IRS Form 8821 (Tax Information Authorization), How It Gives Limited Authority Without Full Power of Attorney

TLDR;

Form 8821 = “view-only” access. It is a Tax Information Authorization, not an IRS power of attorney.

No representation power. Form 8821 does not let anyone speak, negotiate, or sign for you with the IRS. That requires Form 2848.

8821 vs 2848:

8821 → share information/transcripts.

2848 → full IRS representation within listed years/issues.

Best use of 8821: diagnostic work – pulling transcripts, checking balances, confirming missing returns, and supporting loan/underwriting requests.

Good first step with a tax relief firm: use 8821 to review your IRS account before you commit to full representation.

Scope matters. Line 3 should list specific forms and years; avoid vague “all years/all taxes.”

Security & ethics: the form is limited, but you should still vet the company; aggressive firms can misuse access to pressure you.

You stay in control. 8821 can be revoked or replaced at any time with a new form or a written revocation.

Common mistakes:

Overly broad years/tax types

Thinking 8821 = power of attorney

Not checking the box to send your designee copies of notices when you actually want that

Smart workflow: start with 8821 for facts and planning, then move to 2848 only if and when you’re ready for true IRS representation.

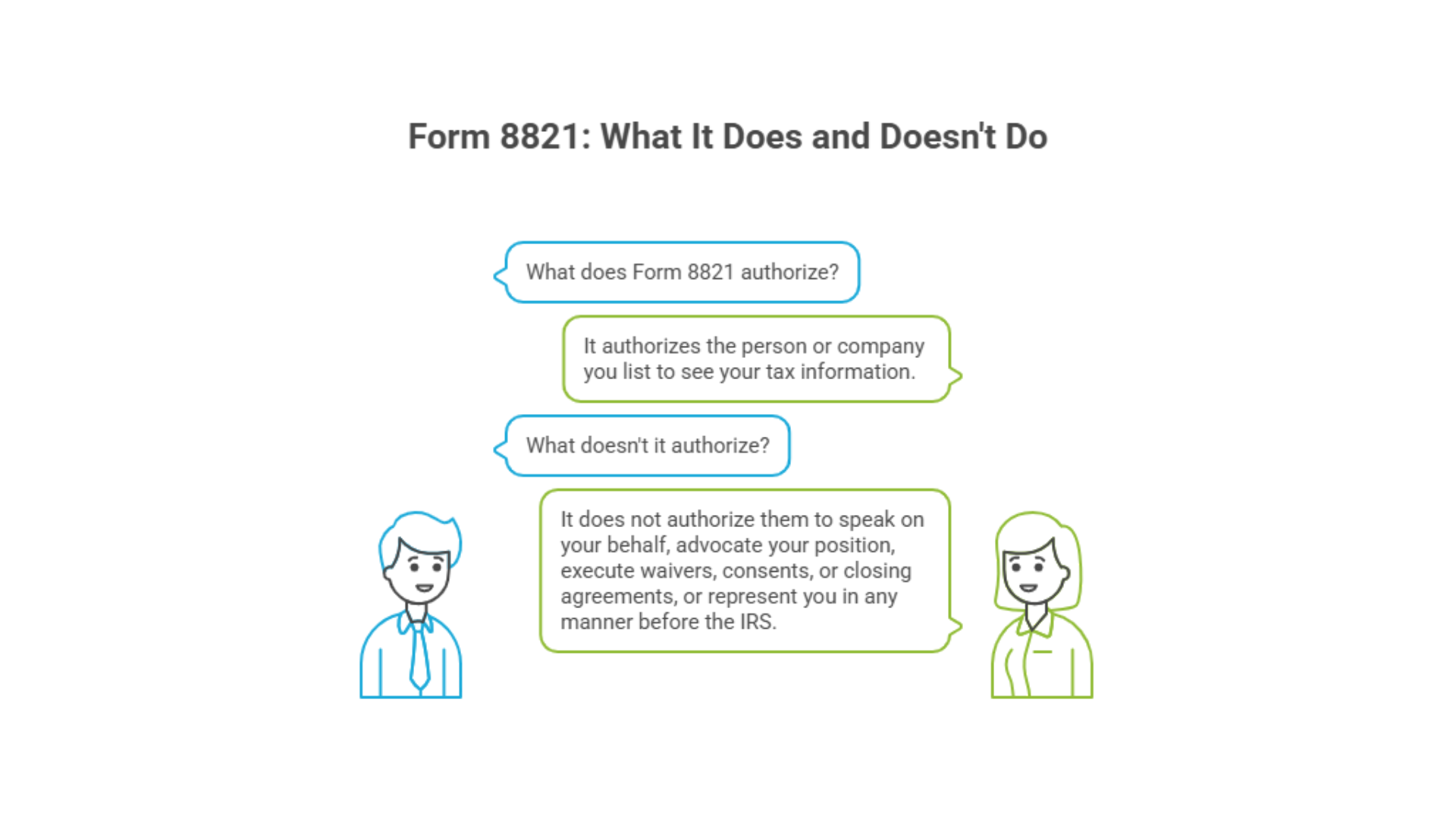

Section 1, What IRS Form 8821 Actually Authorizes

According to the IRS, you file Form 8821 to

Authorize any individual, corporation, firm, organization, or partnership you choose to inspect and or receive your confidential tax information, verbally or in writing, for specific tax matters and years you list

Delete or revoke prior tax information authorizations on file

From the official Instructions for Form 8821, in plain language

Form 8821 authorizes the person or company you list to see your tax information. It does not authorize them to

Speak on your behalf

Advocate your position

Execute waivers, consents, or closing agreements

Represent you in any manner before the IRS

What your designee can do with Form 8821

With a properly completed and filed IRS Form 8821, your designee can

Pull IRS account transcripts, wage and income transcripts, and return transcripts

Receive copies of certain IRS notices, if you check the box on line 2

Request information needed for loans, underwriting, due diligence, or tax relief analysis

Access online IRS records through e Services Transcript Delivery, if you authorize that

What Form 8821 does not authorize

The IRS is very clear that Form 8821 is not an IRS power of attorney.

