IRS Form 2848 Power of Attorney Guide: When You Need It, What It Covers & How to Fill It Out

If you want someone to deal with the IRS so you don’t have to, IRS Form 2848 is the official tool the IRS recognizes for you to be represented by a power of attorney. This form, called Power of Attorney and Declaration of Representative, which gives your tax professional the authority to speak to the IRS, access your records, and represent you for specific years and issues. Your Tax POA figuratively, steps into your shoes when dealing with the IRS.

This guide is based on:

Official IRS sources, including Form 2848 instructions

Independent explanations from trusted tax platforms

IRS Publication 1: Taxpayer Bill of Rights.

Real tax relief cases from my practice at Semper Tax Relief, including audits, Offer in Compromise work, and complex back-tax situations

TLDR;

Form 2848 = IRS Power of Attorney. It’s the official IRS POA form that lets a qualified rep talk to the IRS and act for you on specific years/issues.

Use 2848 when you want representation, not just info. Audits, back taxes, levies, liens, OIC, CNC, and payment plans usually need Form 2848, not just Form 8821.

8821 is “read-only.” If you only need someone to access transcripts or share info with a lender, Form 8821 (Tax Information Authorization) is often enough.

Scope lives on Line 3. You must clearly list tax type, form number, and years/periods (e.g., “Income, Form 1040, 2021–2023”). Vague “all years/all taxes” entries get rejected.

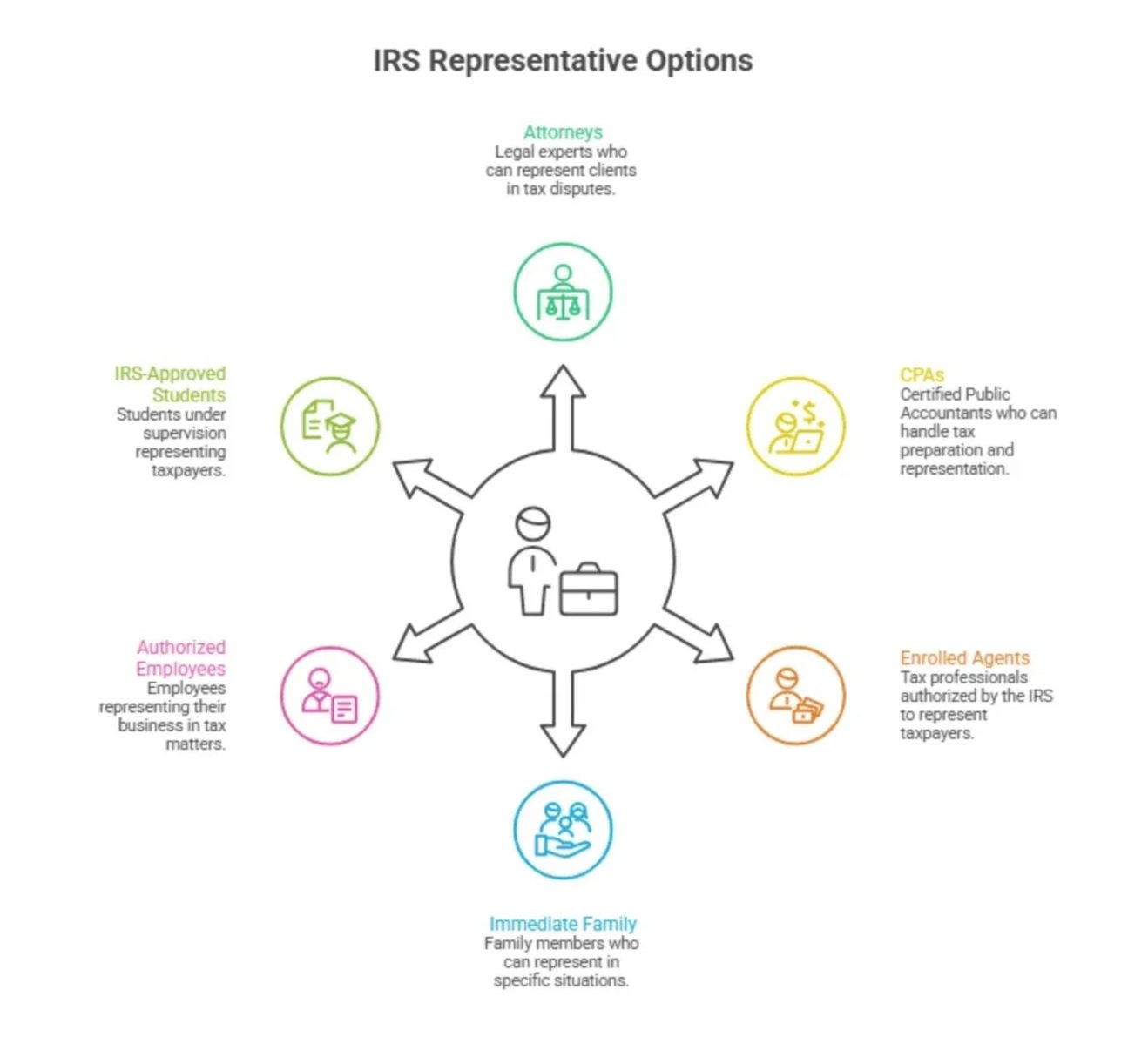

Only certain people can represent you. Attorneys, CPAs, Enrolled Agents, some officers/employees, and certain other approved categories can be your IRS representative.

