures

Single Member LLC

If you expect to owe $1,000 or more in taxes after subtracting credits and withholding, you’re likely required to make the Quarterly Estimated Tax Payments, using Form 1040-ES

Why Estimated Payments Aren’t Optional

If you don’t make quarterly payments when required, you could get hit with penalties and interest. Even if you pay everything by the April deadline, skipping estimated payments can still cost you.

Another Extremely important factor: If you have IRS tax debt for prior years, the Quarterly Estimated Tax payments are required for qualifying for tax relief programs.

If you are not in compliance with the ES payments, the IRS can simply not consider your request for relief until you catch up with the required ES payments.

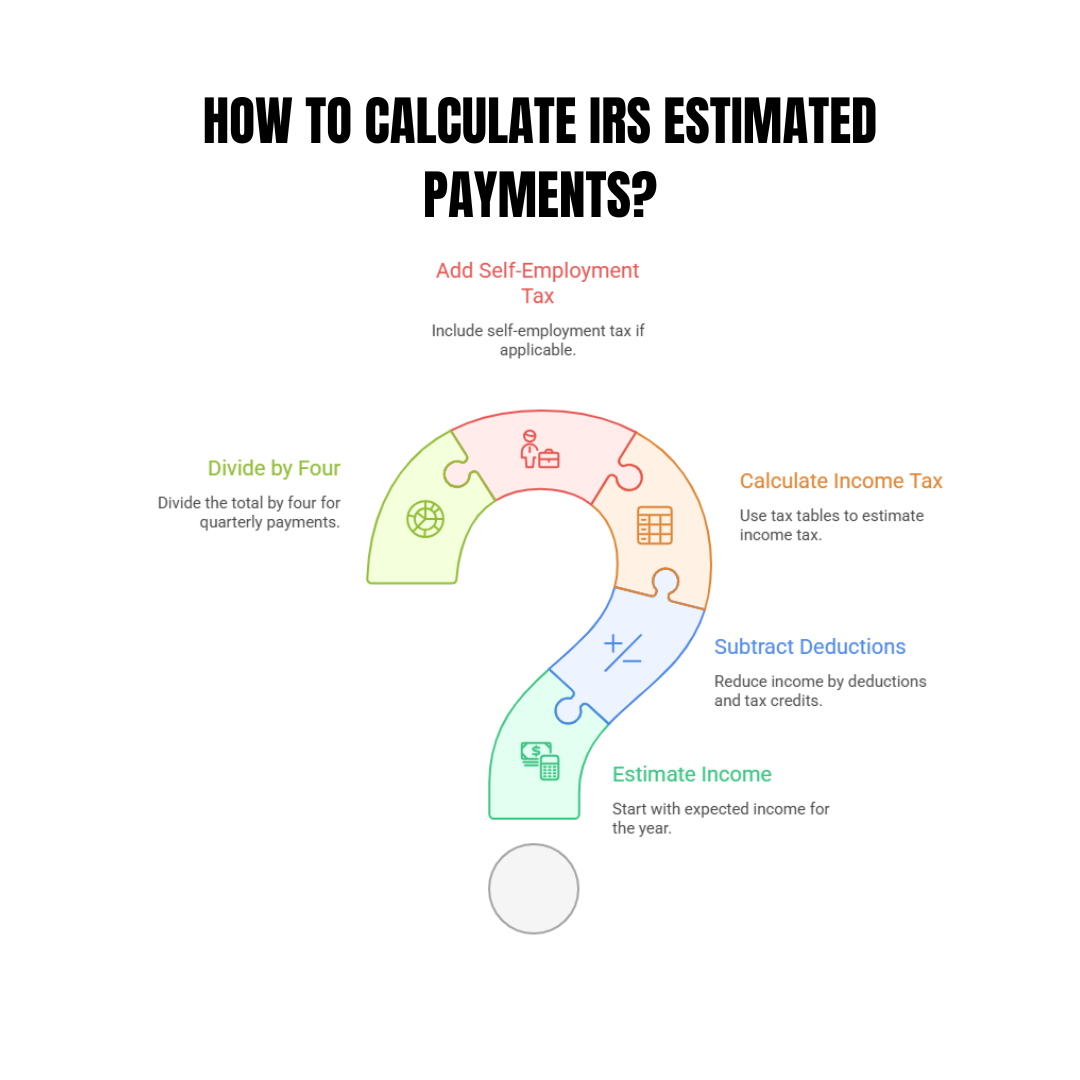

How to Calculate Your IRS Estimated Payments

Start with your expected income for the year. Then subtract out deductions and tax credits.