With only Form 8821 in place, your designee cannot

Represent you at an audit or appeal

Negotiate an installment agreement, Offer in Compromise, or other settlement

Argue your position about tax law or account adjustments

Sign waivers, consents, or closing agreements

Endorse or negotiate your refund check or receive your refund by direct deposit

For those activities, you need IRS Form 2848 and a qualified representative, such as an Enrolled Agent, CPA, or attorney.

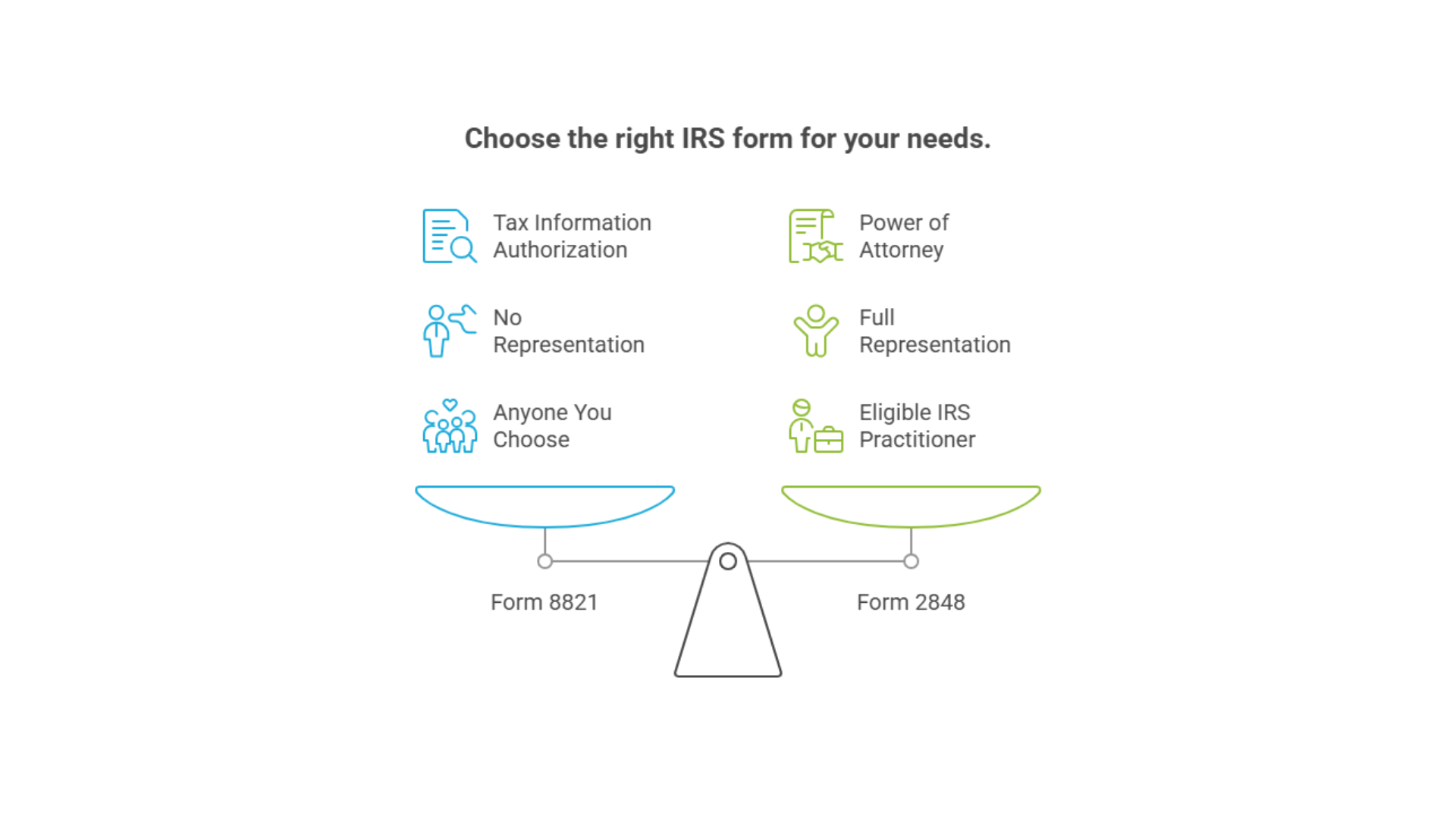

Section 2, IRS Form 8821 vs Form 2848, Limited Authority vs Full Representation

This is where most taxpayers get confused, Form 8821 compared to Form 2848.

High level comparison

Type of authorization

Form 8821, Tax Information Authorization

Form 2848, Power of Attorney

What it does

Form 8821, lets your designee see and receive confidential tax information for specific tax matters and years

Form 2848, lets your representative both see your information and represent you before the IRS

IRS representation

Form 8821, no representation, they cannot advocate, negotiate, or argue your case

Form 2848, full representation within the scope you list, such as audits, appeals, and collections

Who you can appoint

Form 8821, anyone you choose, a tax pro, lender, lawyer, bookkeeper, even a non professional

Form 2848, someone who is eligible to practice before the IRS, such as an EA, CPA, attorney, or other limited categories like certain family members in specific situations