Your rep gets tax rights, not full financial control. Form 2848 lets them receive tax info, call the IRS, negotiate, and sign some consents—not cash your refund or run your bank accounts.

Separate forms for different roles. Often you’ll have one 2848 for you personally and another for your business (941, 1120, 1065, etc.).

Signatures and details matter. Most rejections come from bad IDs, missing signatures, or sloppy Line 3 entries—double-check before submitting.

Best submission: online when possible. The IRS upload tool + proper e-signature is usually the fastest way; fax/mail works but is slower and more error-prone.

You can change or revoke a 2848. File a new one or send a marked “REVOKE” copy to update who represents you and for which years.

Think long-term but not permanent. A 2848 stays active for the listed periods until issues are resolved or you revoke it; IRS may keep it on file for years.

Core use in tax relief work. In real cases, Form 2848 is the gateway that lets a pro stand between you and the IRS so you don’t have to handle every call and notice yourself.

Quick Answer: What IRS Form 2848 Actually Does?

In Plain English, no confusion: the IRS 2848 gives a qualified representative the legal authority to talk, communicate, negotiate to the IRS on your behalf.

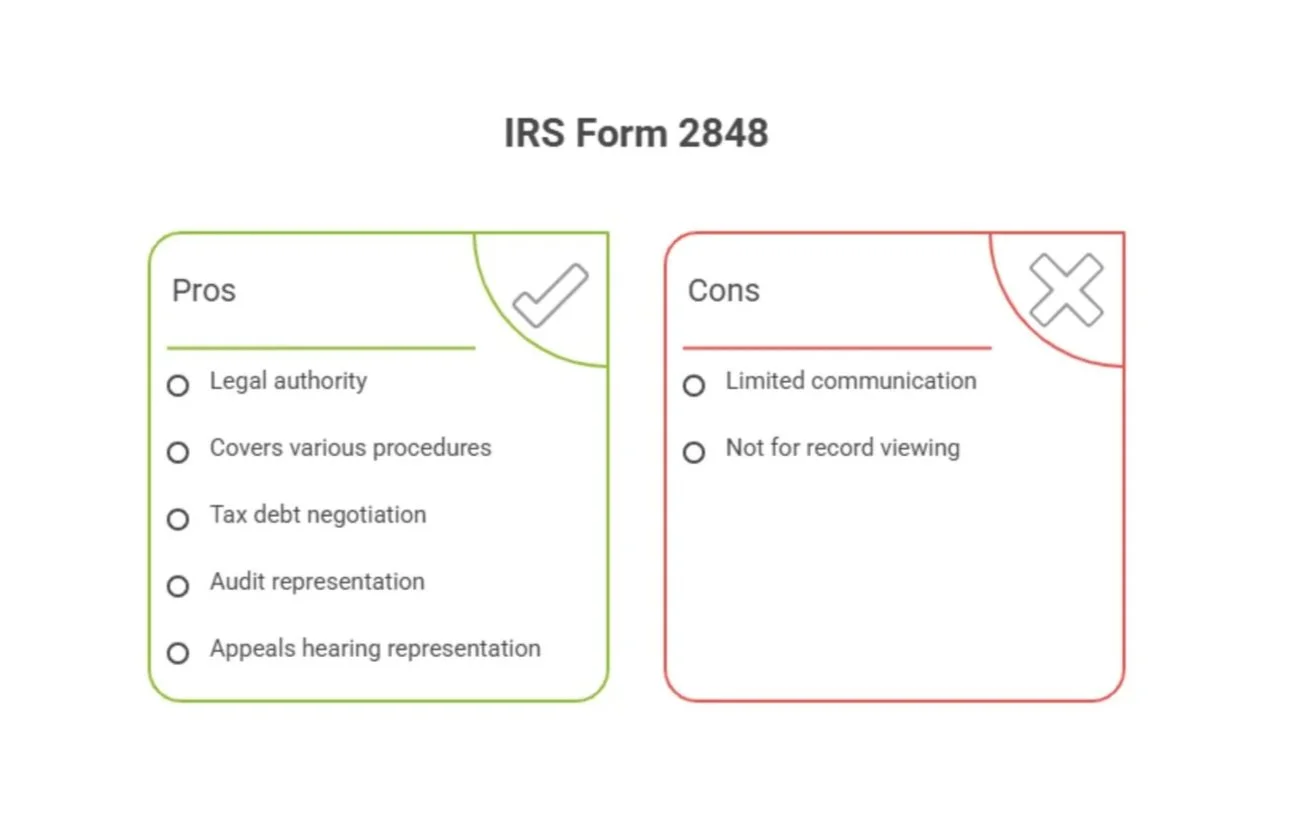

The Tax POA covers for IRS procedures such as for audits, payment plans, back-tax debt negotiations, appeals, and more.

