What Happened to My IRS Payment? Tracking Delays, Offsets, and Missing Tax Payments

Tracking Delays, Offsets, and Missing Payments

You sent your payment to the IRS, maybe online or by check. And now? Nothing. No update, no confirmation. You’re stuck refreshing your account, wondering, “Did the IRS even get it?” You’re not alone. Missing or delayed payments are more common than you might think.

This blog explains why payments sometimes don’t show up, what the Treasury Offset Program is, and the steps you can take to track or fix the issue.

TLDR;

IRS payments can be delayed due to processing backlogs, errors, or manual review.

Payments might be misapplied to the wrong tax year or form.

The Treasury Offset Program can redirect your payment to cover other debts.

Use IRS tools like Direct Pay confirmations or account transcripts to check status.

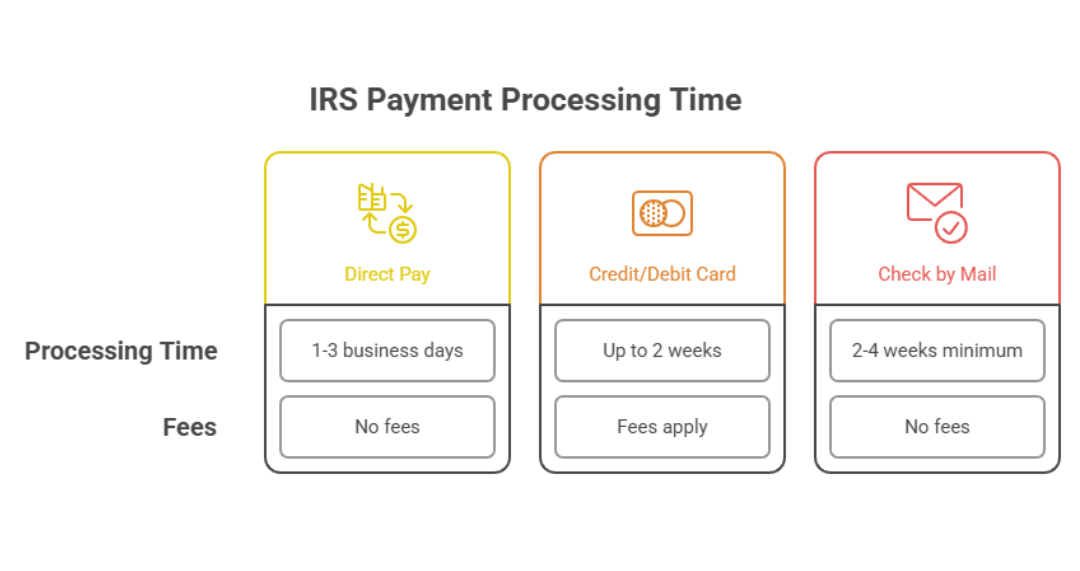

IRS processing times vary:

1–3 days for online payments

2–4+ weeks for mailed checks

If it’s been too long, submit Form 3911 to trace a missing payment.

Don’t assume it’s lost right away—wait 7–10 business days first.

Misapplied payments can be corrected by calling the IRS or submitting a written request.

Keep proof: bank records, confirmation emails, and screenshots.

If you're unsure or stuck, professional help can get answers faster.

Common Reasons Your IRS Payment Isn’t Showing Up

IRS is still processing

During busy times, it can take longer for payments to post. Even if your bank shows it cleared, the IRS may not have updated your account yet.Payment misapplied

If you didn’t note the correct tax year or form number, your money might have been applied to the wrong balance. It’s fixable, but it takes action.Manual review

Payments sometimes get flagged for extra checks if amounts don’t match, information is missing, or something looks unusual in your file.

Treasury Offset Program: Was Your Payment Redirected?

The IRS may never see your money if it was taken to pay another debt through the Treasury Offset Program. Common offsets include:

Past-due child support

Federal student loans

State income taxes

Unemployment overpayments

If this happened, your IRS balance won’t change because the payment went straight to another agency.

How to Track Your IRS Payment

IRS Direct Pay: Check your confirmation screen or email.

IRS Account Transcript: Create an IRS account online to see if a payment was applied.

Call the IRS: It can take forever, but if you're out of options, this is your backup plan.

Make sure you wait at least 7-10 business days before assuming the payment is lost.

What If the Payment Was Applied to the Wrong Year?

It happens. You meant to pay 2023, but the IRS posted it to 2022. Fixing it usually requires:

Calling the IRS to request a transfer

Sending a written request with proof of payment

It’s annoying, but fixable.

How Long Does the IRS Take to Process a Payment?