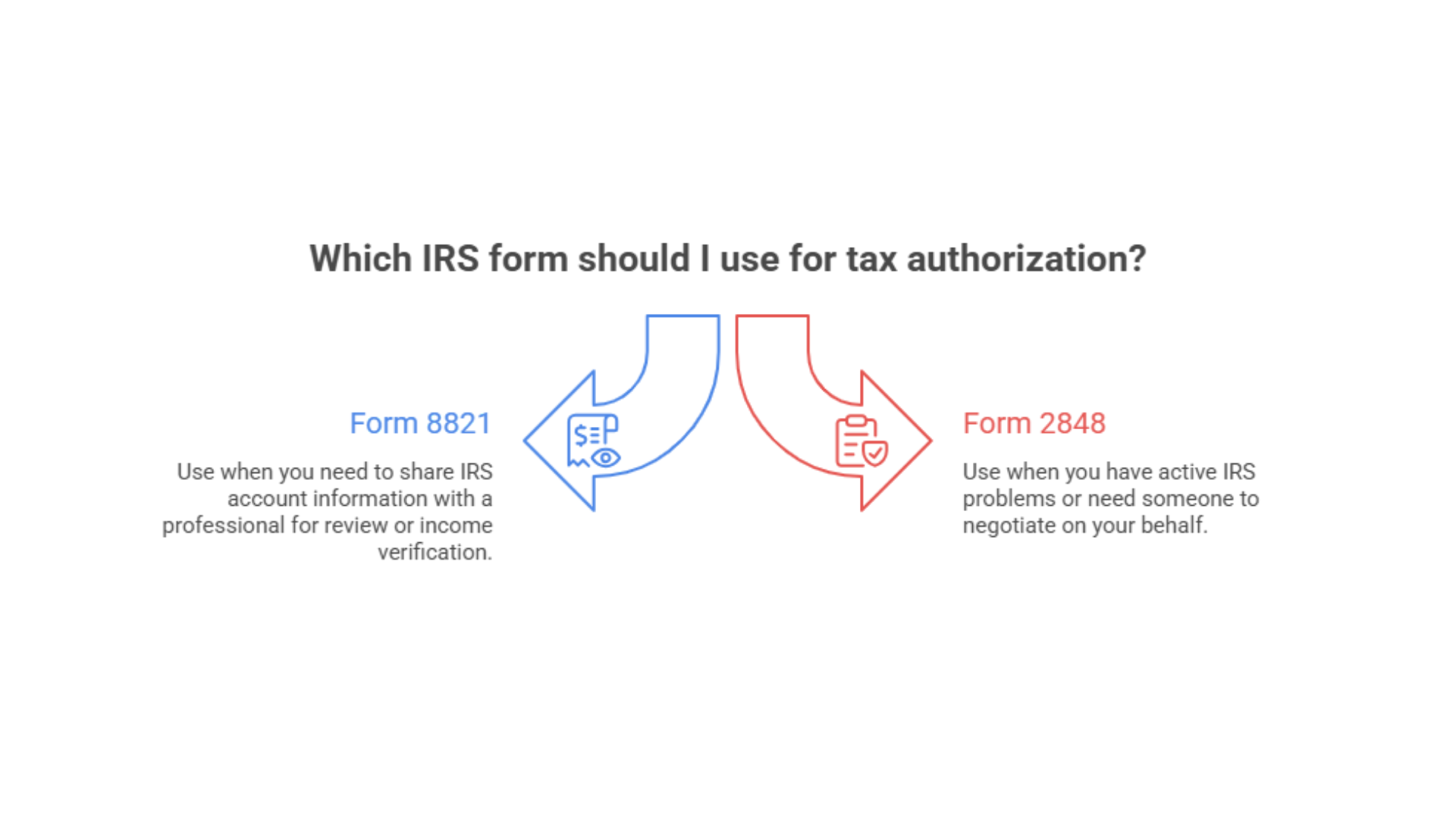

Typical use cases

Form 8821 is commonly used when you

Want a tax professional, lender, or advisor to review your IRS account and transcripts before you fully engage

Need income verification for loans or student aid

Want an internal review of your IRS history before strategy is decided

Form 2848 is commonly used when

You have active IRS problems

You are facing audits, tax debt collections, Appeals, Offers in Compromise, or complex issues that need someone to speak and negotiate for you

Level of authority

Form 8821, limited authority, think read only access

Form 2848, broad authority within the tax years and issues listed, think authorized agent

Signing agreements

Form 8821, cannot sign IRS agreements

Form 2848, can sign certain agreements, consents, and extension requests within the scope of authority

CAF recording

CAF is the IRS Centralized Authorization File.

Form 8821, generally recorded on CAF unless you check the specific use only box

Form 2848, also recorded on CAF

Revoking prior authorizations

A new Form 8821 can revoke previous 8821 authorizations for the same matters and years, unless you attach the ones you want to keep

A new Form 2848 can revoke prior 2848 authorizations for the same matters and years, unless you specify otherwise