You may need Form 2848 if you want someone to:

Call the IRS, respond to letters, and pull transcripts from the IRS

Tax Debt Negotiate: Payment Plans, Offers in Compromise (OIC), or Currently Not Collectible (CNC), Partial Pay Installment Agreements.

Represent you during an IRS Audit

Represent you for an IRS Appeals Hearing

You probably don’t need Form 2848 if someone only needs to view your IRS records. In those cases, Form 8821 is enough. An 8821 differs because it only allows a limited communication between the IRS & the representative on the 8821.

2848 vs 8821 vs Third-Party Designee

This is usually the first decision I make with a new client.

| Tool / Form | What It Is | What Your Tax Pro Can Do | When You Use It |

|---|---|---|---|

| Form 2848 (POA) | IRS representation authority | Speak to IRS, argue your case, negotiate, attend audits and appeals | Audits, back tax negotiations, OIC, payment plans, serious notices |

| Form 8821 | Tax Information Authorization | Receive info only, no negotiation | Lenders, bookkeepers, or a tax pro gathering data |

| Third Party Designee | One year limited authority | Answer basic questions on the specific filed return by the Tax Professional | Simple filing related questions only |

Simple test:

• If you want someone to fully fight for you on your IRS, IRS Form 2848 is the best choice. choose Form 2848.

• If you want someone to only view your IRS account, and limitations with IRS communications, then Form 8821 is appropriate.

When You Actually Need IRS Form 2848

Here are situations where I recommend filing a POA:

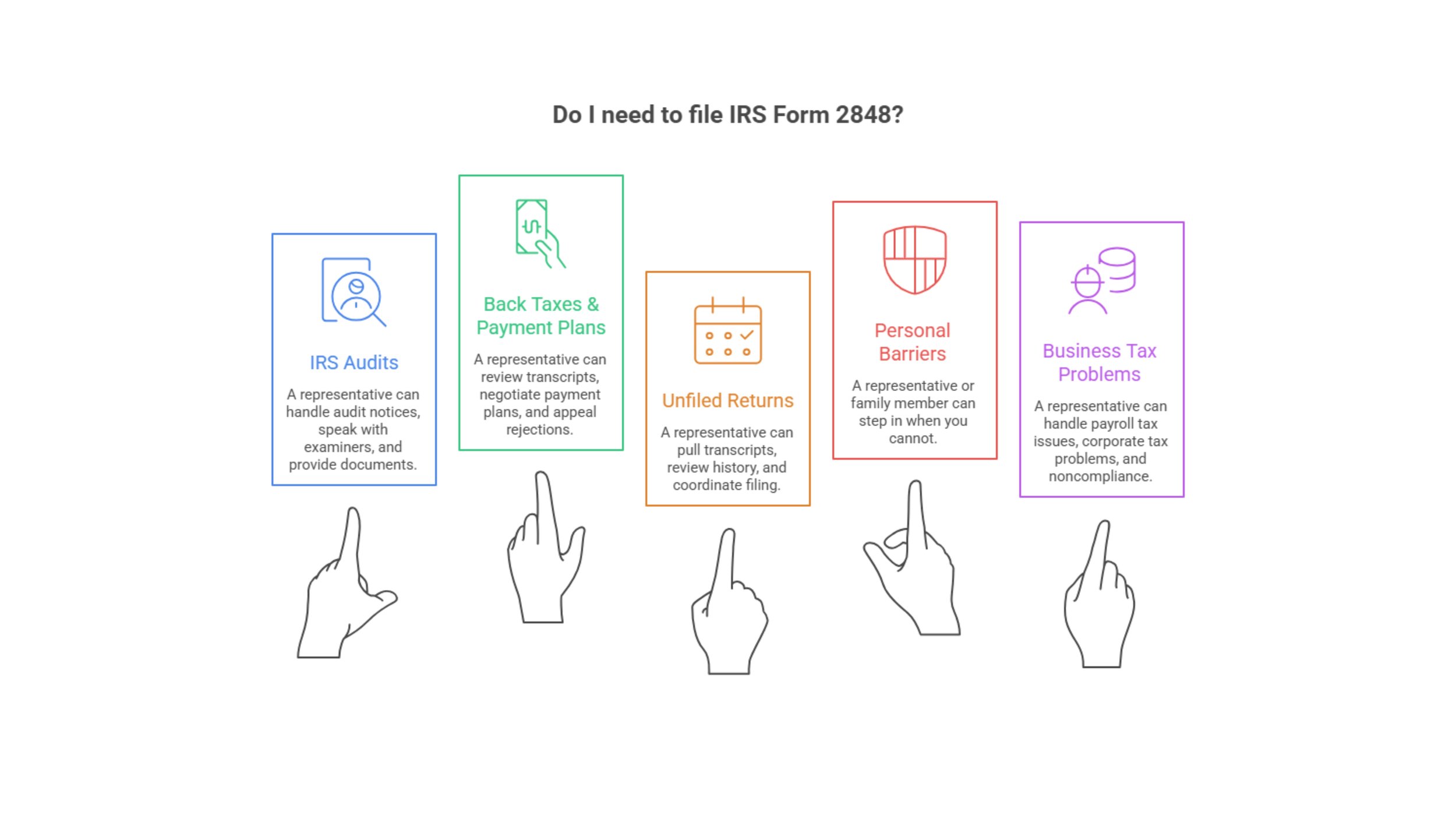

1. IRS Audits

A representative can:

• Receive the audit notice

• Speak directly with the examiner

• Provide documents and defend your position

• Attend conferences on your behalf

2. Back Taxes, Levies, and Payment Plans

Form 2848 allows a representative to:

• Review transcripts

• Handle OIC, CNC, or installment agreement negotiations

• Appeal rejections or collection actions

3. Unfiled Tax Returns

Your representative can:

• Pull wage and income transcripts

• Review account history

• Coordinate filing strategies and communicate with the IRS

4. Health, Death, Language, or Travel Barriers

2848 allows someone to step in when you cannot. In certain situations, your POA may take over to help resolve problems. However, there are times when the 2848 will allow a family member in specific situations. Certain personal situation arise when authority is given to someone else, such as with a General Power of Attorney, Trust, Will, or Court Order.

5. Business Tax Problems

Essential if your business has:

• Payroll tax issues

• Corporate or partnership tax problems

• Multiple years of noncompliance

In addition to Tax Professionals, Corporate officers & Employees can be authorized on a 2848 of a business they operate.

What Rights You Give (and What You Don’t)

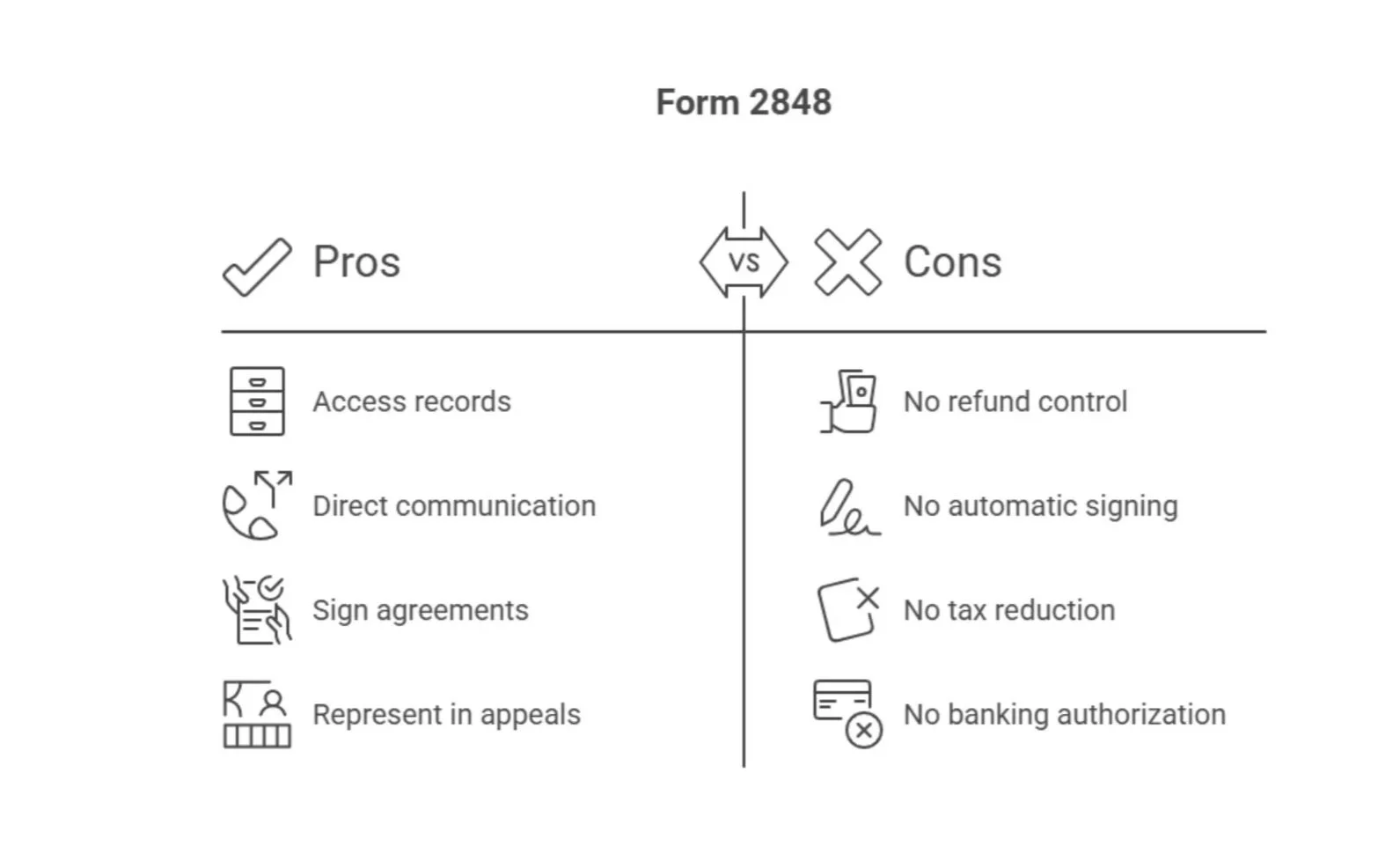

With Form 2848, your representative can:

• Access your confidential IRS records

• Communicate directly with IRS departments

• Sign certain consents and agreements

• Represent you in conferences and appeals

But they cannot:

• Cash your refund or control your personal finances

• Automatically sign your tax return

• Reduce your tax balance without proper IRS programs

Sign off on certain banking authorizations.