Here’s a rough timeline:

Electronic payment via Direct Pay: 1 to 3 business days

Credit/Debit card payments: Up to 2 weeks (with fees)

Checks by mail: 2 to 4 weeks minimum

But delays can stretch longer if:

The IRS is backlogged (yes, again)

You mailed it to the wrong address

The payment included errors

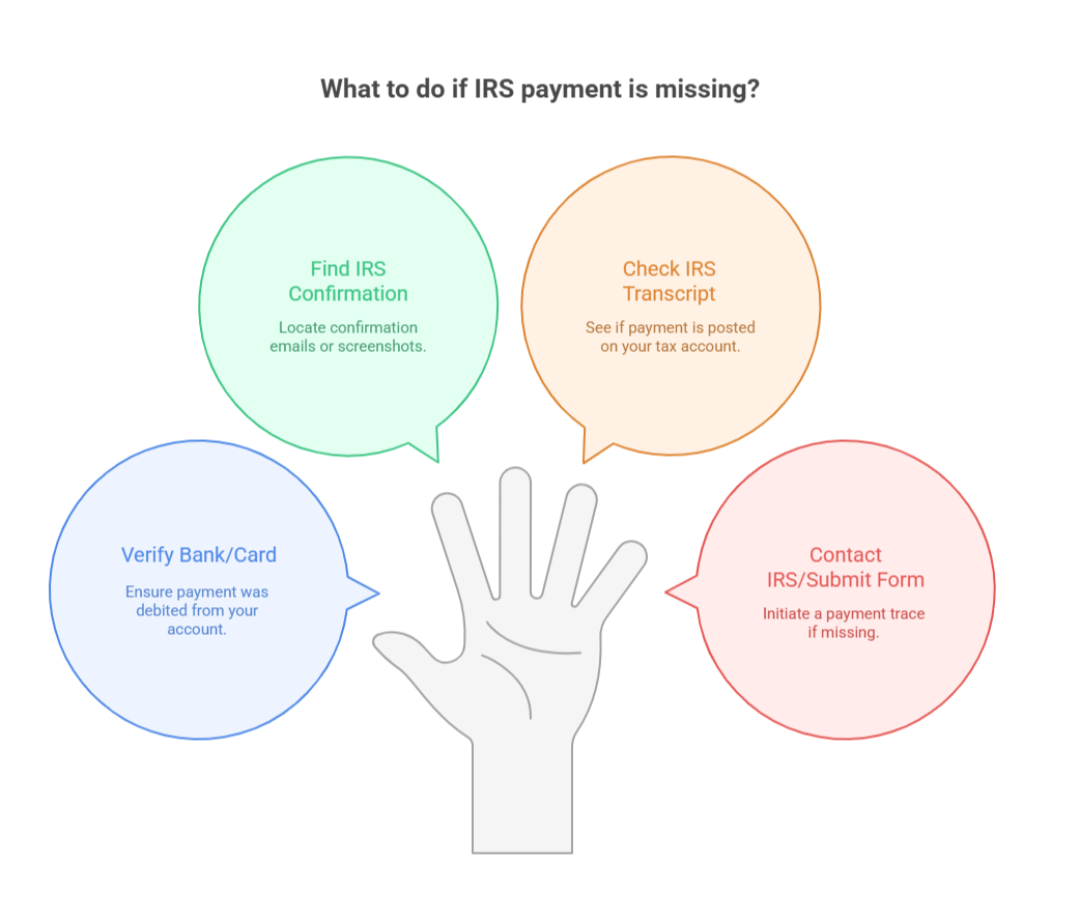

What to Do If Your IRS Payment Still Isn’t Showing Up

Here’s your action plan:

Double-check your bank or card provider

Was the payment pulled?

Find your IRS confirmation (if any)

Save screenshots or emails

Pull a transcript on IRS.gov

See if the payment posted

Call the IRS or submit Form 3911

This starts a payment trace

Need help? We handle these situations every week. No guessing games.

When to Wait vs. When to Act

Wait: Less than 10 business days (online) or 21 days (check).

Act: Beyond those windows with no update, it’s time to investigate.

What Happened to My IRS Payment FAQs

-

For online payments, give it 7–10 business days to show on your IRS account. For checks, 2–4+ weeks is common. If you’re outside those windows, start your trace.

-

Check your bank/processor receipt, your Direct Pay/EFTPS confirmation, and your IRS Online Account (Account Transcript) for a matching payment line on the correct tax year.

-

Collect proof (bank/processor receipt, date, amount, last 4 of account, confirmation ID). Then:

Verify you used the right tax form & year when you paid.

If wrong/missing, call the IRS to locate/reapply the payment and be ready to fax/upload proof.

If by check, confirm it cleared and keep the front/back image.

-

Your money was credited to the wrong tax year, wrong tax type (e.g., estimated tax instead of balance due), or even the wrong SSN/EIN. The fix is a payment transfer request.

-

Call the IRS and ask for a payment transfer. You may also be asked to send a brief written request with proof (amount, date, confirmation, where it is vs. where it should be).

-

Yes. Through the Treasury Offset Program (TOP), your payment can be redirected to debts like past-due child support, federal student loans, state taxes, or unemployment overpayments. If that happened, your IRS balance won’t drop.

-

You’ll usually get a separate offset notice stating how much was taken and which agency received it. Keep that letter—it’s your proof of where the money went.

-

If the entire payment went to another agency and you still owed the IRS, yes—your IRS balance remains until you pay it directly (or set up a plan).

-

Usually yes. Provide the payment proof and the correct SSN/EIN. The IRS can research and re-post the payment once they verify ownership.

-

Possibly, if it sits in the wrong bucket past the deadline. Ask the IRS to reapply it to the correct year/form to minimize or remove penalties/interest.

Stay Calm, but Don’t Wait Forever

Delays and misapplied payments happen often. Most are fixable, but they can create stress and extra penalties if ignored. If your payment isn’t showing up, don’t assume it will sort itself out.

We help clients track down and fix missing IRS payments every week. If you’re stuck, reach out for a free case review. We’ll handle the back-and-forth with the IRS so you don’t have to.