Bottom line

Form 8821, IRS taxpayer authorization to share information

Form 2848, IRS representation authorization

Section 3: How I Decide When To Use IRS Form 8821 vs Form 2848

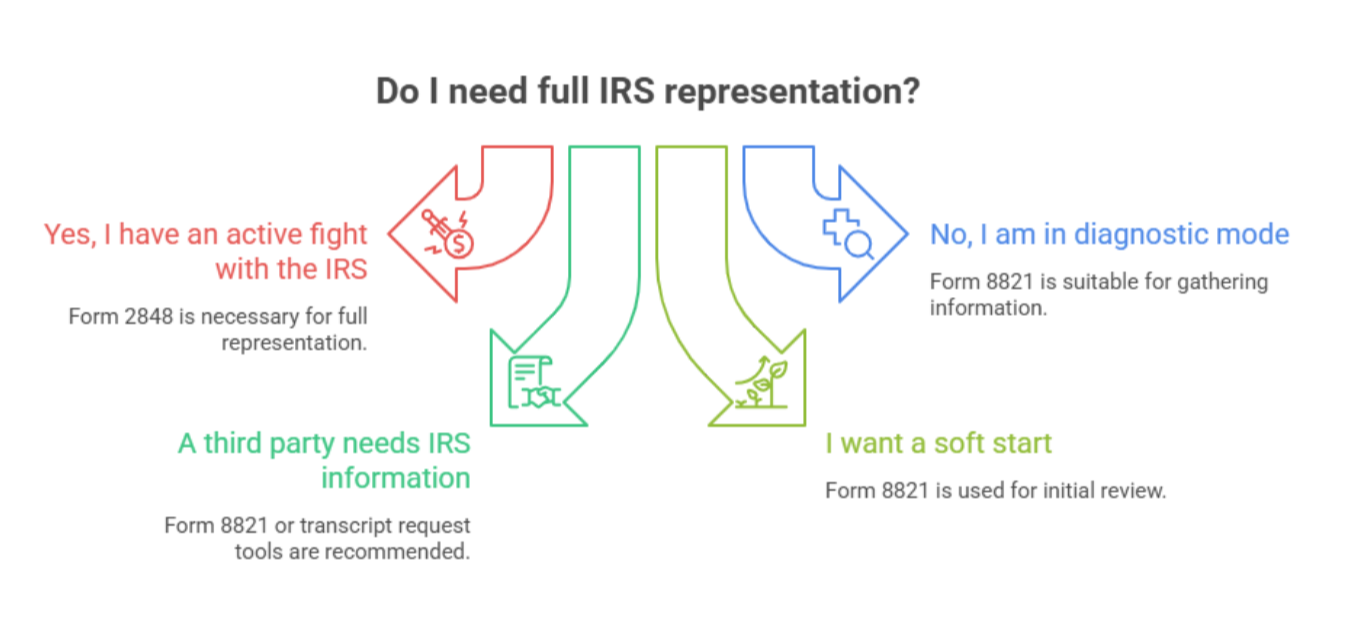

In my tax relief practice, I use a simple decision framework.

Question 1, Is there already an active fight with the IRS

Do you already have an audit notice, levy, lien filing, Appeals matter, or aggressive collections

If yes, I usually go straight to Form 2848 so I can fully represent you

Question 2, Are we still in diagnostic mode

You are pretty sure you owe, but you do not know how much

You are not sure which years have balances

You do not know what the IRS has on file

Here, Form 8821 is ideal. It lets me pull transcripts, notices, and account history so I can build a game plan before stepping into full representation.

Question 3, Is a third party asking for IRS information

If a lender, SBA program, or bank needs IRS proof for underwriting or income verification, the IRS often recommends using a Tax Information Authorization such as Form 8821 or transcript request tools.

Question 4, Does the taxpayer want a soft start with a tax relief firm

Some clients are cautious, with good reason.

In those cases, we use Form 8821 first so I can review the IRS account before you commit to a full representation engagement.

After I show you exactly what the IRS records say, you can decide if you want to move forward with Form 2848.

Question 5, Is there a potential for abuse

I always review

Which years are being authorized

Which tax types are listed

Whether the firm wants copies of all notices

If I see extremely broad authorizations with no clear purpose, that is a red flag, especially with high pressure telemarketing style tax firms.