Who Can Serve as Your Representative

The IRS only accepts certain professionals:

• Attorneys

• CPAs

• Enrolled Agents (EAs)

• Immediate family members in specific cases

• Certain authorized employees for business matters

• IRS-approved students under strict supervision

Always choose someone who understands IRS procedure and works under Circular 230 standards.

How to Fill Out IRS Form 2848 (Simplified Step-By-Step)

Part I – Power of Attorney

Line 1: Taxpayer Information

Enter your name, address, and SSN or EIN.

Line 2: Representative Information

Add the rep’s name, address, phone number, and CAF number.

If no CAF exists, write “NONE”.

Line 3: Acts Authorized (Most Important Section)

List:

• Tax type

• Form number

• Years or periods

Example:

• “1040, 2022–2024”

• “941, 1Q 2023–4Q 2024”

Avoid vague entries like “all years”.

Line 4: Specific-Use POA

Check this if it’s a one-time issue that shouldn’t be stored in the IRS CAF system.

Line 5: Additional Powers or Restrictions

Allow limited return signing or add a restriction for your rep.

Line 6: Retention of Prior POAs

A new 2848 revokes older ones unless you attach copies to keep them active.

Line 7: Signature

You must sign.

Spouses must each sign a separate Form 2848.

Part II – Declaration of Representative

Your representative signs and certifies their qualifications.