From there:

Estimate your income tax using tax tables.

Add self-employment tax if applicable (usually 15.3%).

Divide the total by four.

You can use the worksheet included in Form 1040-ES or your last tax return as a guide.

Pro Tip: Income fluctuates? Update your estimate every quarter. No one wants to overpay or get surprised

2026 IRS 1040-ES Due Dates

Mark these on your calendar for the current year:

April 15 (Q1)

June 16 (Q2)

September 15 (Q3)

January 15, (Of the following year(Q4)

If the due date falls on a weekend or holiday, it shifts to the next business day.

You can further break down the payments to a monthly amount, as long as you are caught up by the due date. This seems to make it easier to budget on a monthly basis rather than the larger quarterly amount.

How to Make IRS 1040-ES Payments

You’ve got options. Here's how to make your estimated payments:

Online: Use IRS Direct Pay, EFTPS, or the IRS2Go mobile app.

Online without any Log-Ins: https://www.irs.gov/payments

By Mail: Use the payment vouchers that come with Form 1040-ES.

Through Software: Most tax preparation platforms can help generate and schedule 1040-ES payments.

I usually recommend IRS Direct Pay or EFTPS. If you’re old-school, mail in the vouchers. There’s even an IRS app. Just don’t forget to double-check your totals before submitting.

What If You Miss a 1040-ES Payment?

Late payments come with a cost, literally.

If you don’t pay enough by the quarterly deadlines, the IRS may charge you a penalty. Even if you file your return on time.

Still better to pay something than nothing. The IRS bases penalties on how late and how short your payment is.

Can’t Pay your Quarterly ES Payments? Don’t Panic

If cash is tight, the worst thing to do is ignore it.

Instead:

Pay what you can each quarter, or break it down to a monthly amount

Re-run your numbers and adjust the next payment.

Look into installment agreements if you fall behind.

And if it’s way off course, talk to a tax pro (that’s where we come in).

IRS 1040 ES Payments FAQs

-

Anyone who expects to owe $1,000+ after withholding and credits generally must pay estimated tax—common for self-employed, landlords, investors, and gig workers.

-

Pay in enough so your total withholding + estimates cover 90% of 2025 tax or 100% of 2024 tax (110% if your 2024 AGI exceeded certain thresholds).

-

April 15, 2026; June 16, 2026; September 15, 2026; January 15, 2026. If a date hits a weekend/holiday, it rolls to the next business day.

-

Yes. The IRS cares that enough is paid by each quarterly due date, not how you split it up. Many filers use monthly drafts for cash-flow sanity.

-

-

Pay as soon as you can. The IRS figures any underpayment penalty on Form 2210 using timing/amount paid. Penalty stops growing once you’re current.

-

Use the Annualized Income Installment Method (Form 2210 Schedule AI) so each quarter reflects when you actually earned the money.

-

Yes. Increasing W-2 withholding can replace some/all estimates—and withholding is treated as paid evenly through the year.

Final Thoughts

If you're running a business or earning income without a W-2, IRS estimated payments aren’t optional, they’re part of staying in the game.

Use IRS Form 1040-ES to stay ahead, avoid penalties, and keep the IRS off your back.

Got questions about how to calculate quarterly tax payments, IRS 1040-ES online payment options, or estimated tax payments for self-employed individuals? We can help break it down and map out a plan.

Schedule your free tax case review and let’s make tax season feel less like a visit to the dentist.