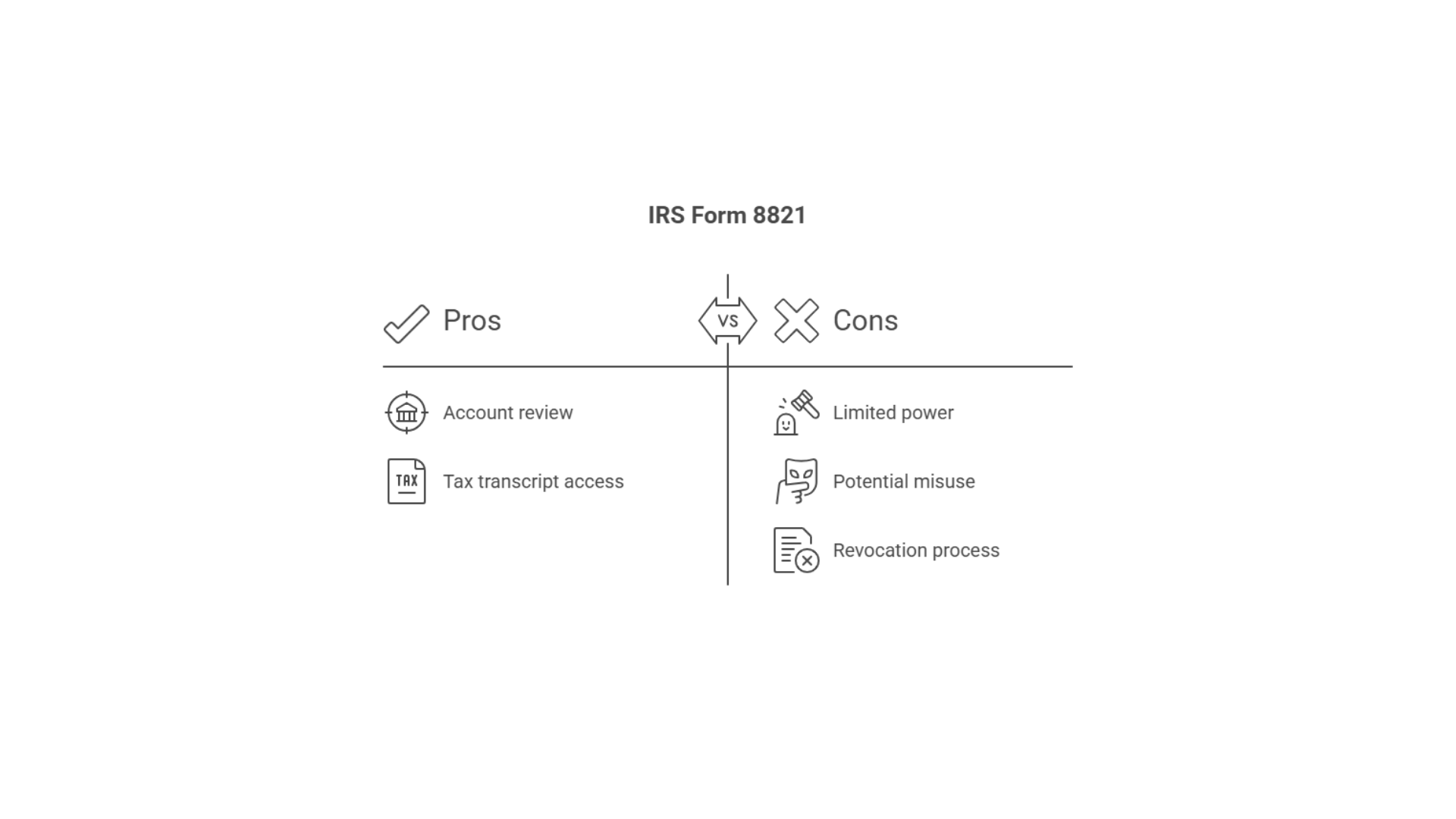

Section 4: Pros and Cons of Signing IRS Form 8821

Pros of IRS Form 8821

Form 8821 can be very useful when used correctly. It

Lets a trusted tax professional see what the IRS sees, transcripts, balances, penalties, and filing history

Does not grant IRS power of attorney, your designee cannot bind you to deals, agreements, or tax positions

Is helpful for pre engagement reviews, for example, is my case worth pursuing, what years are open, what are the statute dates

Is useful for loan applications and lender verification, many lenders and SBA programs rely on transcript based verification

Can be limited by year, tax type, and specific matters, which keeps the scope controlled

Can be revoked or replaced with a new authorization at any time

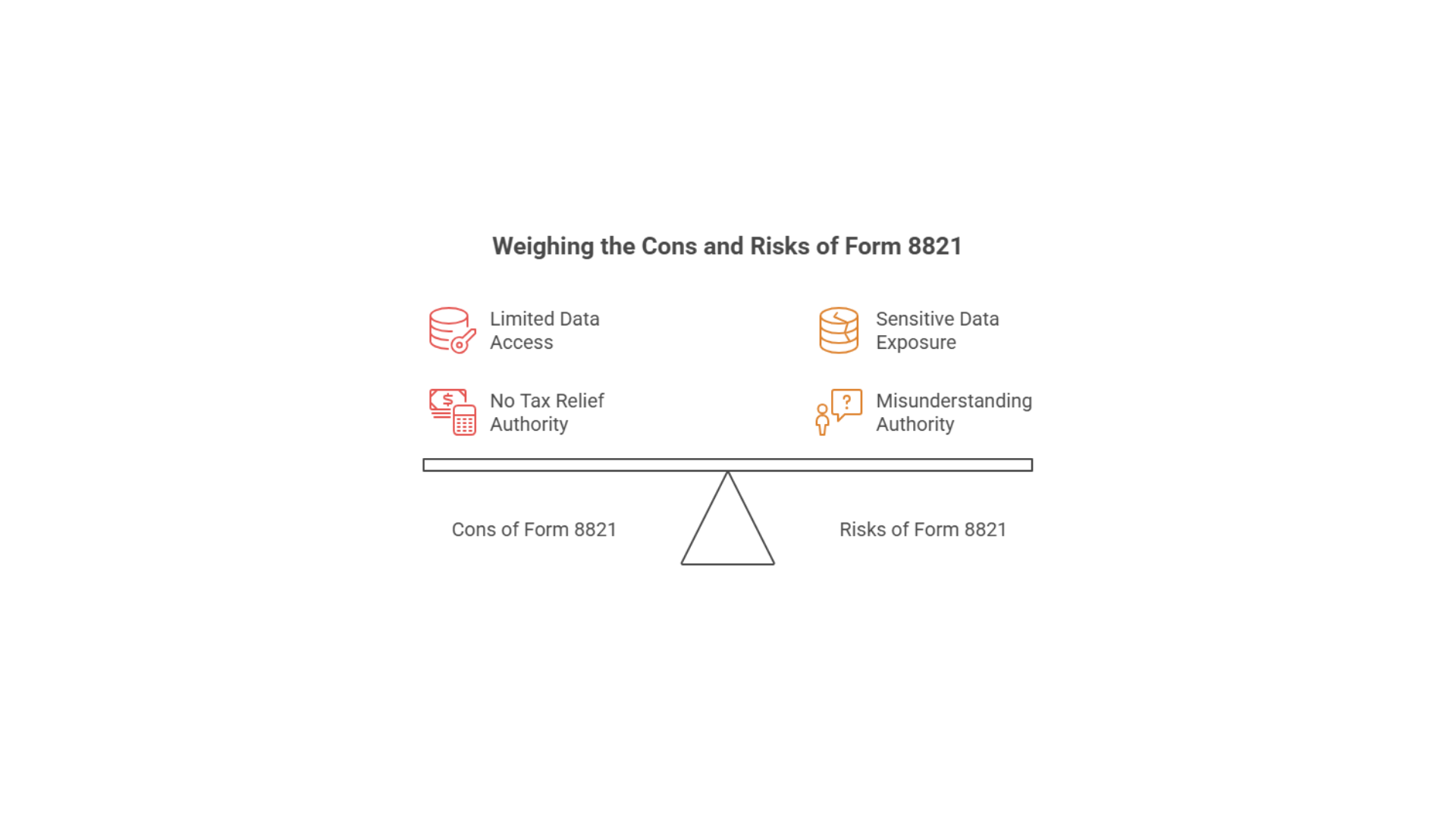

Cons and risks of Form 8821

You still need to respect the risks.