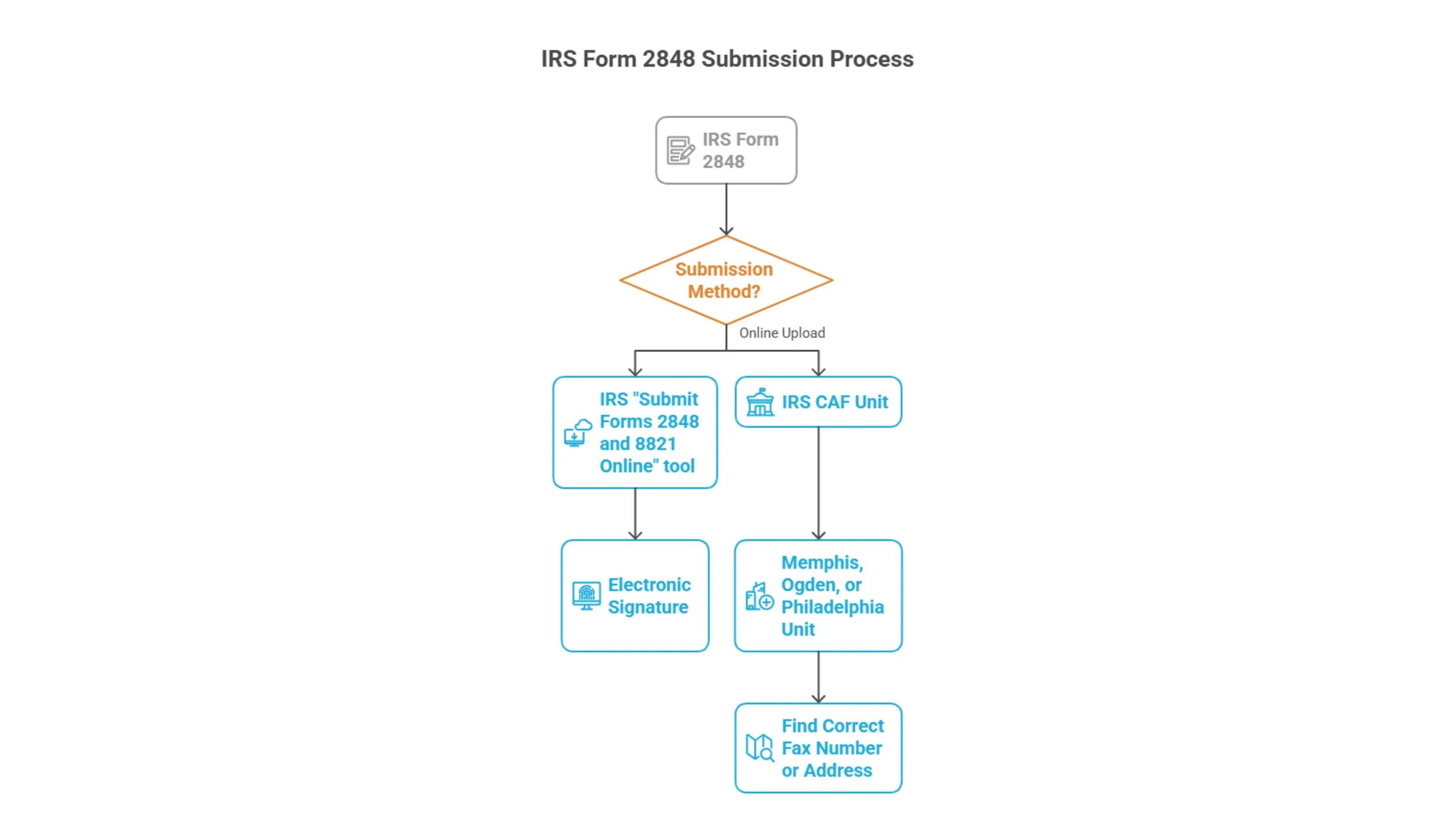

How to Submit IRS Form 2848

The IRS has a Centralized Authorization File Unit ( CAF Unit) that processed IRS POAS. Once they receive the 2848, the IRS systems will be coded that there is a POA on file. The submission fo the IRS 2848 can be:

1. Online Upload (Fastest)

IRS “Submit Forms 2848 and 8821 Online” tool allows secure uploads.

Electronic signatures are accepted only when submitted through approved channels.

2. Fax or Mail

The IRS CAF unit is spit between 3 campuses: The Memphis, Ogden & Philadelphia unit. Depending on where you reside, is the department you would need to send the 2848. Use the “Where to File” chart in the instructions to find the correct fax number or address.

How Long IRS Form 2848 Stays on File

In practice, a 2848 usually stays active for up to 7 years, unless:

The matter is resolved

The POA withdraws

The Taxpayer revokes authorization

You replace it with a new one

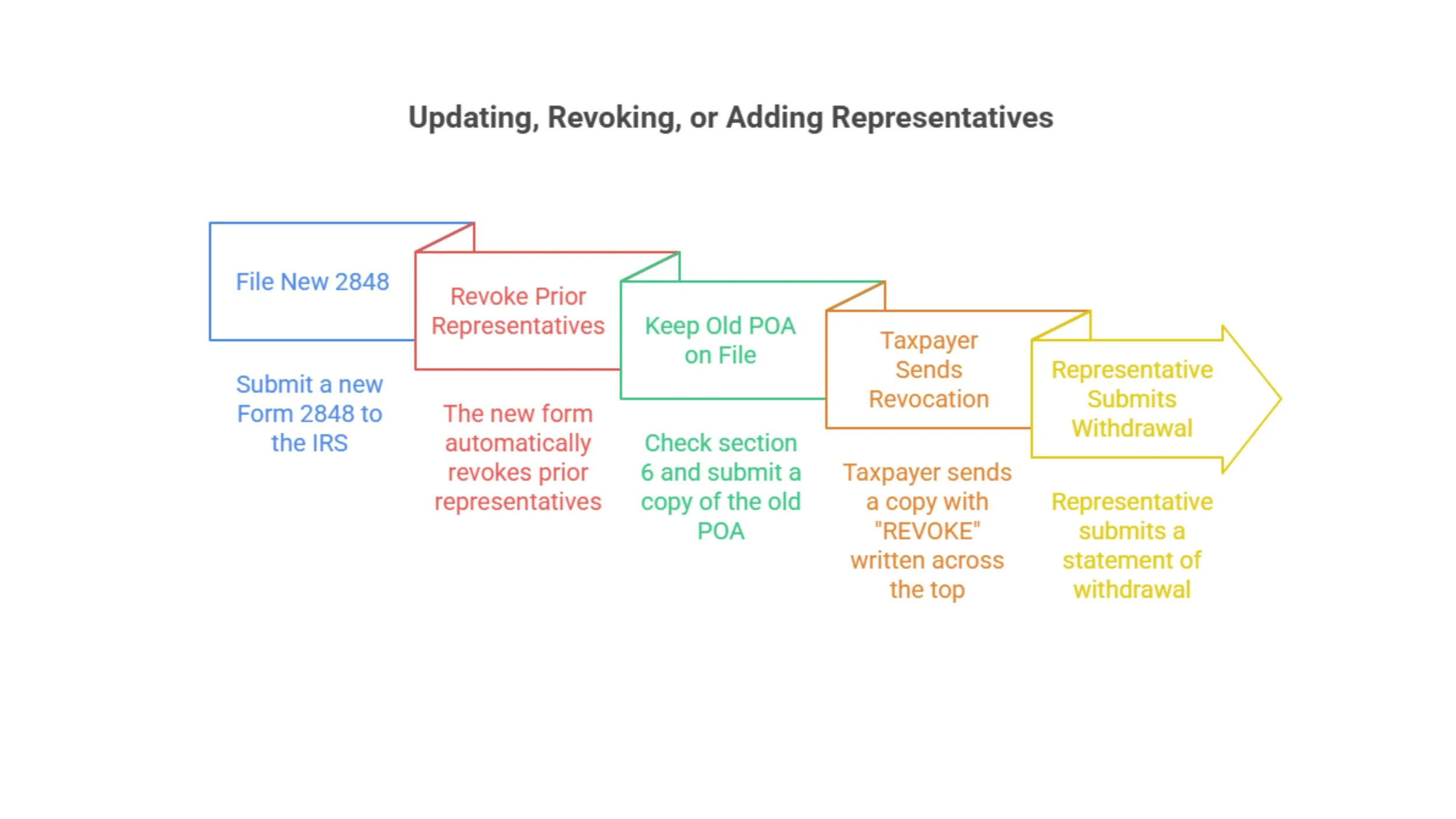

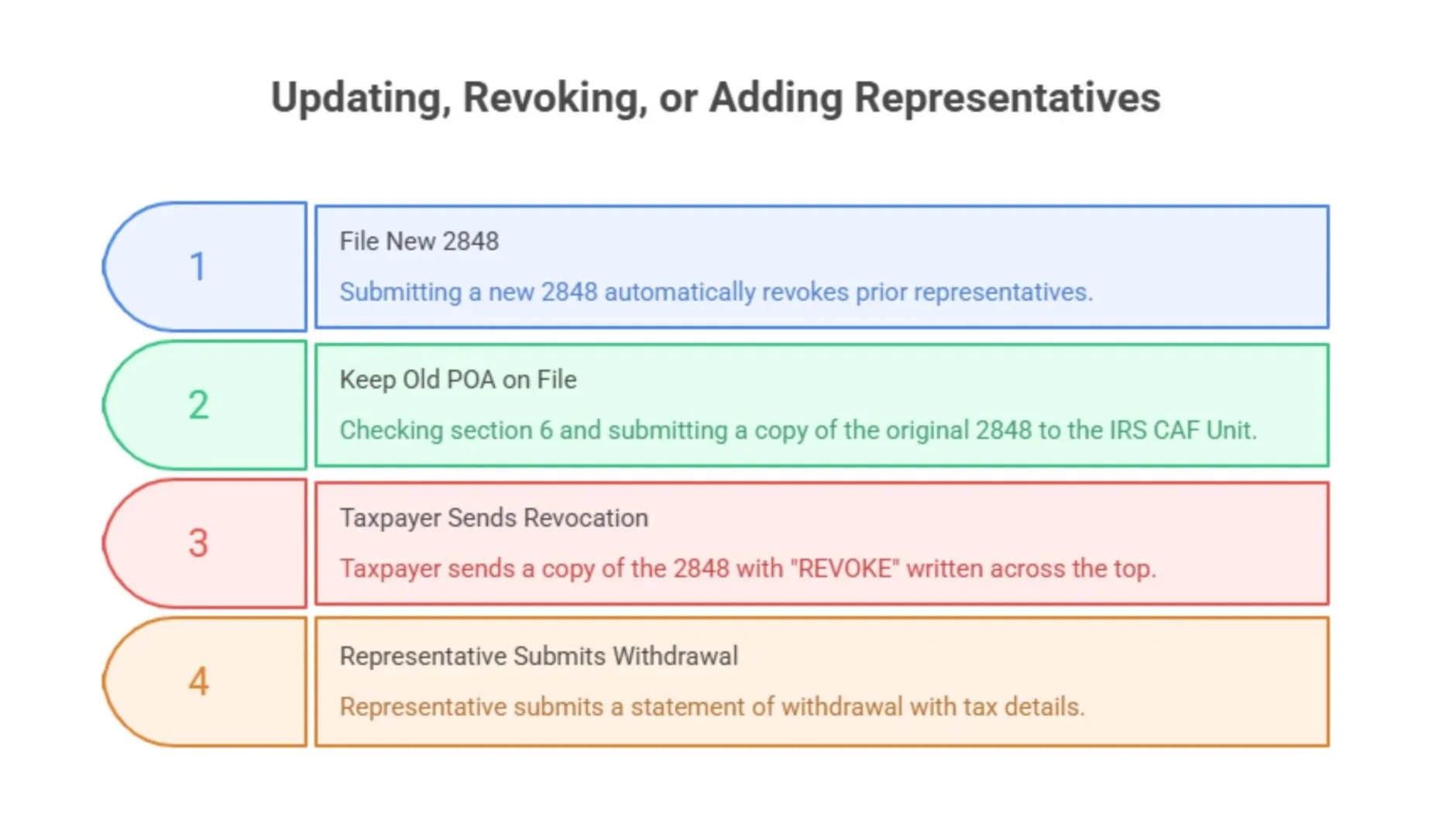

Updating, Revoking, or Adding Representatives

You can:

Filing a new 2848 automatically revokes any prior representatives. However , you can keep the old POA on file by checking section 6 on the new 2848 & submitting a copy of the original 2848 to the IRS CAF Unit.

Taxpayer Sends the IRS a copy with “REVOKE” written across the top, signed & dated .

Representative submits a statement of withdrawal, with the Tax Type, Tax forms & Tax Years.

Special Situations

Joint Tax Debts between Spouses.

Each spouse has their own individual 2848 to authorize.

Business Tax Issues

An authorized officer signs on behalf of the entity.

Unfiled Returns

Your rep uses 2848 to pull transcripts and confirm balances before filing.