You are giving access to confidential tax records that contain sensitive data

A bad actor can use your tax information for aggressive sales pressure, even if they cannot act in front of the IRS

If you authorize too many years or all tax types, the designee may see more than is truly necessary

Some taxpayers misunderstand Form 8821 and assume, my tax relief company is already my official representative, which can cause dangerous delays when a real power of attorney Form 2848 is needed with Collections or Appeals

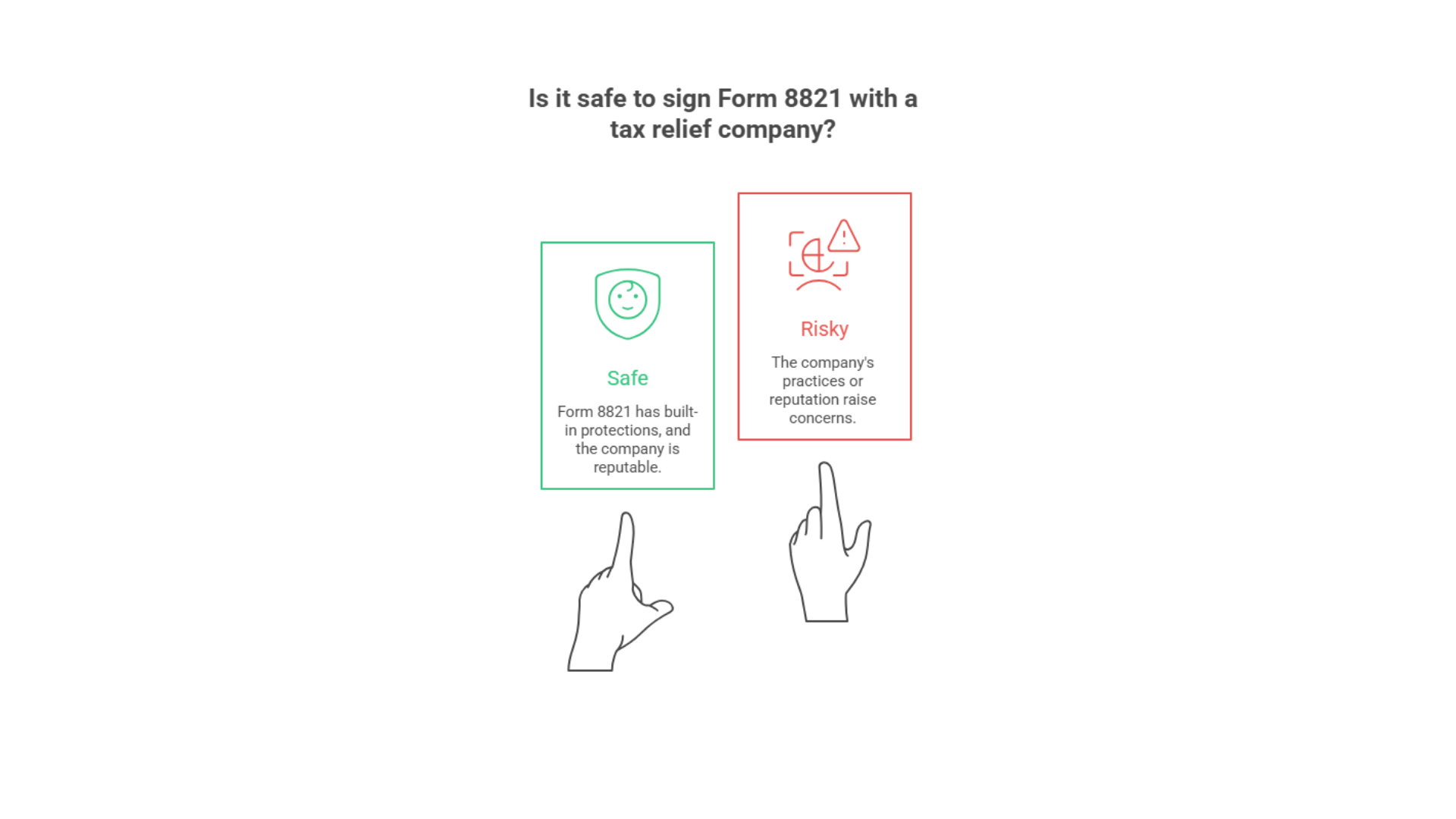

Section 5: Is It Safe To Sign Form 8821 With a Tax Relief Company

A very common question I get is

Is it safe to sign Form 8821 with a tax relief company

My view, Form 8821 is designed with built in limits and protections, however the real risk depends on who holds that access and what they do with it.

What the law requires

IRS rules under Internal Revenue Code section 6103 c restrict how your information can be used and re shared.

Unauthorized use or disclosure can lead to civil penalties and, in serious cases, criminal penalties.

Practical safety checklist before signing

If you are thinking about signing IRS Form 8821 for tax transcript access only, ask these questions

Who exactly will be listed on line 2 as the designee

Is it a named EA, CPA, or attorney, or only a generic company name

Which years and tax forms are listed on line 3

It should match the real need, for example, Form 1040 for tax years 2017 through 2024, not all years and all taxes

Are they using it only to review your IRS account before you hire them

That is common and usually reasonable

Do they clearly explain that Form 8821 does not give power of attorney or full IRS representation

If they blur this line, that is a concern

Do they give you a copy and show you how to revoke Form 8821 later

If a firm hides the form, rushes you, or pushes you to sign paperwork you do not understand, step back

Form 8821 is simply a tool. How safe it is depends on who is holding it and how clearly the limits are explained.

Section 6: How Tax Relief Firms Use IRS Form 8821 To Access Transcripts?

Here is the typical pattern for a legitimate tax relief firm using Form 8821

You sign Form 8821 for specific years and tax types

The firm pulls IRS transcripts and account history through e Services or the IRS transcript delivery system

They analyze

Balances by year

Penalties and interest

Collection status, such as notice status, active collections, or currently not collectible

Statute dates, estimated Collection Statute Expiration Dates

They deliver a written or verbal case review that explains

What the IRS records show

Potential options, such as installment agreement, Offer in Compromise, currently not collectible, penalty relief, and so on

If you decide to move forward, they then file Form 2848 to provide full IRS representation

This is exactly how I use it in my own practice, Form 8821 for diagnostics, Form 2848 for representation.

Section 7: Step by Step Guide To Completing IRS Form 8821

Always use the latest revision of the form from the official IRS site.

Line 1, Taxpayer Information

Enter your legal name exactly as shown on your tax return

Enter your Social Security Number or Employer Identification Number and your mailing address

For joint filers, each spouse must file a separate Form 8821 if both want to authorize someone

Line 2, Designee

Enter the full name and address of the individual or organization you are authorizing

Enter the CAF number if they already have one, if they do not, they can write the word none and the IRS will assign one

If you want them to receive copies of IRS notices, check the box under their name, you can list up to two designees

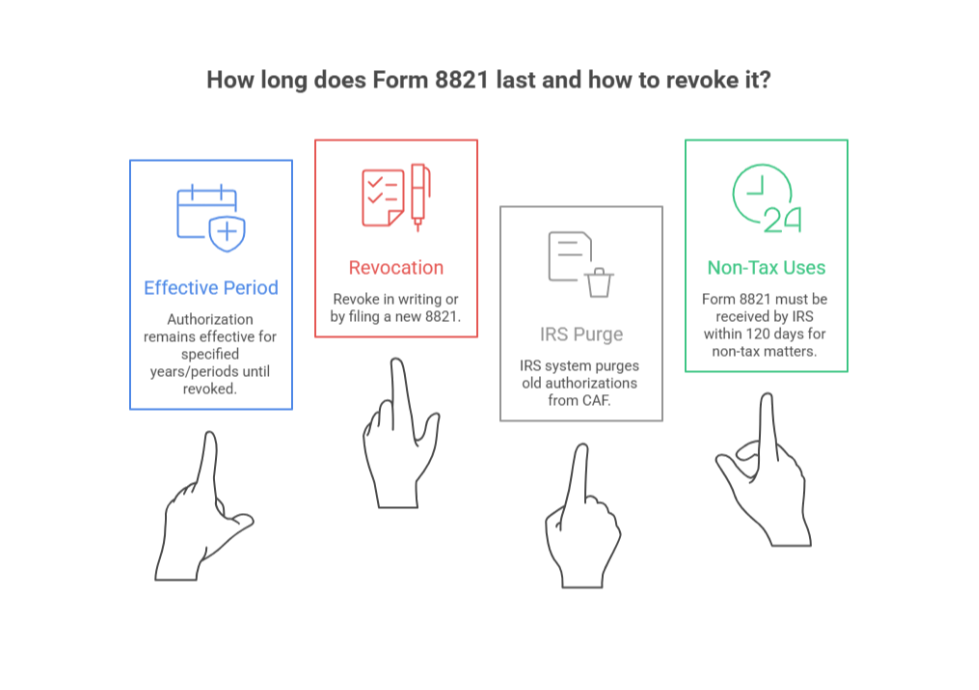

Section 8: How Long Form 8821 Lasts and How To Revoke It

Duration

The IRS does not set a simple fixed expiration date for every Form 8821. Instead, the authorization remains effective for the specific years and periods listed until

You revoke it in writing or by filing a new 8821 that revokes it

The IRS system eventually purges very old authorizations from CAF

For some non tax matter uses, like lender income verification, Form 8821 usually must be received by the IRS within 120 days of the date you sign.

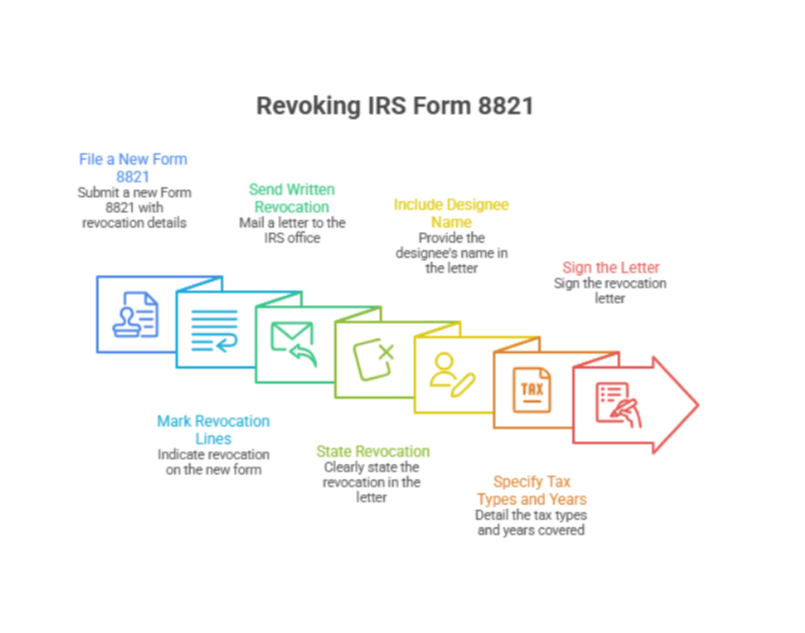

How to revoke or withdraw Form 8821

You can revoke IRS Form 8821 in two main ways

File a new Form 8821

Use the same line 3 tax information, mark the lines related to revocation as described in the instructions

Send a written revocation to the IRS office where the original form was filed, that letter should state

That you revoke the prior 8821

The designee name

The tax types and years covered

Your signature

You can also update a designee address by written notice without filing a brand new 8821.