IRS Form 2848 Power of Attorney FAQs

-

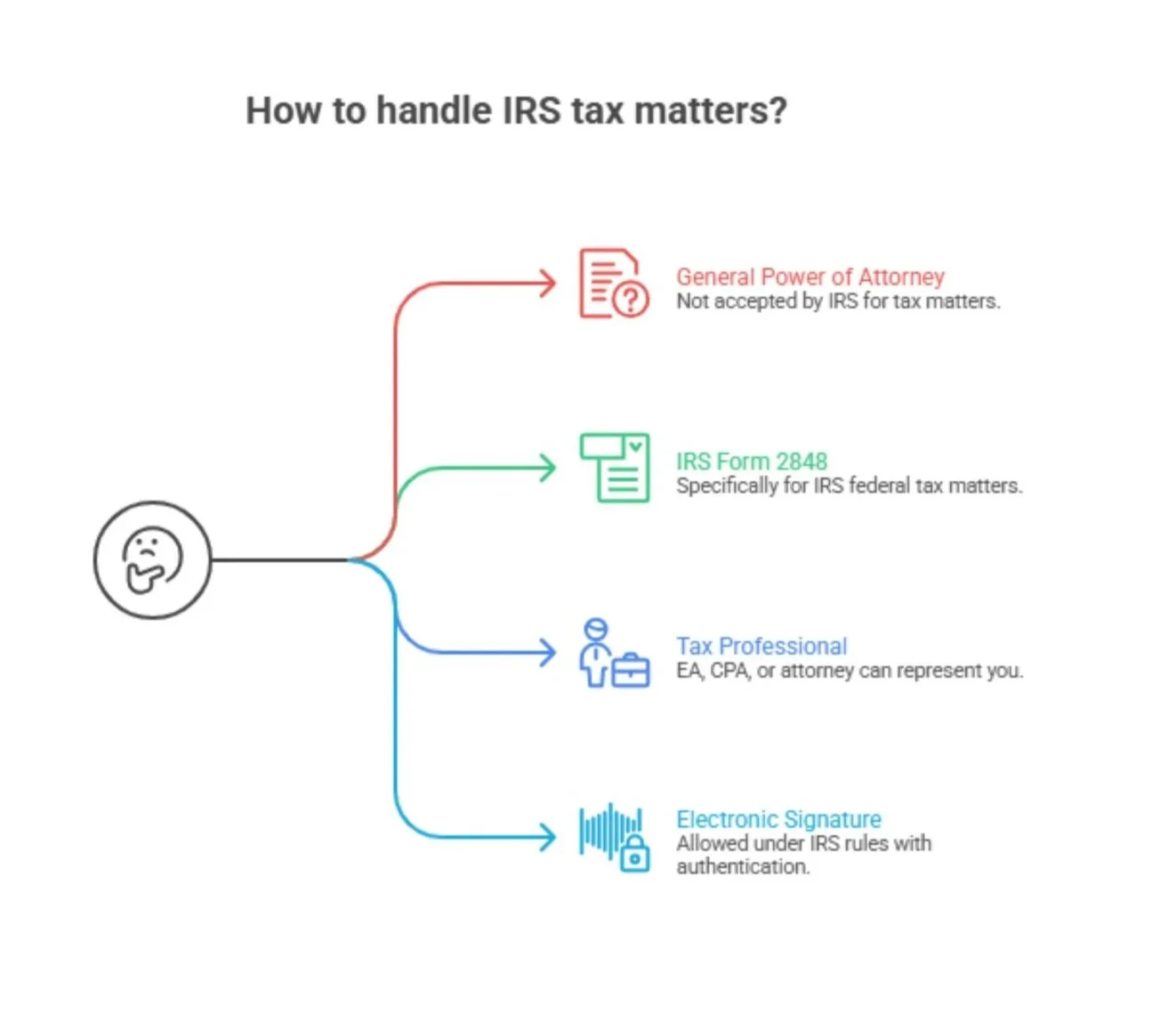

No. The IRS will not accept a general POA without Form 2848 requirements. The IRS Form 2848 is strictly for IRS Federal Tax Matters, not authorizing any other usage.

-

Any of the three types of Tax Professionals have unlimited representation with the IRS & can represent you. A tax preparer that is not an Attorney, Enrolled Agent or CPA can not be on a 2848 except for limited situations.

-

Yes, under IRS e-signature rules. The e-signing must meet a “Knowledge Based Authentication", where you have to verify your identity while signing. There are special processing for e-signed 2848s, where the authorization must be submitting electronically by your tax professional through their IRS account. The IRS will not accept this form via fax.

If you have an IRS.gov account, your Tax Professional may send you a sign request through your IRS.gov account, and you can authroize the 2848 through the IRS website.

Final Thought

If you’re facing IRS notices, audits, or back taxes, Form 2848 is the gateway to having a qualified professional handle the IRS for you.

Use this guide to understand:

• What the form actually does

• Whether you need 2848 or 8821

• How to fill it out correctly

• How to avoid delays and common mistakes

This guide is information only, but it gives you a strong foundation before speaking with any tax professional.

If you want my team to review your IRS options, you can schedule a free case review anytime.