Line 3, Tax Information, this line sets the scope

This is where you control what your limited authority form actually covers

Column a, type of tax, for example, income

Column b, form number, for example, 1040

Column c, specific years or periods, for example, 2019 through 2024

Column d, any specific information you want them to receive, for example, account transcripts and balance due information

Important points

Do not write all years or all taxes, the IRS will reject the form

You can include future years, but the IRS will not record more than three future years beyond the year they receive the form

You can also check the box to authorize use of intermediate service providers, third party transcript retrieval software. If you leave it blank, your designee must pull transcripts directly from the IRS systems

Line 4, Specific Use Not Recorded on CAF

Check this box only if Form 8821 is for a one time, specific use that the IRS will not record in its CAF system, such as some lender requests or background checks or specific forms like SS 4, W 2, or W 7.

For ongoing tax debt or tax relief cases, we usually do not check this box. We want the authorization on CAF so IRS personnel can see it.

Line 5, Retention or revocation of prior authorizations

If line 4 is not checked, the default rule is

A new Form 8821 automatically revokes all prior Forms 8821 on file for the same tax matters and years, unless you attach copies of prior forms you want to keep

Use line 5 to keep specific older 8821 authorizations in place by attaching copies.

Line 6, Signature of taxpayer

Sign and date the form

For entities, the signer must have proper authority, such as officer, partner, trustee, or executor

How to file Form 8821

You can file Form 8821 in a few ways

Online, by uploading securely through the IRS Form 8821 submission portal, which requires a Secure Access account

Fax or mail, using the addresses in the instructions, typically the CAF units in Ogden or Memphis, or a specific office if line 4 is checked

Section 9: Using IRS Form 8821 Before Hiring a Tax Pro

Many taxpayers want to see the damage before they commit to a full representation engagement. Form 8821 is perfect for that.

A common flow looks like this

You sign Form 8821 for the years you are worried about

The tax pro pulls transcripts and builds a year by year breakdown of

Balances

Penalties

Filing compliance

Statute dates

You receive clear options and likely timelines

Then you decide whether you want formal IRS representation with Form 2848

It gives you a clear picture first, before you sign a larger agreement.

Section 10: Common Mistakes When Filing IRS Form 8821

Here are common mistakes I see in real tax relief and tax debt cases

Using vague language like all years or all taxes

The IRS will reject the form, you must list specific tax types, forms, and years

Authorizing too many years just in case

You can always file another 8821 later, over authorizing exposes more data than needed

Forgetting to check the box for notices when you actually want the designee to see them

If you want your tax professional to receive IRS letters at the same time you do, you must check the box on line 2

Forgetting to attach prior Forms 8821 you want to keep

If you do not use line 5 correctly, a new 8821 can automatically revoke earlier authorizations for the same years

Mixing up Form 8821 with Form 2848

Some people sign 8821 and assume they now have IRS representation, then ignore IRS notices, this is dangerous. Remember, Tax Information Authorization is not Power of Attorney

Not limiting access to the correct taxpayer or entity

For business owners, be clear whether you are authorizing access for yourself personally, your LLC or S corporation, or both. Each may require its own form

Section 11: Real World Case Snapshots

Case Snapshot 1, Do I really owe that much

A self employed contractor was told over the phone that he owed more than two hundred thousand dollars. He was not sure if that was accurate.

We

Filed Form 8821 for the past ten years of 1040 income tax

Pulled account transcripts, wage and income, and penalty data

Found that a large part of the balance came from estimated penalties on unfiled years, not actual assessed tax yet

With that information, we mapped out

Which returns had to be filed first

How much of the balance could change

Whether an Offer in Compromise was realistic

All of this happened before filing a power of attorney.

Case Snapshot 2, Is this tax relief company legit

A taxpayer had already signed Form 8821 with a call center style tax relief company but felt uneasy.

We reviewed their 8821 and saw

It covered many more years than she thought she authorized

The firm had authorized intermediate service providers for transcript access

She revoked that 8821 and filed a new, narrow Form 8821 with us.

Once we pulled transcripts and laid out everything in writing, she could compare our plan and pricing with what she had been promised over the phone.

Form 8821 allowed a clean second opinion without giving anyone full IRS representation.

How IRS Form 8821 gives limited authority FAQs

-

No. Form 8821 is a Tax Information Authorization. It does not allow representation or advocacy before the IRS.

-

Form 8821, lets someone inspect and receive your confidential tax information

Form 2848, lets someone both represent you before the IRS and receive your information

-

Use Form 8821 when you

Want a tax professional or lender to see your IRS records

Need transcript based verification for a mortgage, SBA loan, or business lending

Want a tax relief firm to review your account before you decide to hire them

Use Form 2848 when you need full IRS representation for audits, collections, Appeals, or negotiations.

-

It usually lasts until you revoke it or until the IRS system clears it, for the specific years and tax types listed. Some non tax uses require the IRS to receive the form within 120 days of your signature date.

-

Yes. You can revoke Form 8821 by

Filing a new 8821 that revokes prior authorizations, or

Sending a written revocation to the IRS with enough detail to identify the prior authorization

-

No. That is a common use, but it also covers other account level details, notices, and specific tax information you list in line 3.

Conclusion.

Form 8821 is a powerful information only authorization. Used correctly, it helps

You see your IRS situation clearly

Your tax professional perform a thorough review

Everyone stay honest about who can, and cannot, speak for you at the IRS

At the same time, it is still a legal authorization involving your confidential tax records. This guide is educational, it does not replace a one on one review of your actual IRS transcripts, letters, or forms.

If you want to go further, the next step can be a simple checklist or worksheet you can hand to prospects that explains, in plain English

What happens when they sign Form 8821 with your firm

What you can do with 8821

What you cannot do until they sign Form 2848